Question: BP Co issued floating rate loan notes, with a face value of $400 million, to fund the investment in plant and machinery. The loan notes

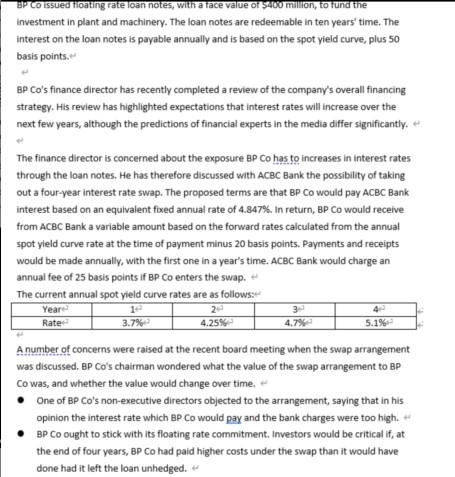

BP Co issued floating rate loan notes, with a face value of $400 million, to fund the investment in plant and machinery. The loan notes are redeemable in ten years' time. The interest on the loan notes is payable annually and is based on the spot yield curve, plus 50 basis points.

BP Co's finance director has recently completed a review of the company's overall financing strategy. His review has highlighted expectations that interest rates will increase over the next few years, although the pr

Required Prepare the report for the chairman which:

(b) Calculate BP Co's interest payment liability for Year 1 if the yield curve rate is 4.5% or 2.9%, and comment on your results.

BP Co issued floating rate loan notes, with a face value of $400 million, to fund the investment in plant and machinery. The loan notes are redeemable in ten years' time. The interest on the loan notes is payable annually and is based on the spot yield curve, plus 50 basis points. BP Co's finance director has recently completed a review of the company's overall financing strategy. His review has highlighted expectations that interest rates will increase over the next few years, although the predictions of financial experts in the media differ significantly. The finance director is concerned about the exposure BP Co has to increases in interest rates through the loan notes. He has therefore discussed with ACBC Bank the possibility of taking out a four-year interest rate swap. The proposed terms are that BP Co would pay ACBC Bank interest based on an equivalent fixed annual rate of 4.847%. In return, BP Co would receive from ACBC Bank a variable amount based on the forward rates calculated from the annual spot yield curve rate at the time of payment minus 20 basis points. Payments and receipts would be made annually, with the first one in a year's time. ACBC Bank would charge an annual fee of 25 basis points if BP Co enters the swap. The current annual spot yield curve rates are as follows: Year Rate 3.7% 4.25% 34 4.7% 4 5.1% A number of concerns were raised at the recent board meeting when the swap arrangement was discussed. BP Co's chairman wondered what the value of the swap arrangement to BP Co was, and whether the value would change over time. One of BP Co's non-executive directors objected to the arrangement, saying that in his opinion the interest rate which BP Co would pay and the bank charges were too high. BP Co ought to stick with its floating rate commitment. Investors would be critical if, at the end of four years, BP Co had paid higher costs under the swap than it would have done had it left the loan unhedged. BP Co issued floating rate loan notes, with a face value of $400 million, to fund the investment in plant and machinery. The loan notes are redeemable in ten years' time. The interest on the loan notes is payable annually and is based on the spot yield curve, plus 50 basis points. BP Co's finance director has recently completed a review of the company's overall financing strategy. His review has highlighted expectations that interest rates will increase over the next few years, although the predictions of financial experts in the media differ significantly. The finance director is concerned about the exposure BP Co has to increases in interest rates through the loan notes. He has therefore discussed with ACBC Bank the possibility of taking out a four-year interest rate swap. The proposed terms are that BP Co would pay ACBC Bank interest based on an equivalent fixed annual rate of 4.847%. In return, BP Co would receive from ACBC Bank a variable amount based on the forward rates calculated from the annual spot yield curve rate at the time of payment minus 20 basis points. Payments and receipts would be made annually, with the first one in a year's time. ACBC Bank would charge an annual fee of 25 basis points if BP Co enters the swap. The current annual spot yield curve rates are as follows: Year Rate 3.7% 4.25% 34 4.7% 4 5.1% A number of concerns were raised at the recent board meeting when the swap arrangement was discussed. BP Co's chairman wondered what the value of the swap arrangement to BP Co was, and whether the value would change over time. One of BP Co's non-executive directors objected to the arrangement, saying that in his opinion the interest rate which BP Co would pay and the bank charges were too high. BP Co ought to stick with its floating rate commitment. Investors would be critical if, at the end of four years, BP Co had paid higher costs under the swap than it would have done had it left the loan unhedged

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts