Question: Brittany started a law practice as a sole proprietor. She owned a computer, printer, desk, and file cabinet she purchased during law school ( several

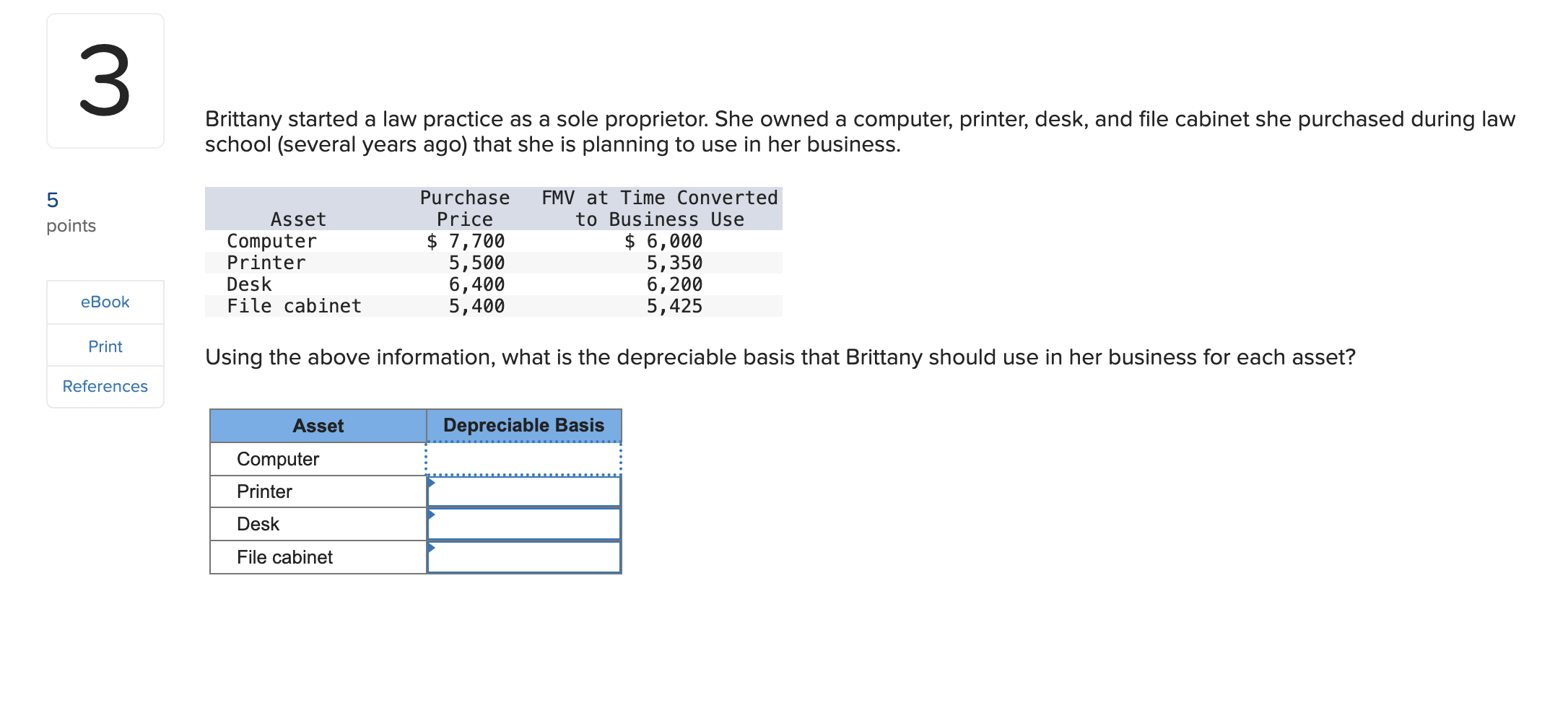

Brittany started a law practice as a sole proprietor. She owned a computer, printer, desk, and file cabinet she purchased during law

school several years ago that she is planning to use in her business.

Using the above information, what is the depreciable basis that Brittany should use in her business for each asset?Brittany started a law practice as a sole proprietor. She owned a computer, printer, desk, and file cabinet she purchased during law school several years ago that she is planning to use in her business.

Asset Purchase Price FMV at Time Converted to Business Use

Computer $ $

Printer

Desk

File cabinet

Using the above information, what is the depreciable basis that Brittany should use in her business for each asset?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock