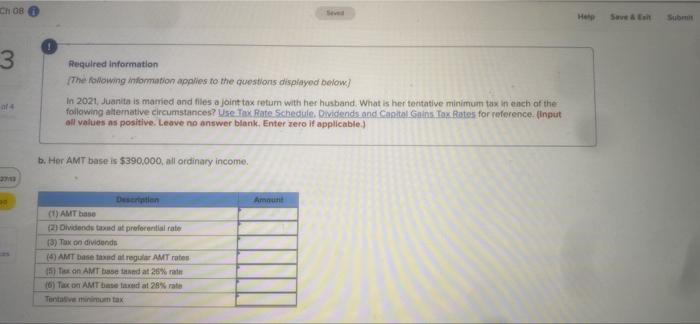

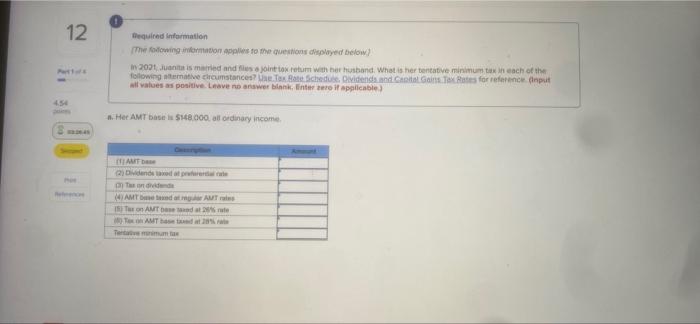

Question: both questions please Ch 08 Save Sub 3. Required information The following information applies to the questions displayed below) In 2021. Juanita is married and

Ch 08 Save Sub 3. Required information The following information applies to the questions displayed below) In 2021. Juanita is married and files a joint tax retum with her husband. What is her tentative minimum tax in each of the following alternative circumstances? Use Tax Rate Schedule. Dividends and Canal Gains Tax Rates for reference input all values as positive. Leave no answer blank, Enter xero if applicable) b. Her AMT base is $390,000, all ordinary income. (1) AMT base (2) Dividends and preferate 13) Toxon dividende (4) AMT based on regular AMT rates 15) Ties on AMT based at 25% rate (6) TAMT bewed at 28% rata Tentavimax 12 Required Information The following information to the questions red below! 2001 Jais married and joint to return with her husband. What is her tentative minimum toxin each of the following stative reumstances? Une Tax Rate Schedus Ovidends and Co Gains Tax Rates for reference input wil values as positive. Leave no answer bank, interroit applicable) 454 Her AMT $18.000all ordinary income MIAMI 2nd per on the 4 AMT AMT IST AMT Date Team

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts