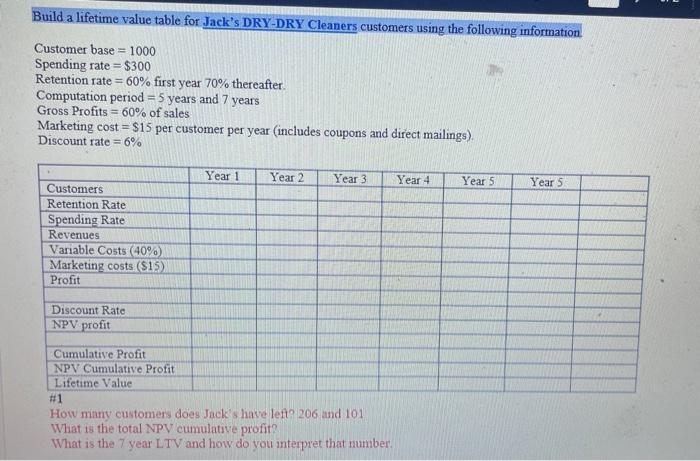

Question: Build a lifetime value table for Jack's DRY-DRY Cleaners customers using the following information Customer base = 1000 Spending rate = $300 Retention rate=60% first

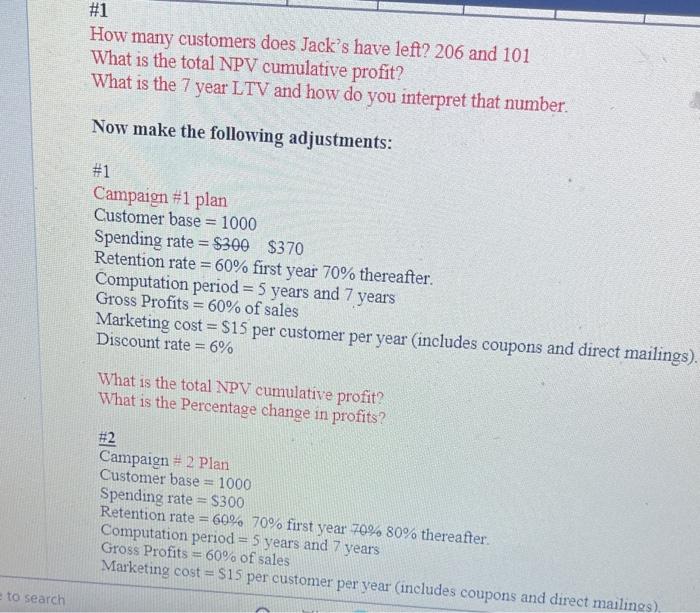

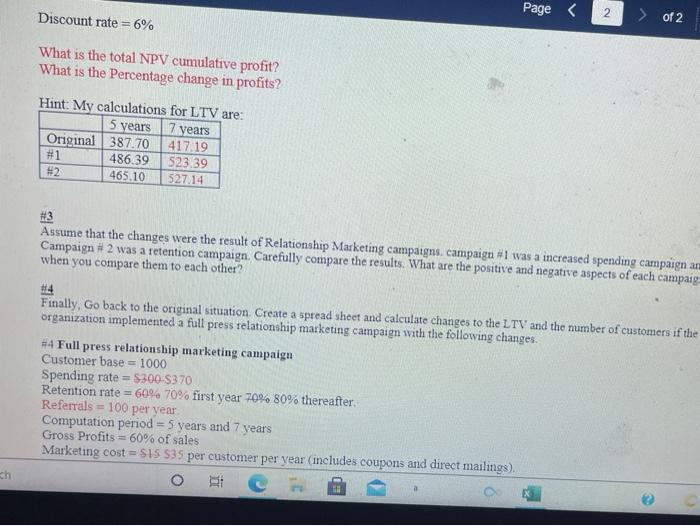

Build a lifetime value table for Jack's DRY-DRY Cleaners customers using the following information Customer base = 1000 Spending rate = $300 Retention rate=60% first year 70% thereafter. Computation period = 5 years and 7 years Gross Profits = 60% of sales Marketing cost = $15 per customer per year (includes coupons and direct mailings). Discount rate = 6% Year 1 Year 2 Year 3 Year 4 Year 5 Year 5 Customers Retention Rate Spending Rate Revenues Variable Costs (40%) Marketing costs ($15) Profit Discount Rate NPV profit Cumulative Profit NPV Cumulative Profit Lifetime Value #1 How many customers does Jack's have left 206 and 101 What is the total NPV cumulative profit? What is the 7 year LTV and how do you interpret that number. #1 How many customers does Jack's have left? 206 and 101 What is the total NPV cumulative profit? What is the 7 year LTV and how do you interpret that number. Now make the following adjustments: = #1 Campaign #1 plan Customer base = 1000 Spending rate = $300 $370 Retention rate = 60% first year 70% thereafter. Computation period = 5 years and 7 years Gross Profits 60% of sales Marketing cost = $15 per customer per year (includes coupons and direct mailings). Discount rate = 6% What is the total NPV cumulative profit? What is the Percentage change in profits? #2 Campaign = 2 Plan Customer base = 1000 Spending rate = $300 Retention rate = 60% 70% first year 70% 80% thereafter. Computation period = 5 years and 7 years Gross Profits = 60% of sales Marketing cost = $15 per customer per year (includes coupons and direct mailings) to search Page of 2 What is the total NPV cumulative profit? What is the Percentage change in profits? Hint: My calculations for LTV are: 5 years 7 years Original 387.70 417.19 #1 486.39 523 39 #2 465.10 527.14 #3 Assume that the changes were the result of Relationship Marketing campaigns, campaign. I was a increased spending campaign am Campaign #2 was a retention campaign. Carefully compare the results. What are the positive and negative aspects of each campaig when you compare them to each other? #4 Finally, Go back to the original situation. Create a spread sheet and calculate changes to the LTV and the number of customers if the organization implemented a full press relationship marketing campaign with the following changes #4 Full press relationship marketing campaign Customer base = 1000 Spending rate = $300-S370 Retention rate = 60% 70% first year 70% 80% thereafter, Referrals = 100 per year Computation period = 5 years and 7 years Gross Profits = 60% of sales Marketing cost = $15 535 per customer per year (includes coupons and direct mailings). ch Computation period=> years and 7 years Gross Profits = 60% of sales Marketing cost = $15 $35 per customer per year (includes coupons and direct mailings). Discount rate=6% Build a lifetime value table for Jack's DRY-DRY Cleaners customers using the following information Customer base = 1000 Spending rate = $300 Retention rate=60% first year 70% thereafter. Computation period = 5 years and 7 years Gross Profits = 60% of sales Marketing cost = $15 per customer per year (includes coupons and direct mailings). Discount rate = 6% Year 1 Year 2 Year 3 Year 4 Year 5 Year 5 Customers Retention Rate Spending Rate Revenues Variable Costs (40%) Marketing costs ($15) Profit Discount Rate NPV profit Cumulative Profit NPV Cumulative Profit Lifetime Value #1 How many customers does Jack's have left 206 and 101 What is the total NPV cumulative profit? What is the 7 year LTV and how do you interpret that number. #1 How many customers does Jack's have left? 206 and 101 What is the total NPV cumulative profit? What is the 7 year LTV and how do you interpret that number. Now make the following adjustments: = #1 Campaign #1 plan Customer base = 1000 Spending rate = $300 $370 Retention rate = 60% first year 70% thereafter. Computation period = 5 years and 7 years Gross Profits 60% of sales Marketing cost = $15 per customer per year (includes coupons and direct mailings). Discount rate = 6% What is the total NPV cumulative profit? What is the Percentage change in profits? #2 Campaign = 2 Plan Customer base = 1000 Spending rate = $300 Retention rate = 60% 70% first year 70% 80% thereafter. Computation period = 5 years and 7 years Gross Profits = 60% of sales Marketing cost = $15 per customer per year (includes coupons and direct mailings) to search Page of 2 What is the total NPV cumulative profit? What is the Percentage change in profits? Hint: My calculations for LTV are: 5 years 7 years Original 387.70 417.19 #1 486.39 523 39 #2 465.10 527.14 #3 Assume that the changes were the result of Relationship Marketing campaigns, campaign. I was a increased spending campaign am Campaign #2 was a retention campaign. Carefully compare the results. What are the positive and negative aspects of each campaig when you compare them to each other? #4 Finally, Go back to the original situation. Create a spread sheet and calculate changes to the LTV and the number of customers if the organization implemented a full press relationship marketing campaign with the following changes #4 Full press relationship marketing campaign Customer base = 1000 Spending rate = $300-S370 Retention rate = 60% 70% first year 70% 80% thereafter, Referrals = 100 per year Computation period = 5 years and 7 years Gross Profits = 60% of sales Marketing cost = $15 535 per customer per year (includes coupons and direct mailings). ch Computation period=> years and 7 years Gross Profits = 60% of sales Marketing cost = $15 $35 per customer per year (includes coupons and direct mailings). Discount rate=6%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts