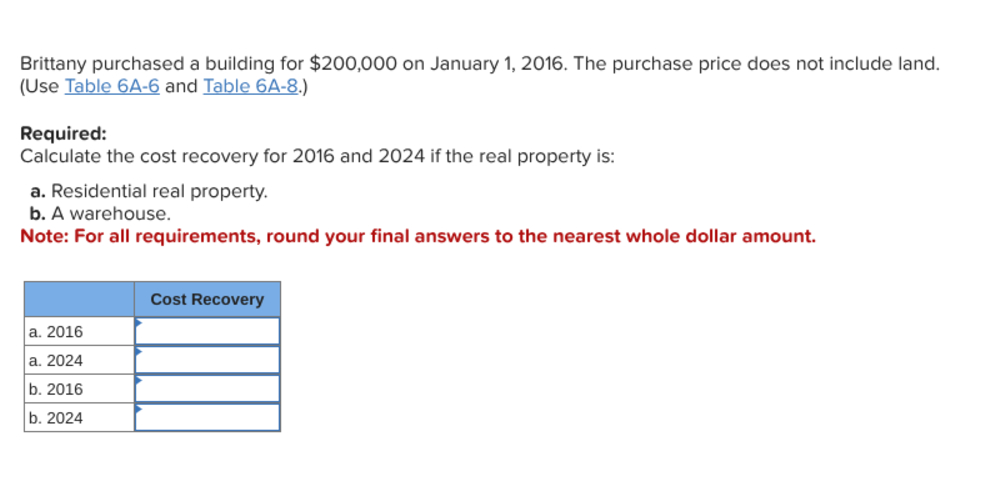

Question: Brittany purchased a building for ( $ 2 0 0 , 0 0 0 ) on January 1 , 2 0 1

Brittany purchased a building for $ on January The purchase price does not include land. Use Table A and Table A Required: Calculate the cost recovery for and if the real property is: a Residential real property. b A warehouse. Note: For all requirements, round your final answers to the nearest whole dollar amount. TABLE A General Depreciation System: StraightLine; Applicable Recovery Period: Years; MidMonth Convention

begintabularlllllllllllll

hline multicolumncMonth in the First Recovery Year the Property is Placed in Service

hline Recovery Year & & & & & & & & & & & &

hline & & & & & & & & & & & &

hline & & & & & & & & & & & &

hline & & & & & & & & & & & &

hline

endtabular

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock