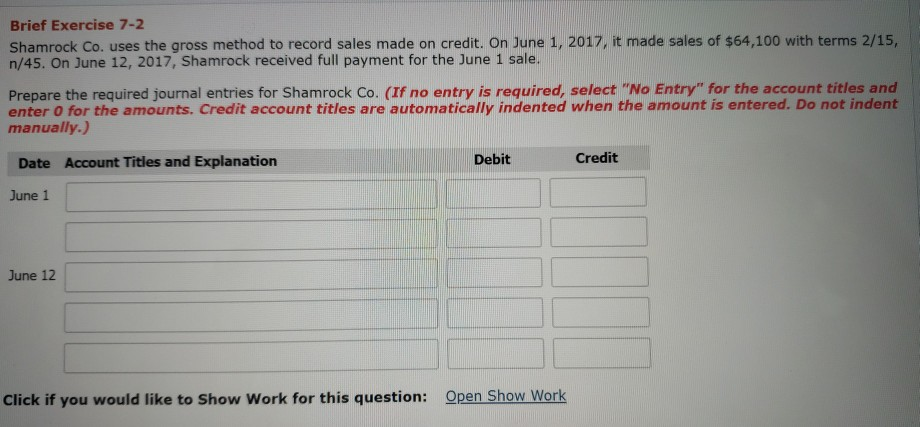

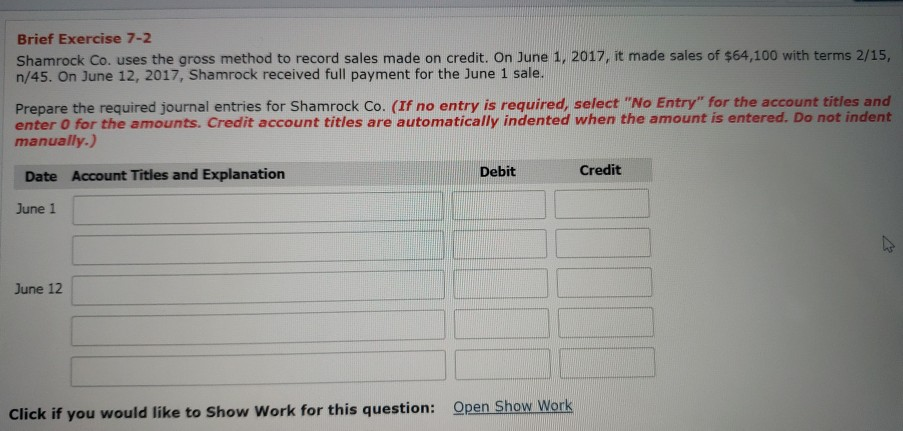

Question: Brief Exercise 7-2 Shamrock Co. uses the gross method to record sales made on credit. On June 1, 2017, it made sales of $64,100 with

Brief Exercise 7-2 Shamrock Co. uses the gross method to record sales made on credit. On June 1, 2017, it made sales of $64,100 with terms 2/15 n/45. On June 12, 2017, Shamrock received full payment for the June 1 sale. Prepare the required journal entries for Shamrock Co. (If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Debit Credit Date Account Titles and Explanation June 1 June 12 Click if you would like to Show Work for this question: Open Show Work Brief Exercise 7-2 Shamrock Co. uses the gross method to record sales made on credit. On June 1, 2017, it made sales of $64,100 with terms 2/15, n/45. On June 12, 2017, Shamrock received full payment for the June 1 sale. Prepare the required journal entries for Shamrock Co. (If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Date Account Tities and Explanation Debit Credit June 1 June 12 Click if you would like to Show Work for this question: Open Show Work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts