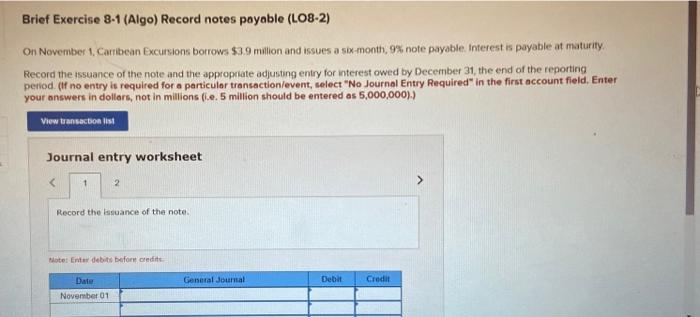

Question: Brief Exercise 8-1 (Algo) Record notes payable (LO8-2) On November 1. Caribean Excursions borrows $3.9 milion and issues a six-month, 9% note payable interest is

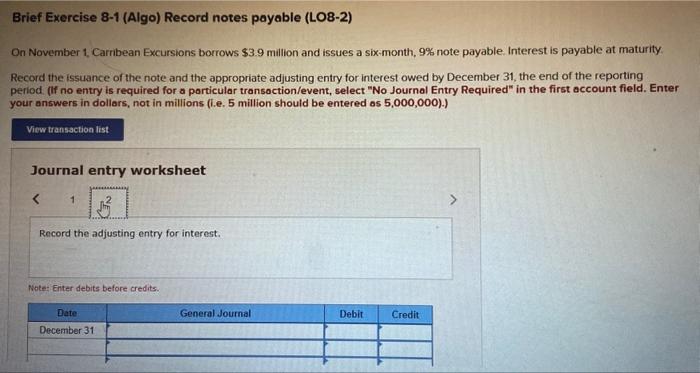

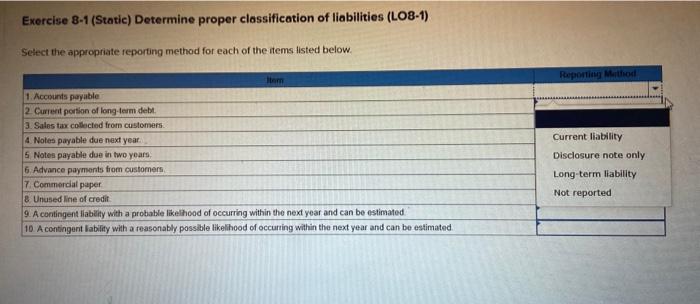

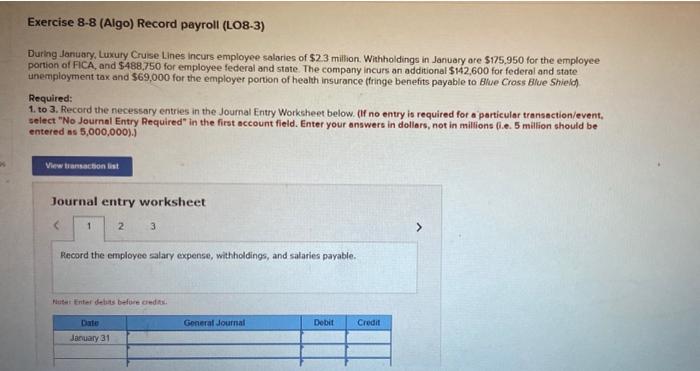

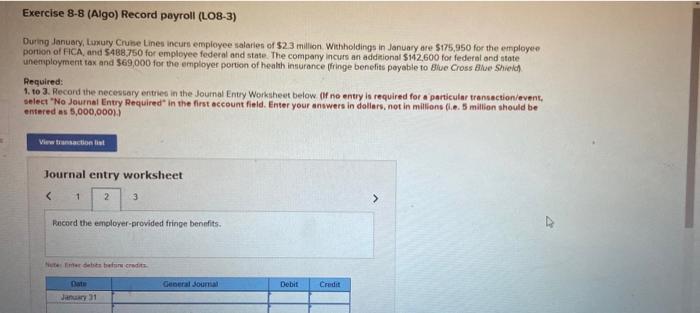

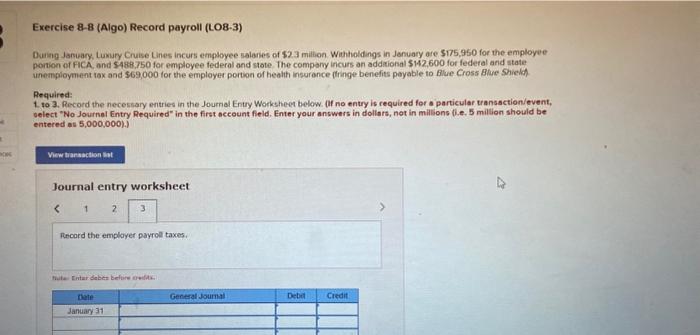

Brief Exercise 8-1 (Algo) Record notes payable (LO8-2) On November 1. Caribean Excursions borrows $3.9 milion and issues a six-month, 9% note payable interest is payable at maturity. Record the sssuance of the note and the appropiate adjusting entry for interest owed by December 31, the end of the reporting period. (If no entry is required for a particulor transaction/event, select "No Journal Entry Required" in the first account field, Enter your onswers in dollars, not in millions (i.e. 5 million should be entered as 5,000,000).) Journal entrv worksheet On November 1, Carribean Excursions borrows $3.9 million and issues a six-month, 9% note payable. Interest is payable at maturity. Record the issuance of the note and the appropriate adjusting entry for interest owed by December 31 , the end of the reporting period (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Enter your answers in doliars, not in millions (i.e. 5 million should be entered os 5,000,000) ).) Journal entry worksheet potes inter aebits betore credits. Exercise 8-1 (Static) Determine proper classification of liabilities (LO8-1) Select the appropriate reporting method for each of the items listed below. During January, Luxury Cruse Lines incurs employee salaries of $23 milion. Withholdings in January are $175,950 for the employee portion of FICA, and $488,750 for employee federal and state. The company incurs an additional $142,600 for federal and state unemployment tax and $69,000 for the employer portion of health insurance (fringe benefits payable to Blue Cross Bllue Shield). Required: 1. to 3. Record the necessary entries in the Joumal Entry Worksheet below. (If no entry is required for a particular transaction/event. select "No Journal Entry Required" in the first account field. Enter your answers in dollars, not in millions (i.e. 5 million should be entered ns 5,000,000) Journal entry worksheet Record the employee salary expense, withholdings, and salaries payable. Fhuteit tintei delats befure ciedisi. Exercise 8-8 (Algo) Record payroll (LO8-3) During January, Lumury Crube Lines incurs employee salaries of $2.3 million. Withholdings in January are 5175.950 for the employee ponion of FCA, and $488,750 for employee federal and state. The company incurs an addeional $142,600 for federal ond atote unenployment tax and $69,000 for the employer portion of health intsurance (fringe benefits poyable to Btue Cross Bhe Shineld). Pequired: 1. to 3. Recond the necessary enteres in the Joumal Entry Worksheet below (If no entry is required for a particular transactionievent, select "No Journal Entry Required" in the first account field. Enter your answers in dollers, not in millions (i.e. 5 million ahould be entered as 5,000,000) Journal entry worksheet Exercise 88 (Algo) Record payroll (LO8-3) Duing Jasuap. Luxury Cruise Lnes incurs employee salanes of $23 miltion Withtioldings in January are $175,950 for the employee portion of FCA , and 5488,750 for employee federal and stote. The compory incurs an addixional $142,600 for federal and state unempioyment tax and $69,000 for the employer portion of bedith insurance (finge benefits payable to Blue Cross Bhive Shielith Required: 1. to 3. Record the necessary entries in she Journal Entry Worksheen below. Of no entry is required for a particular transsction/event, velect "No Journel Entry Required" in the first account field. Enter your answers in dollars, not in millions (b.e. 5 million should be. entered as 5,000,000). . Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts