Question: both ?s please One stock is aggressive while the other is defensive. Beta represents the change in the stock return per unit of change in

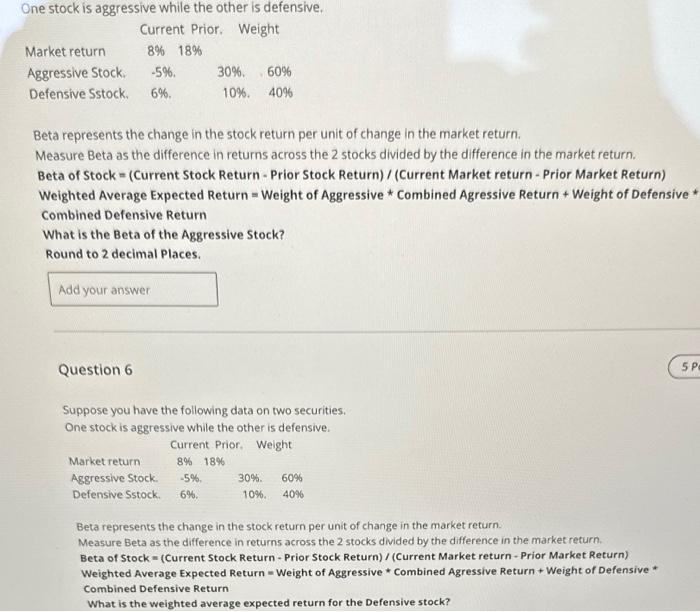

One stock is aggressive while the other is defensive. Beta represents the change in the stock return per unit of change in the market return. Measure Beta as the difference in returns across the 2 stocks divided by the difference in the market return. Beta of Stock = (Current Stock Return - Prior Stock Return) / (Current Market return - Prior Market Return) Weighted Average Expected Return = Weight of Aggressive * Combined Agressive Return + Weight of Defensive Combined Defensive Return What is the Beta of the Aggressive Stock? Round to 2 decimal Places. Question 6 Suppose you have the following data on two securities. One stock is aggressive while the other is defensive. Beta represents the change in the stock return per unit of change in the market return. Measure Beta as the difference in returns across the 2 stocks divided by the difference in the market return. Beta of Stock = (Current Stock Return - Prior Stock Return) / (Current Market return - Prior Market Return) Weighted Average Expected Return = Weight of Aggressive * Combined Agressive Return + Weight of Defensive * Combined Defensive Return What is the weighted average expected return for the Defensive stock? One stock is aggressive while the other is defensive. Beta represents the change in the stock return per unit of change in the market return. Measure Beta as the difference in returns across the 2 stocks divided by the difference in the market return. Beta of Stock = (Current Stock Return - Prior Stock Return) / (Current Market return - Prior Market Return) Weighted Average Expected Return = Weight of Aggressive * Combined Agressive Return + Weight of Defensive Combined Defensive Return What is the Beta of the Aggressive Stock? Round to 2 decimal Places. Question 6 Suppose you have the following data on two securities. One stock is aggressive while the other is defensive. Beta represents the change in the stock return per unit of change in the market return. Measure Beta as the difference in returns across the 2 stocks divided by the difference in the market return. Beta of Stock = (Current Stock Return - Prior Stock Return) / (Current Market return - Prior Market Return) Weighted Average Expected Return = Weight of Aggressive * Combined Agressive Return + Weight of Defensive * Combined Defensive Return What is the weighted average expected return for the Defensive stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts