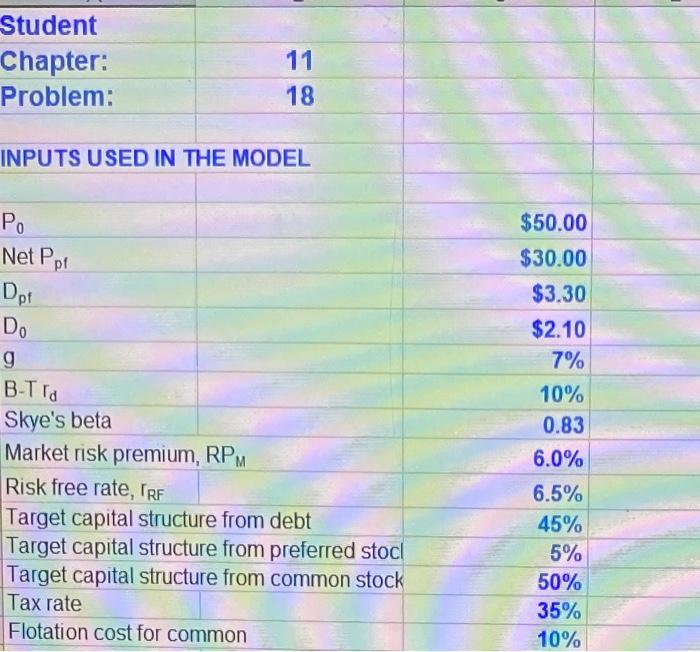

Question: Student Chapter: Problem: 11 18 INPUTS USED IN THE MODEL Po Net Ppt D.pt Do g B-Tra Skye's beta Market risk premium, RPM Risk free

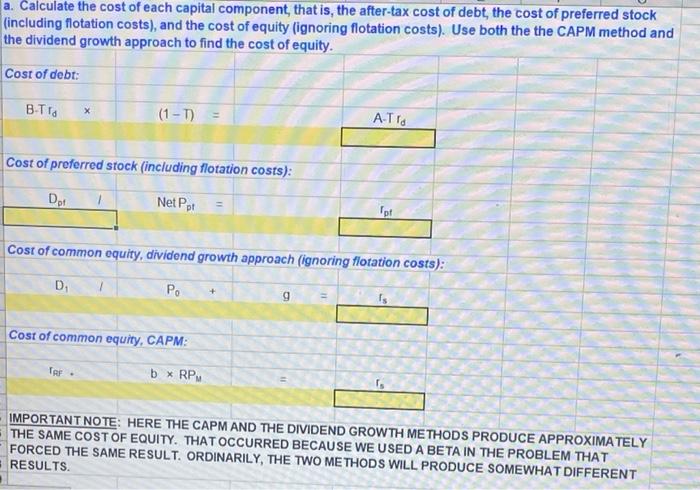

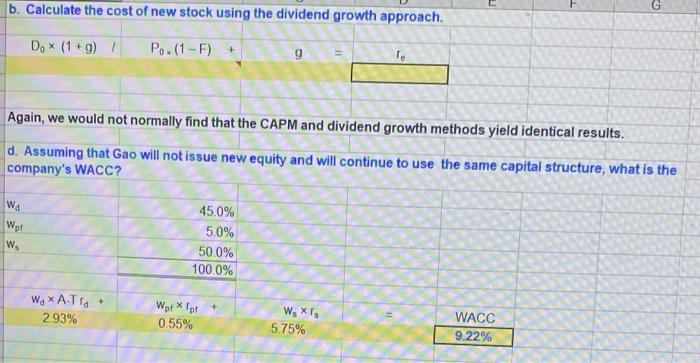

Student Chapter: Problem: 11 18 INPUTS USED IN THE MODEL Po Net Ppt D.pt Do g B-Tra Skye's beta Market risk premium, RPM Risk free rate, IRF Target capital structure from debt Target capital structure from preferred stoc! Target capital structure from common stock Tax rate Flotation cost for common $50.00 $30.00 $3.30 $2.10 7% 10% 0.83 6.0% 6.5% 45% 5% 50% 35% 10% a. Calculate the cost of each capital component, that is, the after-tax cost of debt, the cost of preferred stock (including flotation costs), and the cost of equity (ignoring flotation costs). Use both the the CAPM method and the dividend growth approach to find the cost of equity. Cost of debt: B-Tra x (1 -T) A.Tro Cost of preferred stock (including flotation costs): Dor Net Ppt 'pt Cost of common equity, dividend growth approach (ignoring flotation costs): D Po 9 Cost of common equity, CAPM: TRF b* RPM IMPORTANT NOTE: HERE THE CAPM AND THE DIVIDEND GROWTH METHODS PRODUCE APPROXIMATELY THE SAME COST OF EQUITY. THAT OCCURRED BECAUSE WE USED A BETA IN THE PROBLEM THAT FORCED THE SAME RESULT. ORDINARILY, THE TWO METHODS WILL PRODUCE SOMEWHAT DIFFERENT RESULTS b. Calculate the cost of new stock using the dividend growth approach. G D. * (1 +9)/ Po. (1 - F) + g Again, we would not normally find that the CAPM and dividend growth methods yield identical results. d. Assuming that Gao will not issue new equity and will continue to use the same capital structure, what is the company's WACC? Wa Wor W 45.0% 5.0% 50.0% 100.0% Wa* A-Tro + 2.93% Worx lot 0.55% W, XT 5.75% WACC 9.22%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts