Question: Consider the following two bonds: A and B, both 5% (annual) coupon bonds with Face Value $1,000. Bond A matures in 8 years and bond

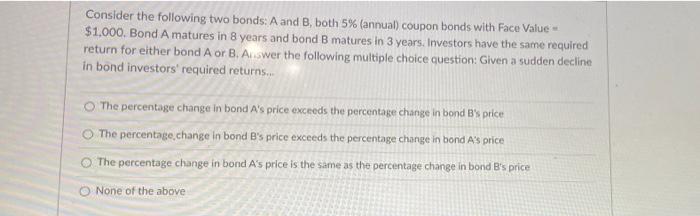

Consider the following two bonds: A and B, both 5% (annual) coupon bonds with Face Value $1,000. Bond A matures in 8 years and bond B matures in 3 years. Investors have the same required return for either bond A or B. Answer the following multiple choice question: Given a sudden decline in bond investors' required returns... The percentage change in bond A's price exceeds the percentage change in bond B's price The percentage, change in bond B's price exceeds the percentage change in bond A's price The percentage change in bond A's price is the same as the percentage change in bond B's price None of the above

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock