Question: Build an Excel spreadsheet for operating expenses. The spreadsheet should clearly display the total operating expenses, other expenses, and total expenses. There are both fixed

Build an Excel spreadsheet for operating expenses. The spreadsheet should clearly display the total operating expenses, other expenses, and total expenses. There are both fixed cost and variable cost items listed. First, the fixed costs are as follows:

Item | Annual Cost |

Vehicle Expense | $12,600.00 |

Repairs & Maintenance | $32,700.00 |

Taxes & Licenses | $4,600.00 |

Trash Removal | $18,800.00 |

Exterminator | $11,800.00 |

Insurance | $46,320.00 |

Equipment Rentals | $10,900.00 |

Armored Car Service | $15,400.00 |

Telephone | $2,575.00 |

Utilities | $30,500.00 |

Other Fixed Costs | $52,000.00 |

Second, the variable costs consist of:

Item | Annual Cost |

Laundry & Uniforms | 0.6% |

Paper Goods | 0.4% |

Cleaning Supplies | 0.5% |

Other Variable Costs | 2.1% |

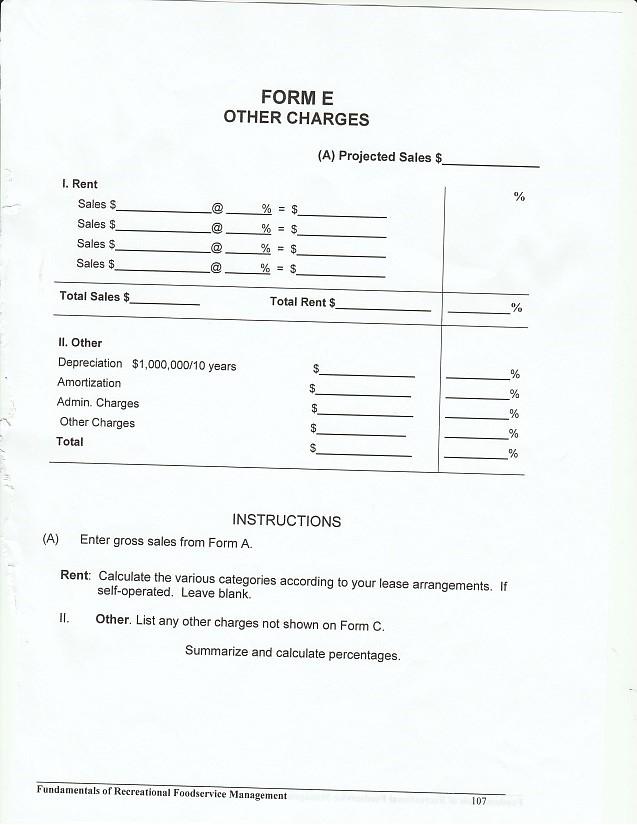

In addition to fixed and variable costs, the stadium should consider rent for running the concession stands. The rent is 41% of annual sales.

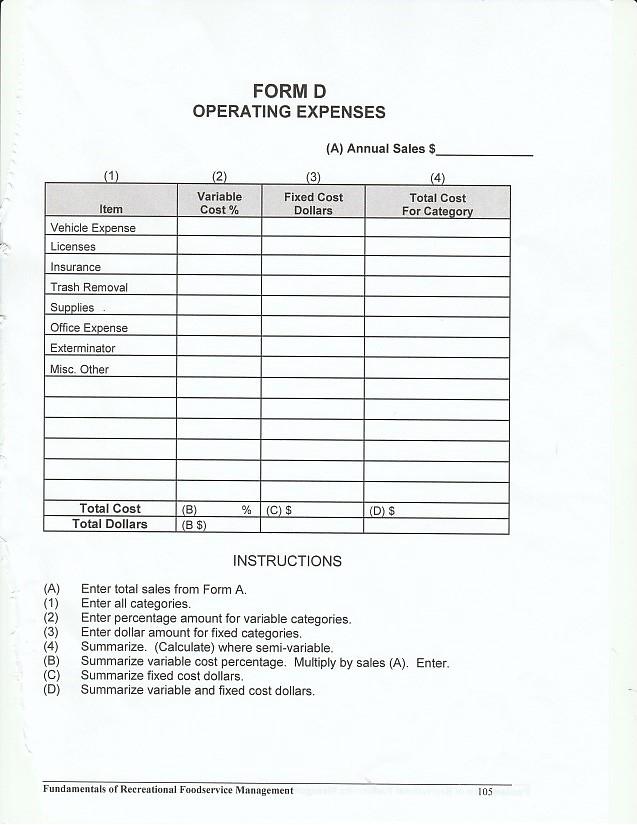

The Operating Expenses spreadsheet created for this section should mirror Forms D & E from the textbook (pages 105 & 107).

(1) Item Vehicle Expense Licenses. Insurance Trash Removal Supplies Office Expense Exterminator Misc. Other (A) (1) (2) (3) (4) (C) Total Cost Total Dollars FORM D OPERATING EXPENSES Variable Cost% (B) (B $) (3) Fixed Cost Dollars % (C) $ (A) Annual Sales $ INSTRUCTIONS Enter total sales from Form A. Enter all categories. Enter percentage amount for variable categories. Enter dollar amount for fixed categories. Fundamentals of Recreational Foodservice Management (D) $ Total Cost For Category Summarize. (Calculate) where semi-variable. Summarize variable cost percentage. Multiply by sales (A). Enter. Summarize fixed cost dollars. Summarize variable and fixed cost dollars. 105

Step by Step Solution

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Stepbystep Explanation FORM D Operational Axpense Anual Income 100... View full answer

Get step-by-step solutions from verified subject matter experts