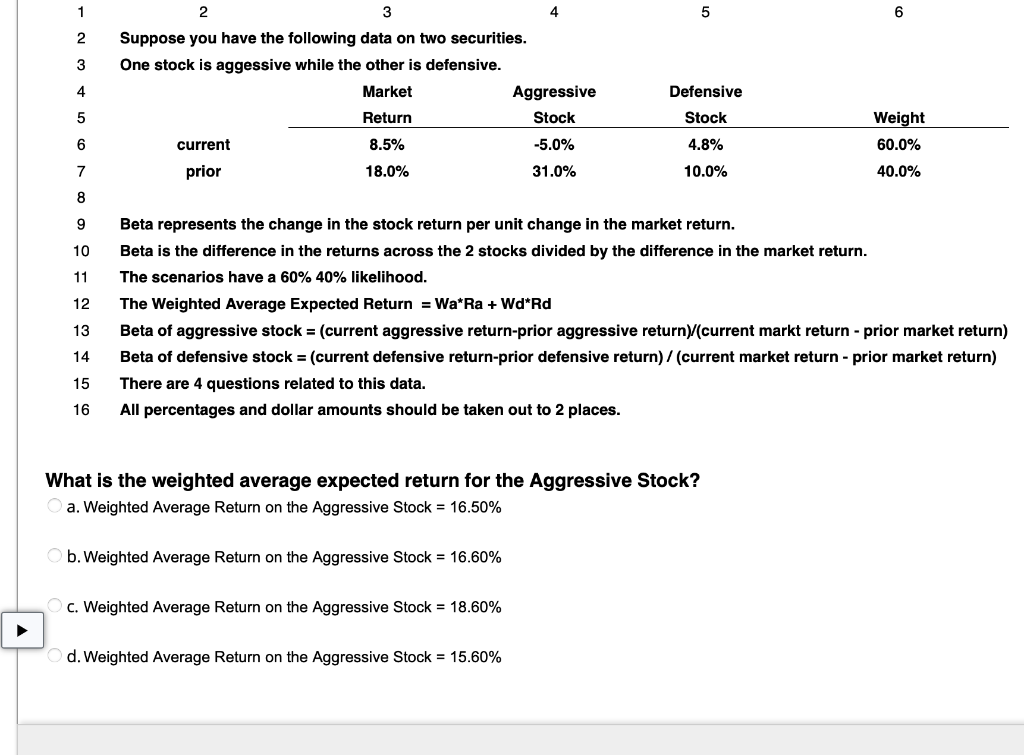

Question: 1 5 6 2 3 4 2 3 4 Suppose you have the following data on two securities. One stock is aggessive while the other

1 5 6 2 3 4 2 3 4 Suppose you have the following data on two securities. One stock is aggessive while the other is defensive. Market Aggressive Return Stock current 8.5% -5.0% prior 18.0% 31.0% Defensive 5 Stock 6 4.8% Weight 60.0% 40.0% 7 10.0% 8 9 10 11 12 Beta represents the change in the stock return per unit change in the market return. Beta is the difference in the returns across the 2 stocks divided by the difference in the market return. The scenarios have a 60% 40% likelihood. The Weighted Average Expected Return = Wa Ra + Wd*Rd Beta of aggressive stock = (current aggressive return-prior aggressive return)(current markt return - prior market return) Beta of defensive stock = (current defensive return-prior defensive return)/(current market return - prior market return) There are 4 questions related to this data. All percentages and dollar amounts should be taken out to 2 places. 13 14 15 16 What is the weighted average expected return for the Aggressive Stock? a. Weighted Average Return on the Aggressive Stock = 16.50% b. Weighted Average Return on the Aggressive Stock = 16.60% c. Weighted Average Return on the Aggressive Stock = 18.60% d. Weighted Average Return on the Aggressive Stock = 15.60%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts