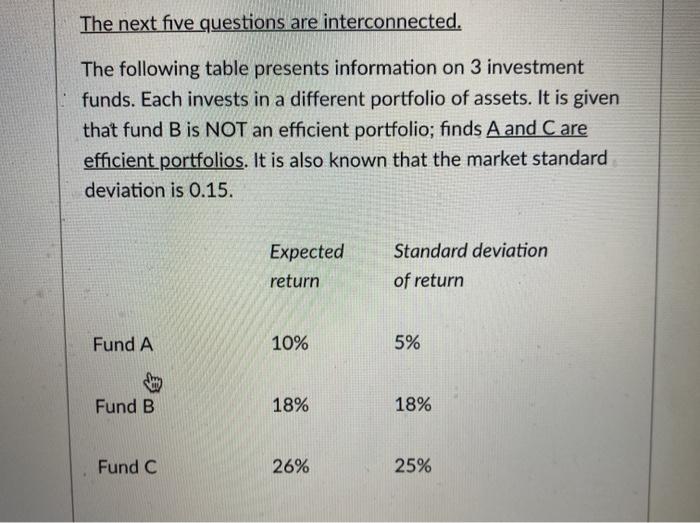

Question: The next five questions are interconnected. The following table presents information on 3 investment funds. Each invests in a different portfolio of assets. It is

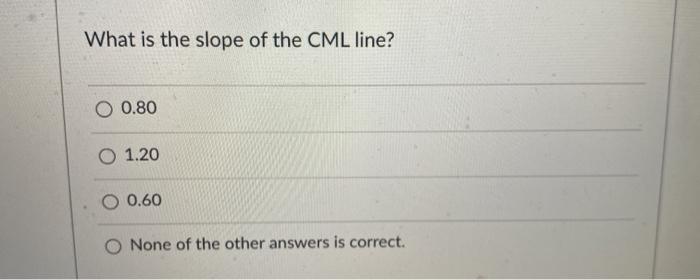

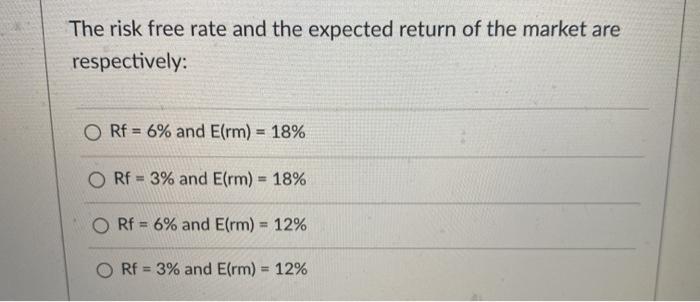

The next five questions are interconnected. The following table presents information on 3 investment funds. Each invests in a different portfolio of assets. It is given that fund B is NOT an efficient portfolio; finds A and Care efficient portfolios. It is also known that the market standard deviation is 0.15. Expected return Standard deviation of return Fund A 10% 5% Fund B 18% 18% Fund C 26% 25% What is the slope of the CML line? 0.80 O 1.20 0.60 None of the other answers is correct. The risk free rate and the expected return of the market are respectively: O Rf 6% and E(rm) = 18% ORF = 3% and E(rm) = 18% Rf = 6% and E(rm) = 12% O Rf = 3% and E(rm) = 12%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts