Question: BSAC 2 2 0 6 / BSAC 2 2 0 2 : CORPORATE ACCOUNTING - 1 : ASSIGNMENT QUESTION - 1 The following are the

BSACBSAC: CORPORATE ACCOUNTING: ASSIGNMENT QUESTION

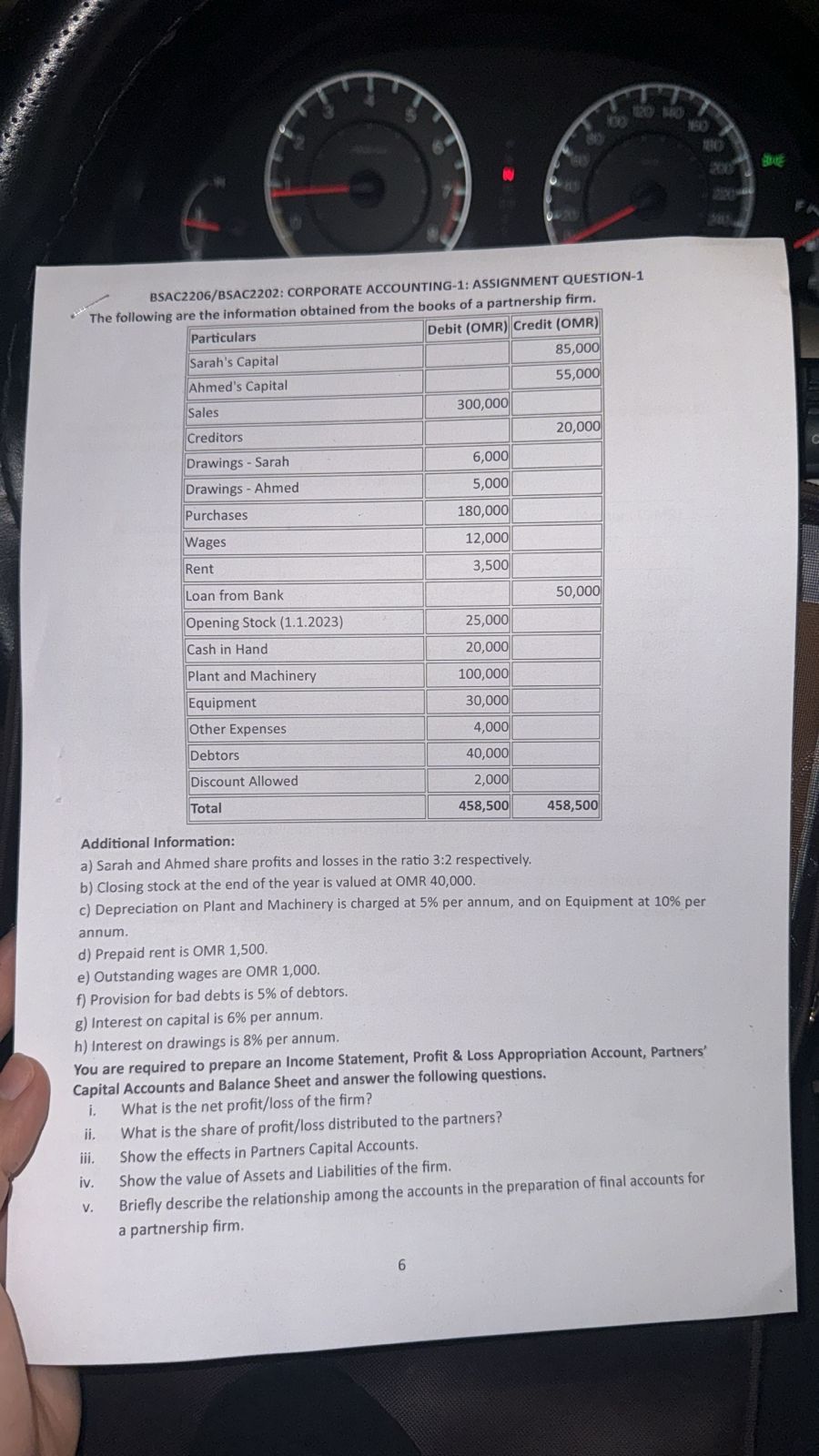

The following are the information obtained from the books of a partnership firm.

begintabularlrr

hline Particulars & Debit OMR & Credit OMR

hline Sarah's Capital & &

hline Ahmed's Capital & &

hline Sales & &

hline Creditors & &

hline Drawings Sarah & &

hline Drawings Ahmed & &

hline Purchases & &

hline Wages & &

hline Rent & &

hline Loan from Bank & &

hline Opening Stock & &

hline hline Cash in Hand & &

hline Plant and Machinery & &

hline hline Equipment & &

hline Other Expenses & &

hline Debtors & &

hline Discount Allowed & &

hline Total & &

hline hline

endtabular

Additional Information:

a Sarah and Ahmed share profits and losses in the ratio : respectively.

b Closing stock at the end of the year is valued at OMR

c Depreciation on Plant and Machinery is charged at per annum, and on Equipment at per annum.

d Prepaid rent is OMR

e Outstanding wages are OMR

f Provision for bad debts is of debtors.

g Interest on capital is per annum.

h Interest on drawings is per annum.

You are required to prepare an Income Statement, Profit & Loss Appropriation Account, Partners' Capital Accounts and Balance Sheet and answer the following questions.

i What is the net profitloss of the firm?

ii What is the share of profitloss distributed to the partners?

iii. Show the effects in Partners Capital Accounts.

iv Show the value of Assets and Liabilities of the firm.

v Briefly describe the relationship among the accounts in the preparation of final accounts for a partnership firm.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock