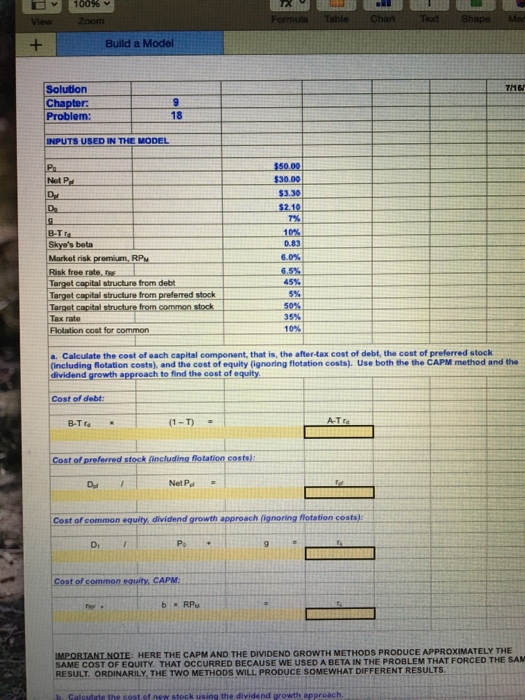

Question: Build a Model Solution Chapter Problem: 18 INPUTS USED IN THE MODEL $50.00 30.00 $3.30 Pa Net Pe B.Trs Skye's beta Market rik premium, RP

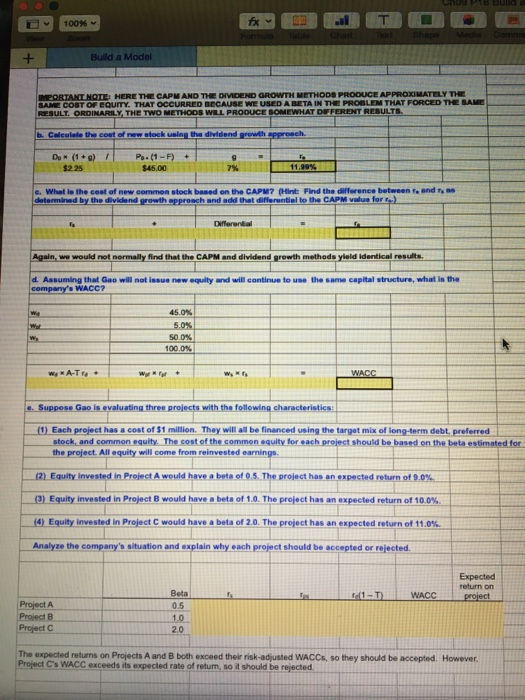

Build a Model Solution Chapter Problem: 18 INPUTS USED IN THE MODEL $50.00 30.00 $3.30 Pa Net Pe B.Trs Skye's beta Market rik premium, RP Risk free rate. Targot capital structure from debt Targot capital structure from prefemed stock Targot c Tax rate Flotation cost for common 10% .83 6.0% 50% 35% 10% .Calculate the cost of each capital component, that is, the after-tax cost of debt, the cost of preferred stock (Including flotation costs), and the cost of equity (ignoring flotation costs). Use both the the CAPM method and the dividend growth approach to find the cost of equity Cost of debt: (1-T) B-Trs = Cost of preferred stock fincluding lotation costsl: Cost of common equity, dividend growth approach fignoring flotation Di Cost of common equity. CAPM IMPORTANT NOTE: HERE THE CAPM AND THE DIVIDEND GROWTH METHODS PRODUCE APPROXIMATELY THE SAME COST OF EQUITY. THAT OCCURRED BECAUSE WE USED A BETA IN THE PROBLEM THAT FORCED THE SAM RESULT. ORDINARILY, THE TWO METHODS WILL PRODUCE SOMEWHAT DIFFERENT RESULTS Build a Model INPORTANLHOE: HERE T CAPM AND T DIVIDEND GROWTH METHODS PROOUCE APPEOXMATELY THE SAME COST OF EQUITY. THAT OCCURRED BECAUSE WE USED A BETA IN THE PROBLEM THAT FORCED THE SAME REsuLT. ORDINARILY THE TWO METHOS WILL PRODUCE SOMEWHAT DFFERENT RESULTS b.Coleulate the cout of new steck using the dividend growth sppresch $225 45.00 e.What is the coat of new common stock based on the CAPW? (Hint Find the difference between f and t B h and add thet differentiel to the CAPM value for s Again, we wwould not normally find that the CAPM and dividend growth methods yield identical results. d. Assuming that Gao will not issue new equity and will continue to use the same capital structure, what is the s WACC7 45 0% 5.0% 50.0% 100 characteristics (1) Each project has a cost of $1 million. They will al be financed using the target mix of long-term debt, preferred common equity. The cost of the common equity for each project should be based on the beta estimated for All equity will come from reinvested the In Equity invested inProiect Awouldhama betaotos. The project has an "pected return of 9.0% 3)Equityinvested in Project B would have a beta of 1.0. The proiect has an expected return of 10.0%. _14 Equity invested in Project C would have a beta of2.0. The proiect has an expected return of 11.0%. Analyze the company's situation and explain why each project should be accepted or rejected. return on Beta 0.5 1.0 2.0 WACC Project A Project B Project C The expected returns on Projects A and B both exceed their risk-adjusted WACCs, so they should be accepted. However Project C's WACC exceeds its expected rate of return, so it should be rejected Build a Model Solution Chapter Problem: 18 INPUTS USED IN THE MODEL $50.00 30.00 $3.30 Pa Net Pe B.Trs Skye's beta Market rik premium, RP Risk free rate. Targot capital structure from debt Targot capital structure from prefemed stock Targot c Tax rate Flotation cost for common 10% .83 6.0% 50% 35% 10% .Calculate the cost of each capital component, that is, the after-tax cost of debt, the cost of preferred stock (Including flotation costs), and the cost of equity (ignoring flotation costs). Use both the the CAPM method and the dividend growth approach to find the cost of equity Cost of debt: (1-T) B-Trs = Cost of preferred stock fincluding lotation costsl: Cost of common equity, dividend growth approach fignoring flotation Di Cost of common equity. CAPM IMPORTANT NOTE: HERE THE CAPM AND THE DIVIDEND GROWTH METHODS PRODUCE APPROXIMATELY THE SAME COST OF EQUITY. THAT OCCURRED BECAUSE WE USED A BETA IN THE PROBLEM THAT FORCED THE SAM RESULT. ORDINARILY, THE TWO METHODS WILL PRODUCE SOMEWHAT DIFFERENT RESULTS Build a Model INPORTANLHOE: HERE T CAPM AND T DIVIDEND GROWTH METHODS PROOUCE APPEOXMATELY THE SAME COST OF EQUITY. THAT OCCURRED BECAUSE WE USED A BETA IN THE PROBLEM THAT FORCED THE SAME REsuLT. ORDINARILY THE TWO METHOS WILL PRODUCE SOMEWHAT DFFERENT RESULTS b.Coleulate the cout of new steck using the dividend growth sppresch $225 45.00 e.What is the coat of new common stock based on the CAPW? (Hint Find the difference between f and t B h and add thet differentiel to the CAPM value for s Again, we wwould not normally find that the CAPM and dividend growth methods yield identical results. d. Assuming that Gao will not issue new equity and will continue to use the same capital structure, what is the s WACC7 45 0% 5.0% 50.0% 100 characteristics (1) Each project has a cost of $1 million. They will al be financed using the target mix of long-term debt, preferred common equity. The cost of the common equity for each project should be based on the beta estimated for All equity will come from reinvested the In Equity invested inProiect Awouldhama betaotos. The project has an "pected return of 9.0% 3)Equityinvested in Project B would have a beta of 1.0. The proiect has an expected return of 10.0%. _14 Equity invested in Project C would have a beta of2.0. The proiect has an expected return of 11.0%. Analyze the company's situation and explain why each project should be accepted or rejected. return on Beta 0.5 1.0 2.0 WACC Project A Project B Project C The expected returns on Projects A and B both exceed their risk-adjusted WACCs, so they should be accepted. However Project C's WACC exceeds its expected rate of return, so it should be rejected

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts