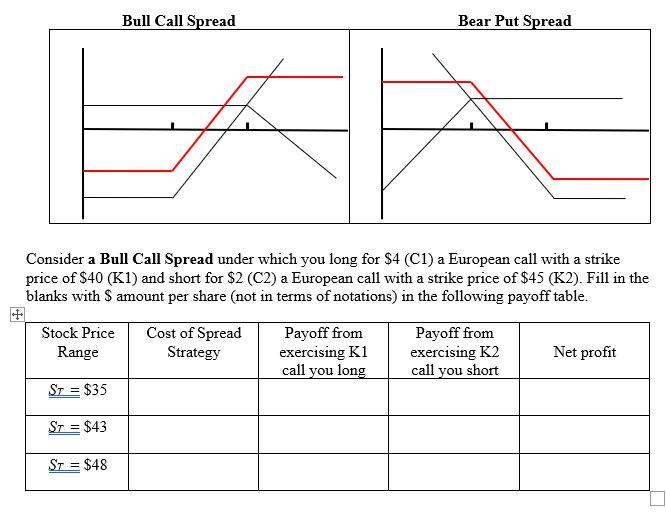

Question: Bull Call Spread Bear Put Spread A Consider a Bull Call Spread under which you long for $4 (C1) a European call with a strike

Bull Call Spread Bear Put Spread A Consider a Bull Call Spread under which you long for $4 (C1) a European call with a strike price of $40 (K1) and short for $2 (C2) a European call with a strike price of $45 (K2). Fill in the blanks with $ amount per share (not in terms of notations) in the following payoff table. Stock Price Cost of Spread Payoff from Payoff from Range Strategy exercising K1 exercising K2 Net profit call you long call you short St = $35 St = $43 St = $48

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock