Question: both questions please! Medium Consider the following two bonds: A and B, both 7% (annual coupon bonds with Face Value = $1000. Bond A in

both questions please!

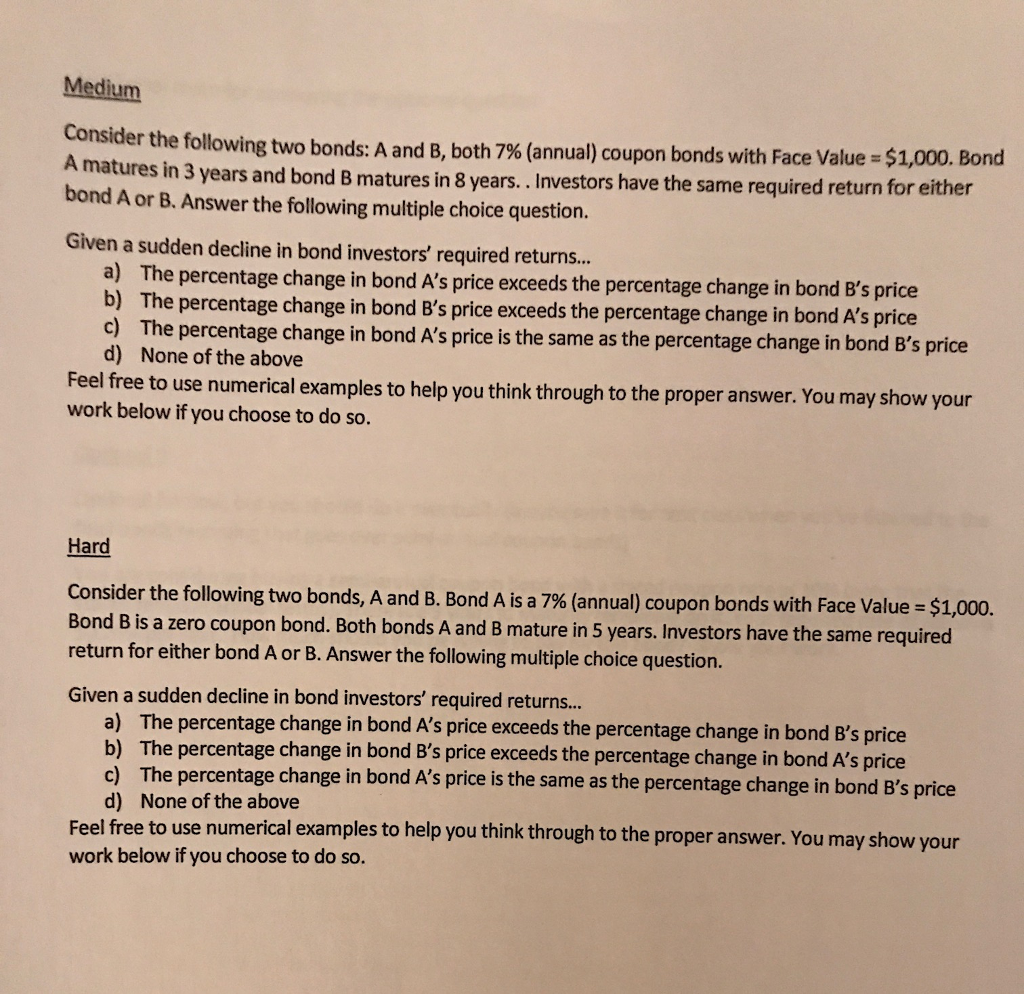

Medium Consider the following two bonds: A and B, both 7% (annual coupon bonds with Face Value = $1000. Bond A in matures 3 years and bond B matures in 8 years. , Investors have the same required return for either bond . A or BAnswer the following multiple choice question. Given a sudden decline in bond investors' required returns. a) The percentage change in bond A's price exceeds the percentage change in bond B's price b) The percentage change in bond Bs price exceeds the percentage change in bond As price c) The percentage change in bond A's price is the same as the percentage change in bond B's price d) None of the above Feel free to use numerical examples to help you think through to the proper answer. You may show your work below if you choose to do so. Hard Consider the following two bonds, A and B. Bond A is a 7% (annual) coupon bonds with Face Value = $1,000. Bond B is a zero coupon bond. Both bonds A and B mature in 5 years. Investors have the same required return for either bond A or B. Answer the following multiple choice question. Given a sudden decline in bond investors' required returns.. a) The percentage change in bond A's price exceeds the percentage change in bond B's price b) The percentage change in bond B's price exceeds the percentage change in bond A's price c) The percentage change in bond A's price is the same as the percentage change in bond B's price d) None of the above Feel free to use numerical examples to help you think through to the proper answer. You may show your work below if you choose to do so

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts