Question: Brief For this coursework project the candidate is required to answer a number of different questions on a simple single name credit default swap (CDS)

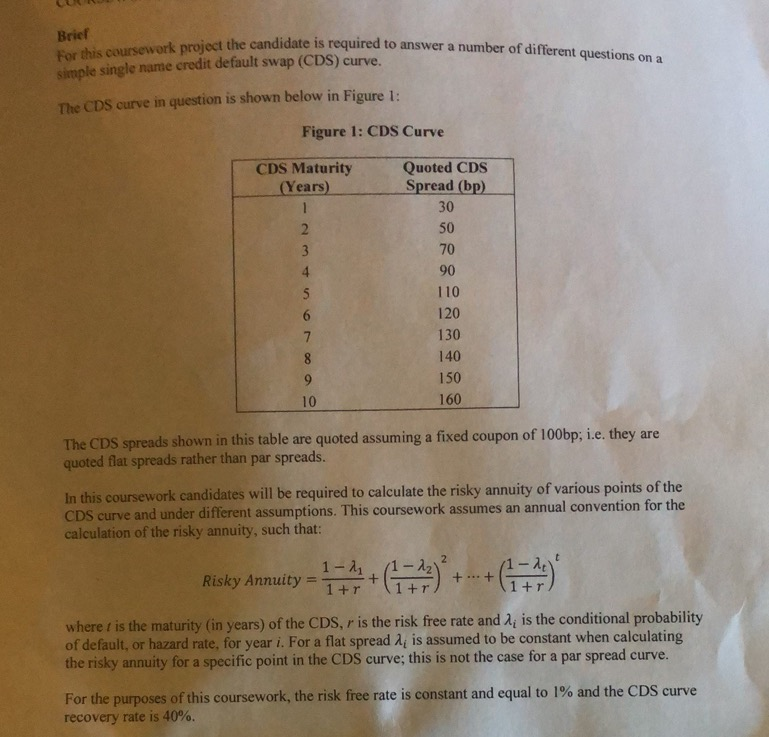

Brief For this coursework project the candidate is required to answer a number of different questions on a simple single name credit default swap (CDS) curve. The CDS curve in question is shown below in Figure 1: Figure 1: CDS Curve CDS Maturity (Years) 1 2 3 4 5 6 7 8 9 10 Quoted CDS Spread (bp) 30 50 70 90 110 120 130 140 150 160 The CDS spreads shown in this table are quoted assuming a fixed coupon of 100bp; i.e. they are quoted flat spreads rather than par spreads. In this coursework candidates will be required to calculate the risky annuity of various points of the CDS curve and under different assumptions. This coursework assumes an annual convention for the calculation of the risky annuity, such that: t Risky Annuity 1-4 + 1 +r + ... + 1+r where is the maturity (in years) of the CDS, r is the risk free rate and li is the conditional probability of default, or hazard rate, for year i. For a flat spread 2 is assumed to be constant when calculating the risky annuity for a specific point in the CDS curve; this is not the case for a par spread curve. For the purposes of this coursework, the risk free rate is constant and equal to 1% and the CDS curve recovery rate is 40%. Question 3 a) Calculate the par spread curve that corresponds to the quoted CDS curve shown in Figure 1. Hint 1: the IY par spread is equal to the lY quoted spread. Hint 2: you will require a root finding process to back out the risky annuity and par spread from a given upfront. Brief For this coursework project the candidate is required to answer a number of different questions on a simple single name credit default swap (CDS) curve. The CDS curve in question is shown below in Figure 1: Figure 1: CDS Curve CDS Maturity (Years) 1 2 3 4 5 6 7 8 9 10 Quoted CDS Spread (bp) 30 50 70 90 110 120 130 140 150 160 The CDS spreads shown in this table are quoted assuming a fixed coupon of 100bp; i.e. they are quoted flat spreads rather than par spreads. In this coursework candidates will be required to calculate the risky annuity of various points of the CDS curve and under different assumptions. This coursework assumes an annual convention for the calculation of the risky annuity, such that: t Risky Annuity 1-4 + 1 +r + ... + 1+r where is the maturity (in years) of the CDS, r is the risk free rate and li is the conditional probability of default, or hazard rate, for year i. For a flat spread 2 is assumed to be constant when calculating the risky annuity for a specific point in the CDS curve; this is not the case for a par spread curve. For the purposes of this coursework, the risk free rate is constant and equal to 1% and the CDS curve recovery rate is 40%. Question 3 a) Calculate the par spread curve that corresponds to the quoted CDS curve shown in Figure 1. Hint 1: the IY par spread is equal to the lY quoted spread. Hint 2: you will require a root finding process to back out the risky annuity and par spread from a given upfront

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts