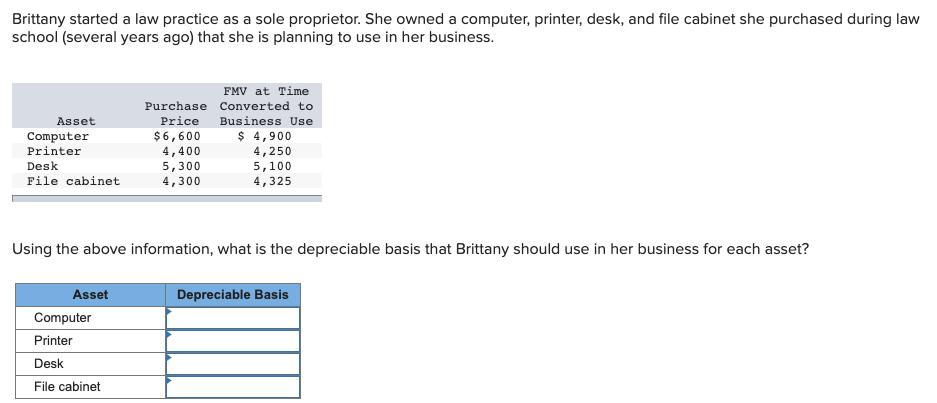

Question: Brittany started a law practice as a sole proprietor. She owned a computer, printer, desk, and file cabinet she purchased during law school (several

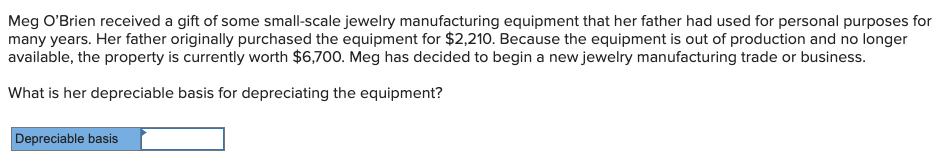

Brittany started a law practice as a sole proprietor. She owned a computer, printer, desk, and file cabinet she purchased during law school (several years ago) that she is planning to use in her business. FMV at Time Purchase Converted to Asset Price Business Use $ 4,900 4,250 5,100 4,325 $6,600 Computer Printer 4,400 5,300 4,300 Desk File cabinet Using the above information, what is the depreciable basis that Brittany should use in her business for each asset? Asset Depreciable Basis Computer Printer Desk File cabinet Meg O'Brien received a gift of some small-scale jewelry manufacturing equipment that her father had used for personal purposes for many years. Her father originally purchased the equipment for $2,210. Because the equipment is out of production and no longer available, the property is currently worth $6,700. Meg has decided to begin a new jewelry manufacturing trade or business. What is her depreciable basis for depreciating the equipment? Depreciable basis

Step by Step Solution

3.59 Rating (156 Votes )

There are 3 Steps involved in it

Answer Part 1 Asset Depreciable B... View full answer

Get step-by-step solutions from verified subject matter experts