Question: Bottom straddles: Long a call option on a stock with strike price of $50 and option price of $7; Long a put option on the

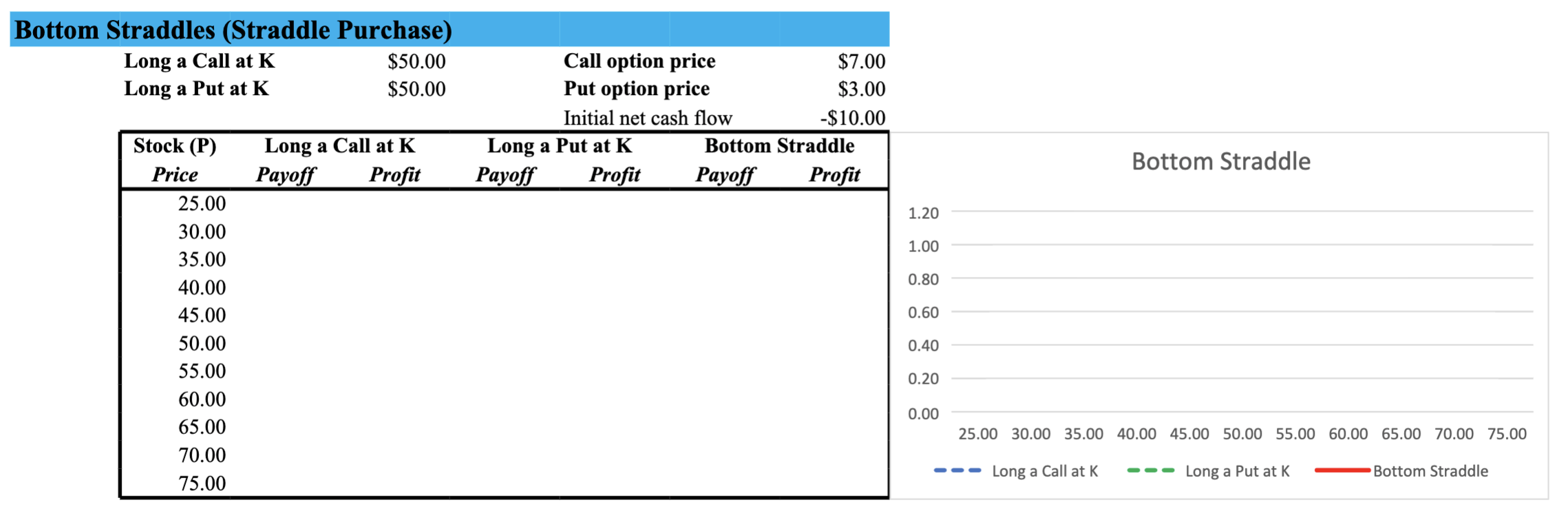

Bottom straddles: Long a call option on a stock with strike price of $50 and option price of $7; Long a put option on the same stock with the same strike price and an option price of $3. The two options have the same expiration date. (**please fill out chart and graph thank you so much**)

Bottom Straddles (Straddle Purchase) Long a Call at K $50.00 Long a Put at K $50.00 Call option price $7.00 Put option price $3.00 Initial net cash flow -$10.00 Long a Put at K Bottom Straddle Payoff Profit Payoff Profit Long a Call at K Payoff Profit Bottom Straddle 1.20 1.00 0.80 Stock (P) Price 25.00 30.00 35.00 40.00 45.00 50.00 55.00 60.00 65.00 70.00 75.00 0.60 0.40 0.20 0.00 25.00 30.00 35.00 40.00 45.00 50.00 55.00 60.00 65.00 70.00 75.00 Long a Call at K Long a Put at K Bottom Straddle

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts