Question: BTN 9 - 3 . Business Decision Problem Kingston Corporation has total assets of $ 5 , 2 0 0 , 0 0 0 and

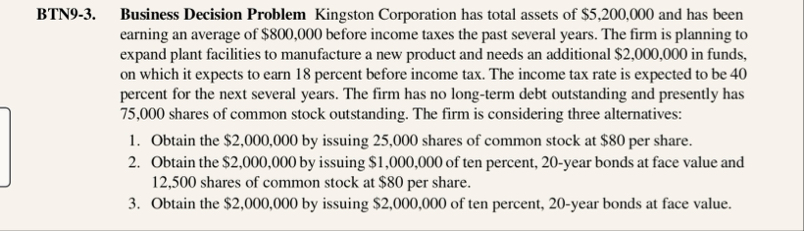

BTN Business Decision Problem Kingston Corporation has total assets of $ and has been earning an average of $ before income taxes the past several years. The firm is planning to expand plant facilities to manufacture a new product and needs an additional $ in funds, on which it expects to earn percent before income tax. The income tax rate is expected to be percent for the next several years. The firm has no longterm debt outstanding and presently has shares of common stock outstanding. The firm is considering three alternatives:

Obtain the $ by issuing shares of common stock at $ per share.

Obtain the $ by issuing $ of ten percent, year bonds at face value and shares of common stock at $ per share.

Obtain the $ by issuing $ of ten percent, year bonds at face value.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock