Question: Brief Exercise 1 7 - 1 4 ( Algo ) Postretirement benefits; Exercise 1 7 - 2 ( Algo ) Determine the projected benefit obligation

Brief Exercise Algo Postretirement benefits; Exercise Algo Determine the projected benefit

obligation LO

On January Ravetch Corporation's projected benefit obligation was

$ million. During pension benefits paid by the trustee were $

million. Service cost for is $ million. Pension plan assets at fair value

increased during by $ million as expected. At the end of there

were no pensionrelated other comprehensive income OCl accounts. The

actuary's discount rate was

Required:

Determine the amount of the projected benefit obligation at December

Note: Enter your answers in millions rounded to decimal places ie

should be entered as Amounts to be deducted should be

indicated with a minus sign.

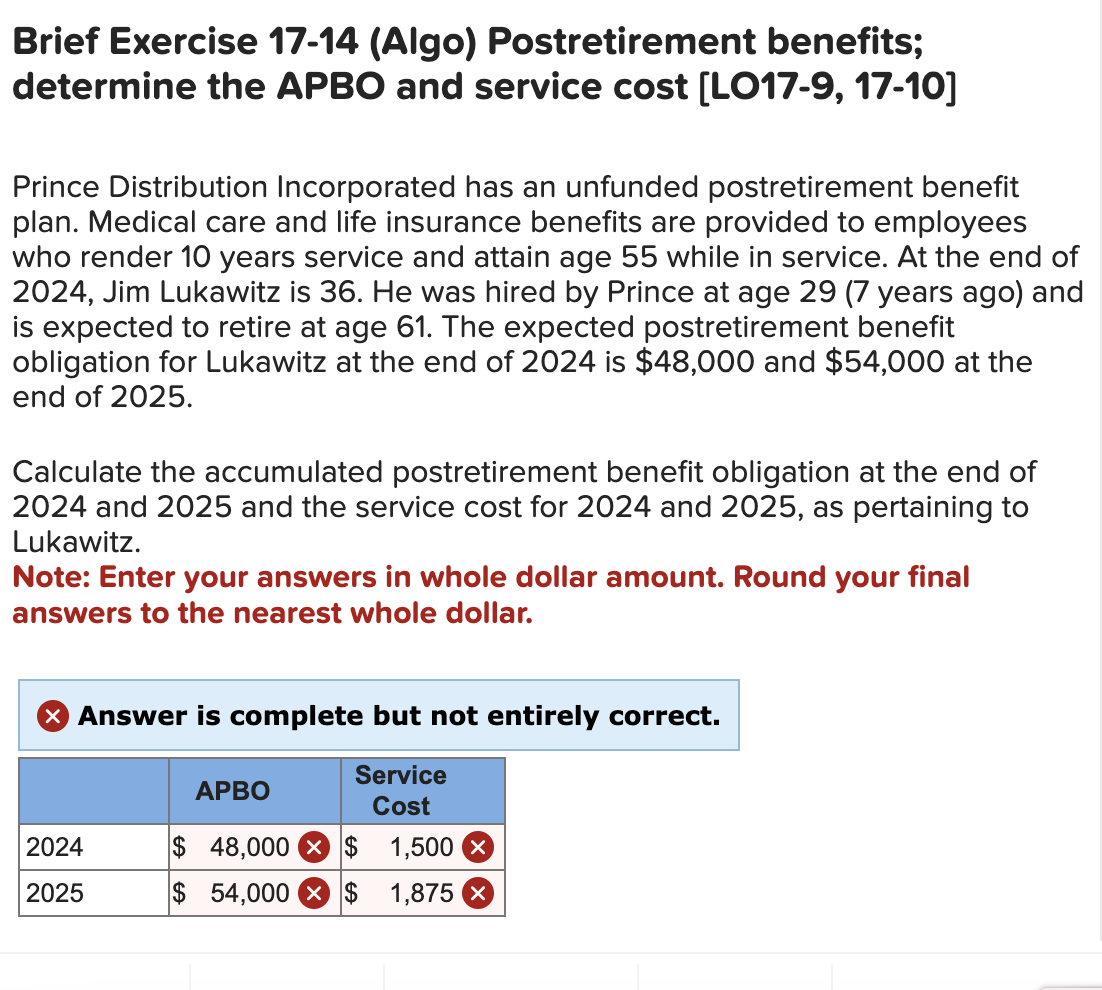

determine the APBO and service cost LO

Prince Distribution Incorporated has an unfunded postretirement benefit

plan. Medical care and life insurance benefits are provided to employees

who render years service and attain age while in service. At the end of

Jim Lukawitz is He was hired by Prince at age years ago and

is expected to retire at age The expected postretirement benefit

obligation for Lukawitz at the end of is $ and $ at the

end of

Calculate the accumulated postretirement benefit obligation at the end of

and and the service cost for and as pertaining to

Lukawitz.

Note: Enter your answers in whole dollar amount. Round your final

answers to the nearest whole dollar.

Answer is complete but not entirely correct.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock