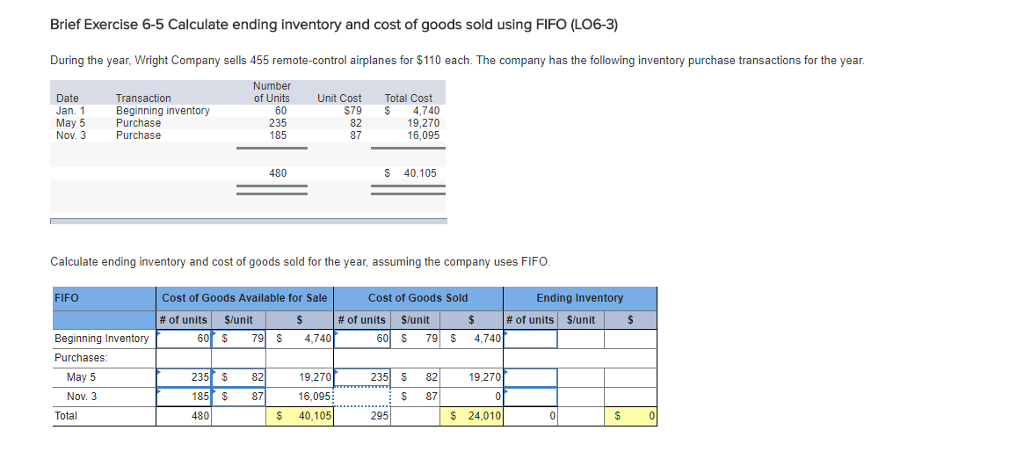

Question: Brief Exercise 6-5 Calculate ending inventory and cost of goods sold using FIFO (LO6-3) During the year, Wright Company sells 455 remote-control airplanes for $110

Brief Exercise 6-5 Calculate ending inventory and cost of goods sold using FIFO (LO6-3) During the year, Wright Company sells 455 remote-control airplanes for $110 each. The company has the following inventory purchase transactions for the year Date Jan. 1 May 5 Nov. 3 Transaction Beginning inventory Purchase Purchase Number of Units 60 235 185 Unit Cost Total Cost S79 $ 4,740 19,270 16,095 82 87 480 S 40,105 Calculate ending inventory and cost of goods sold for the year, assuming the company uses FIFO Cost of Goods Sold S/unit S 79 IFO Cost of Goods Available for Sale Ending Inventory # of units $/unit # of units | # of units | $/unit 60 $ 79S 4,740 4,740 Beginning Inventory Purchases 235 82 185 87 480 19,270 16,095 S 40,105 May 5 235 S 82 19,270 Nov. 3 S 87 Total 295 S 24,010

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts