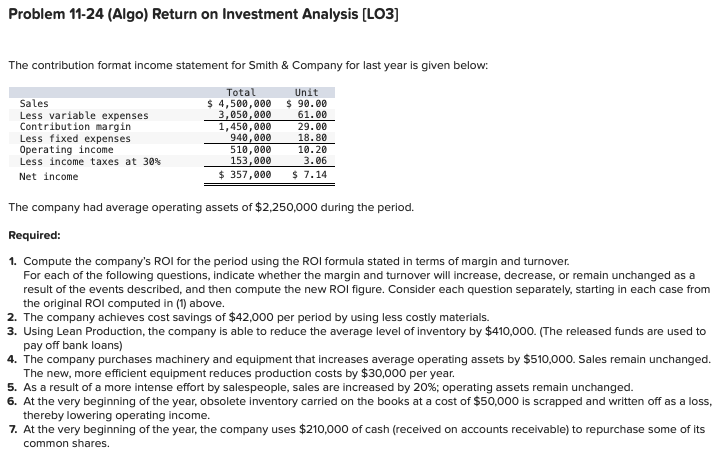

Question: The contribution format income statement for Smith & Company for last year is given below: TotalUnitSales$ 4 , 5 0 0 , 0 0 0

The contribution format income statement for Smith & Company for last year is given below:

TotalUnitSales$ $ Less variable expensesContribution marginLess fixed expensesOperating incomeLess income taxes at Net income$ $

The company had average operating assets of $ during the period.

Required:

Compute the companys ROI for the period using the ROI formula stated in terms of margin and turnover.

For each of the following questions, indicate whether the margin and turnover will increase, decrease, or remain unchanged as a result of the events described, and then compute the new ROI figure. Consider each question separately, starting in each case from the original ROI computed in above.

The company achieves cost savings of $ per period by using less costly materials.

Using Lean Production, the company is able to reduce the average level of inventory by $The released funds are used to pay off bank loans

The company purchases machinery and equipment that increases average operating assets by $ Sales remain unchanged. The new, more efficient equipment reduces production costs by $ per year.

As a result of a more intense effort by salespeople, sales are increased by ; operating assets remain unchanged.

At the very beginning of the year, obsolete inventory carried on the books at a cost of $ is scrapped and written off as a loss, thereby lowering operating income.

At the very beginning of the year, the company uses $ of cash received on accounts receivable to repurchase some of its common shares.

I am really not understanding this question, so if you could explain how you get the answers that would help me prep for my final exam.

The professor also added this note in our announcement boards about this question:

Problem

In the list of requirements that follow the income statement, Reqt lists a change to the average inventory. When you click on the requirement boxes, the values for Reqt are very different. Ignore the values in the blue box. Use the changes listed in the requirements list that follows the income statement.

I do not really understand what he is referring to

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock