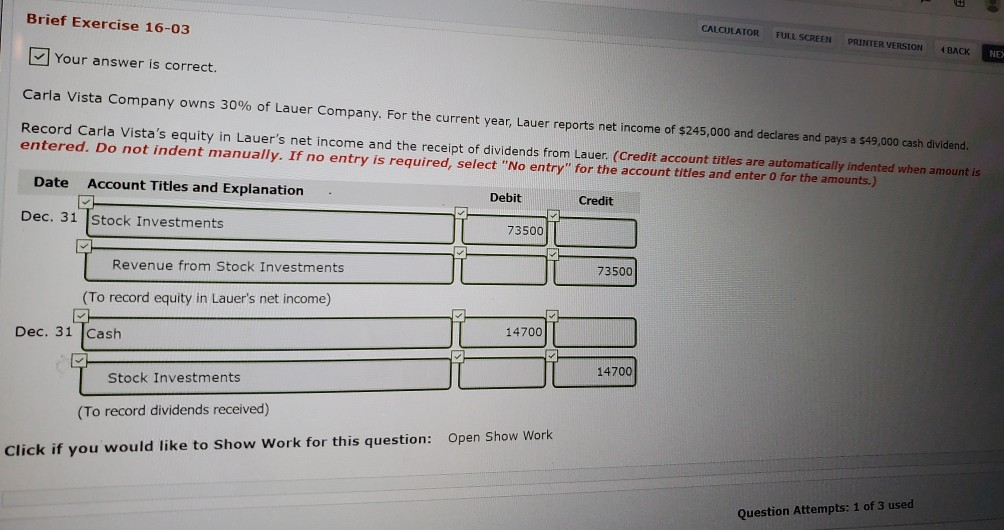

Question: Brief Exercise 16-03 CALCULATOR FULL SCREEN PRINTER VERSION BACK NE Your answer is correct. Carla Vista Company owns 30% of Lauer Company. For the current

Brief Exercise 16-03 CALCULATOR FULL SCREEN PRINTER VERSION BACK NE Your answer is correct. Carla Vista Company owns 30% of Lauer Company. For the current year, Lauer reports net income of $245,000 and declares and pays a 549,000 cash dividend. Record Carla Vista's equity in Lauer's net income and the receipt of dividends from Lauer. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter for the amounts.) Date Account Titles and Explanation Debit Credit Dec. 31 Stock Investments 73500 Revenue from Stock Investments 73500 (To record equity in Lauer's net income) Dec. 31 Cash 14700 Stock Investments 14700 (To record dividends received) Click if you would like to Show Work for this question: Open Show Work Question Attempts: 1 of 3 used

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts