Question: Build a toy Robo advisor program that: a) Calculate the expected number of years left for your client (i.e., life expectancy). explain the logic behind

Build a toy Robo advisor program that:

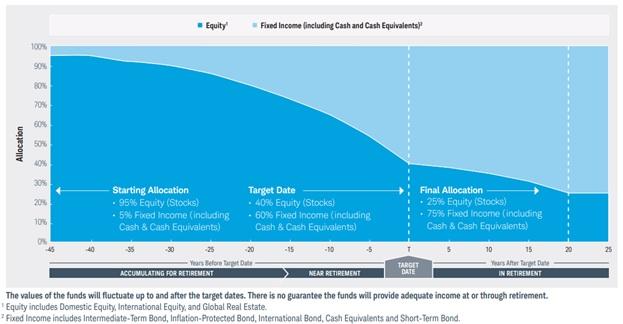

a) Calculate the expected number of years left for your client (i.e., life expectancy). explain the logic behind the life expectancy calculation and asset allocation strategy with the table below.

b) make an asset allocation strategy based on your client's number of years left for retirement (similar to table below).

Allocation 100% 90% 80% 70% 50% 40% 30% 20% 10% Equity Starting Allocation . 95% Equity (Stocks) - 5% Fixed Income (including Cash & Cash Equivalents) -20 Years Before Target Date ACCUMULATING FOR RETIREMENT Fixed Income (including Cash and Cash Equivalents) Target Date 40% Equity (Stocks) -60% Fixed Income (including Cash & Cash Equivalents) -15 NEAR RETIREMENT Final Allocation -25% Equity (Stocks) 75% Fixed Income (including Cash & Cash Equivalents) TARGET DATE 10 Years After Target Date IN RETIREMENT The values of the funds will fluctuate up to and after the target dates. There is no guarantee the funds will provide adequate income at or through retirement. Equity includes Domestic Equity, International Equity, and Global Real Estate. Fixed Income includes Intermediate-Term Bond, Inflation-Protected Bond, International Bond, Cash Equivalents and Short-Term Bond.

Step by Step Solution

3.35 Rating (161 Votes )

There are 3 Steps involved in it

Toy RoboAdvisor Program for Asset Allocation Heres a basic structure for a toy Roboadvisor program that calculates life expectancy and suggests asset ... View full answer

Get step-by-step solutions from verified subject matter experts