Question: Bryant Company has a factory machine with a book value of $87,400 and a remaining useful life of 7 years. It can be sold

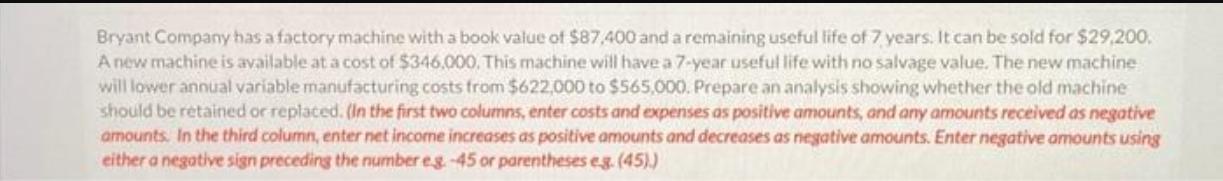

Bryant Company has a factory machine with a book value of $87,400 and a remaining useful life of 7 years. It can be sold for $29,200. A new machine is available at a cost of $346,000. This machine will have a 7-year useful life with no salvage value. The new machine will lower annual variable manufacturing costs from $622,000 to $565,000. Prepare an analysis showing whether the old machine should be retained or replaced. (In the first two columns, enter costs and expenses as positive amounts, and any amounts received as negative amounts. In the third column, enter net income increases as positive amounts and decreases as negative amounts. Enter negative amounts using either a negative sign preceding the number eg.-45 or parentheses eg. (45).)

Step by Step Solution

3.33 Rating (153 Votes )

There are 3 Steps involved in it

To determine whether the old machine should be retained or replaced we need to compare the relevant ... View full answer

Get step-by-step solutions from verified subject matter experts