Question: Brief Exercise 16-2 Temporary difference; determine taxable income; determine prior year deferred tax amount (LO16-1) Kara Fashions uses straight-line depreciation for financial statement reporting and

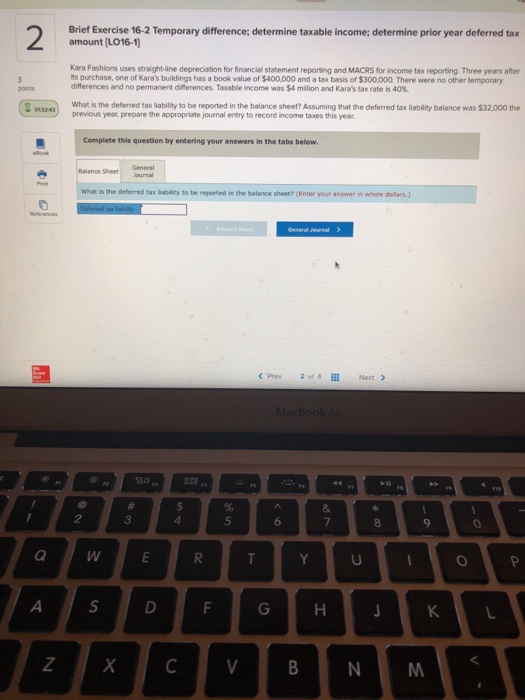

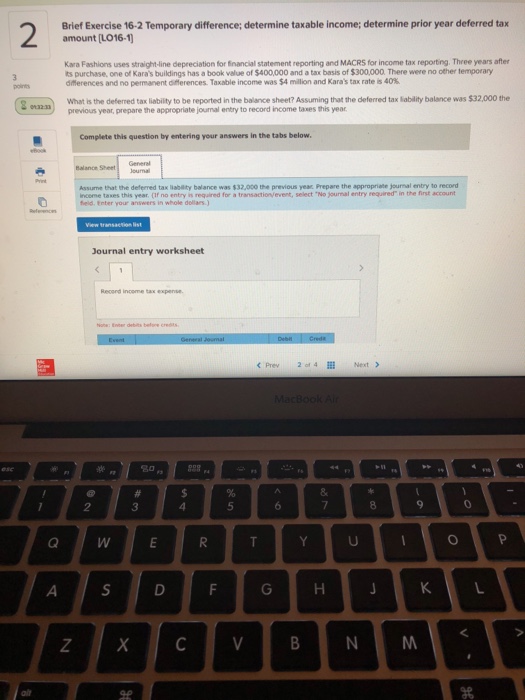

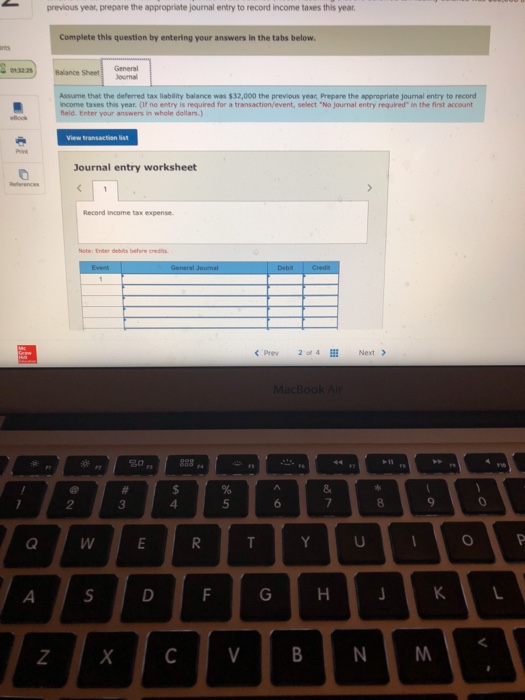

Brief Exercise 16-2 Temporary difference; determine taxable income; determine prior year deferred tax amount (LO16-1) Kara Fashions uses straight-line depreciation for financial statement reporting and MACRS for income tax reporting. Three years after ts purchase, one of Kara's buildings has a book value of $400,000 and a tax basis of $300,000. There were no other temporary differences and no permanent deerences. Taxable income was $4 million and Kara's tax rate is 40% What is the deferred tax lability to be reported in the balance sheet? Assuming that the deferred tax liability balance was $32,000 the previous year, prepare the appropriate journal entry to record income taxes this year Complete this question by entering your answers in the tabs below. Balance Shet General what is the deferred tax Sablity to be reported in the belance sheet? (Enter your answer in whole dollars C Prev2of 4 Next > 20 3 5 8

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts