Question: New Millenium Company earned $2.3 million in net income last year. It took depreciation deductions of $302,000 and made new investments in working capital

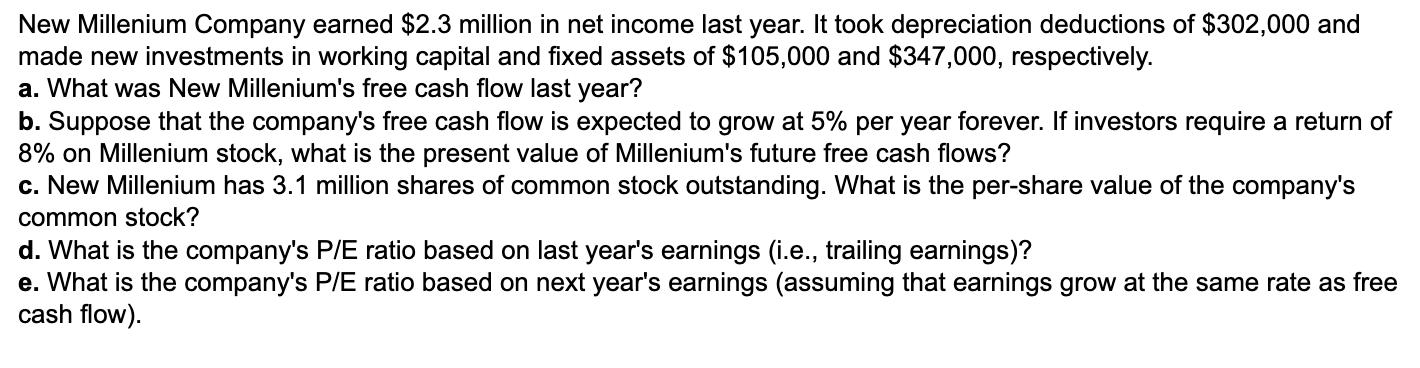

New Millenium Company earned $2.3 million in net income last year. It took depreciation deductions of $302,000 and made new investments in working capital and fixed assets of $105,000 and $347,000, respectively. a. What was New Millenium's free cash flow last year? b. Suppose that the company's free cash flow is expected to grow at 5% per year forever. If investors require a return of 8% on Millenium stock, what is the present value of Millenium's future free cash flows? c. New Millenium has 3.1 million shares of common stock outstanding. What is the per-share value of the company's common stock? d. What is the company's P/E ratio based on last year's earnings (i.e., trailing earnings)? e. What is the company's P/E ratio based on next year's earnings (assuming that earnings grow at the same rate as free cash flow).

Step by Step Solution

There are 3 Steps involved in it

Answer a To calculate New Milleniums free cash flow we use the formula textFree Cash Flow textNet Income textDepreciation textChange in Working Capita... View full answer

Get step-by-step solutions from verified subject matter experts