Question: Briefly explain, with reference to the GST Act, the GST consequences for each line item of cash receipt and cash payment (11 marks). (Hint: copy

Briefly explain, with reference to the GST Act, the GST consequences for each line item of cash receipt and cash payment (11 marks).

(Hint: copy and paste the above table and add two extra columns: (1) explanation and (2) GST payable/Input tax credit).

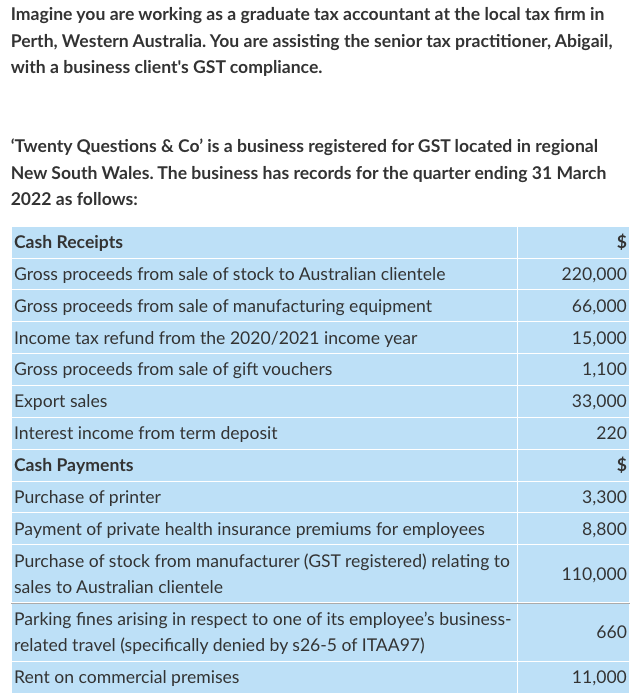

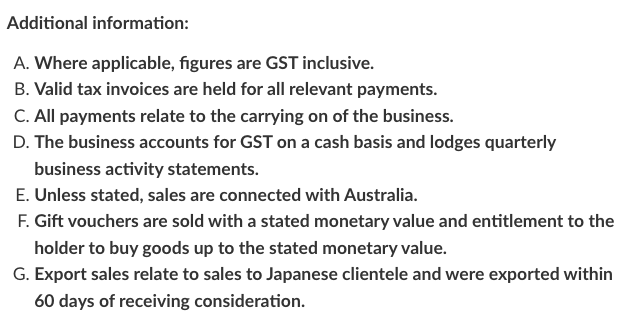

Imagine you are working as a graduate tax accountant at the local tax firm in Perth, Western Australia. You are assisting the senior tax practitioner, Abigail, with a business client's GST compliance. 'Twenty Questions \& Co' is a business registered for GST located in regional New South Wales. The business has records for the quarter ending 31 March 2022 as follows: Additional information: A. Where applicable, figures are GST inclusive. B. Valid tax invoices are held for all relevant payments. C. All payments relate to the carrying on of the business. D. The business accounts for GST on a cash basis and lodges quarterly business activity statements. E. Unless stated, sales are connected with Australia. F. Gift vouchers are sold with a stated monetary value and entitlement to the holder to buy goods up to the stated monetary value. G. Export sales relate to sales to Japanese clientele and were exported within 60 days of receiving consideration

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts