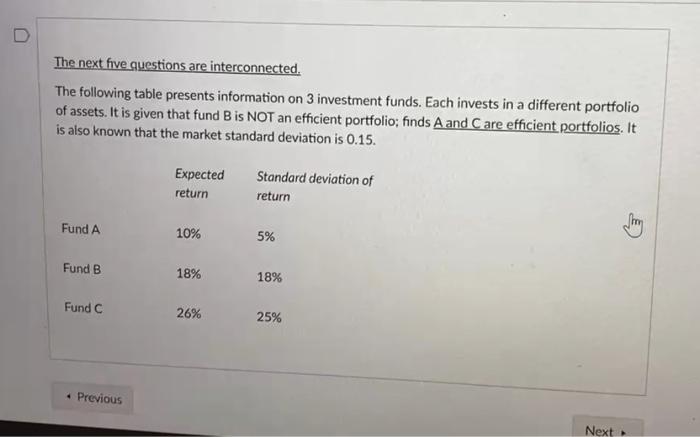

Question: build off each other The next five questions are interconnected. The following table presents information on 3 investment funds. Each invests in a different portfolio

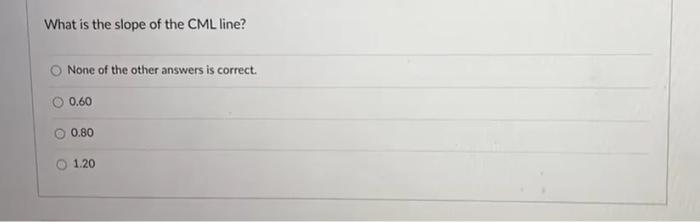

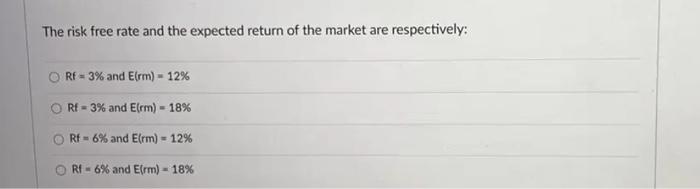

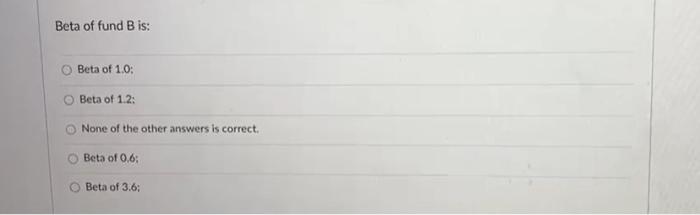

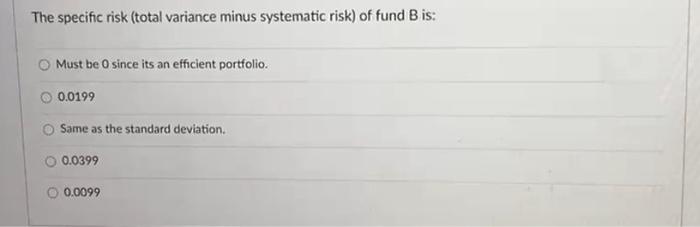

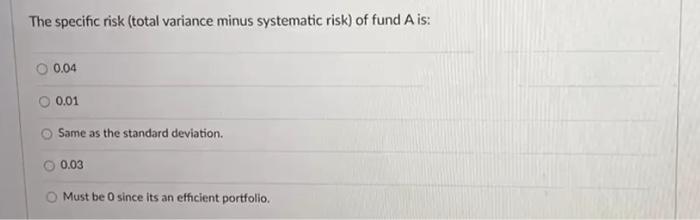

The next five questions are interconnected. The following table presents information on 3 investment funds. Each invests in a different portfolio of assets. It is given that fund B is NOT an efficient portfolio; finds A and C are efficient portfolios. It is also known that the market standard deviation is 0.15. Expected return Standard deviation of return Fund A 10% 5% Fund B 18% 18% Fund C 26% 25% Previous Next What is the slope of the CML line? None of the other answers is correct. 0.60 O 0.80 1.20 The risk free rate and the expected return of the market are respectively: O RF = 3% and Elrm) - 12% RF = 3% and Elem) - 18% RF - 6% and Elrm) = 12% Rf - 6% and E(rm) - 18% Beta of fund B is: Beta of 1.0: Beta of 1.2: None of the other answers is correct. Beta of 0.6; Beta of 3.6; The specific risk (total variance minus systematic risk) of fund B is: Must be O since its an efficient portfolio. 0.0199 Same as the standard deviation. 0.0399 0.0099 The specific risk (total variance minus systematic risk) of fund A is: O 0.04 0.01 Same as the standard deviation. 0.03 Must be O since its an efficient portfolio. The next five questions are interconnected. The following table presents information on 3 investment funds. Each invests in a different portfolio of assets. It is given that fund B is NOT an efficient portfolio; finds A and C are efficient portfolios. It is also known that the market standard deviation is 0.15. Expected return Standard deviation of return Fund A 10% 5% Fund B 18% 18% Fund C 26% 25% Previous Next What is the slope of the CML line? None of the other answers is correct. 0.60 O 0.80 1.20 The risk free rate and the expected return of the market are respectively: O RF = 3% and Elrm) - 12% RF = 3% and Elem) - 18% RF - 6% and Elrm) = 12% Rf - 6% and E(rm) - 18% Beta of fund B is: Beta of 1.0: Beta of 1.2: None of the other answers is correct. Beta of 0.6; Beta of 3.6; The specific risk (total variance minus systematic risk) of fund B is: Must be O since its an efficient portfolio. 0.0199 Same as the standard deviation. 0.0399 0.0099 The specific risk (total variance minus systematic risk) of fund A is: O 0.04 0.01 Same as the standard deviation. 0.03 Must be O since its an efficient portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts