Question: Brief Exercise 9-8 Crane uses the units-of-production method to calculate depreciation on its taxicabs. Each cab is expected to be driven 338,400 km over its

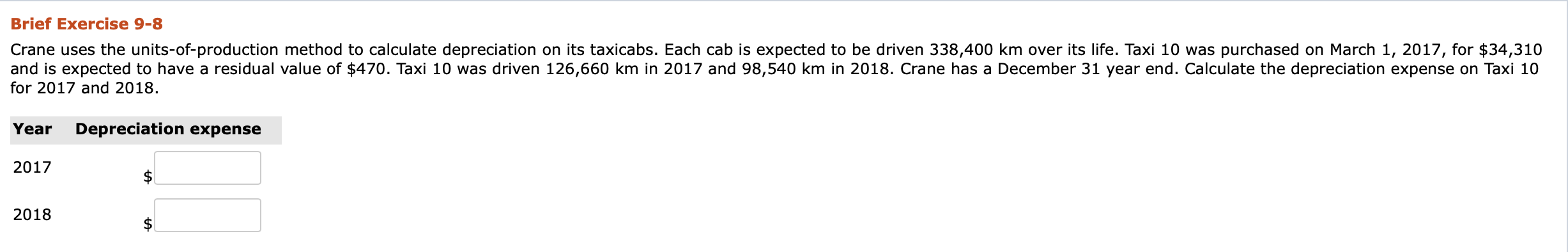

Brief Exercise 9-8 Crane uses the units-of-production method to calculate depreciation on its taxicabs. Each cab is expected to be driven 338,400 km over its life. Taxi 10 was purchased on March 1, 2017, for $34,310 and is expected to have a residual value of $470. Taxi 10 was driven 126,660 km in 2017 and 98,540 km in 2018. Crane has a December 31 year end. Calculate the depreciation expense on Taxi 10 for 2017 and 2018. Year Depreciation expense 2017 2018

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts