Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bupco wants an improvement in collections as well, but the managers are peaceful souls and are leery of hiring Big Jin. They are considering

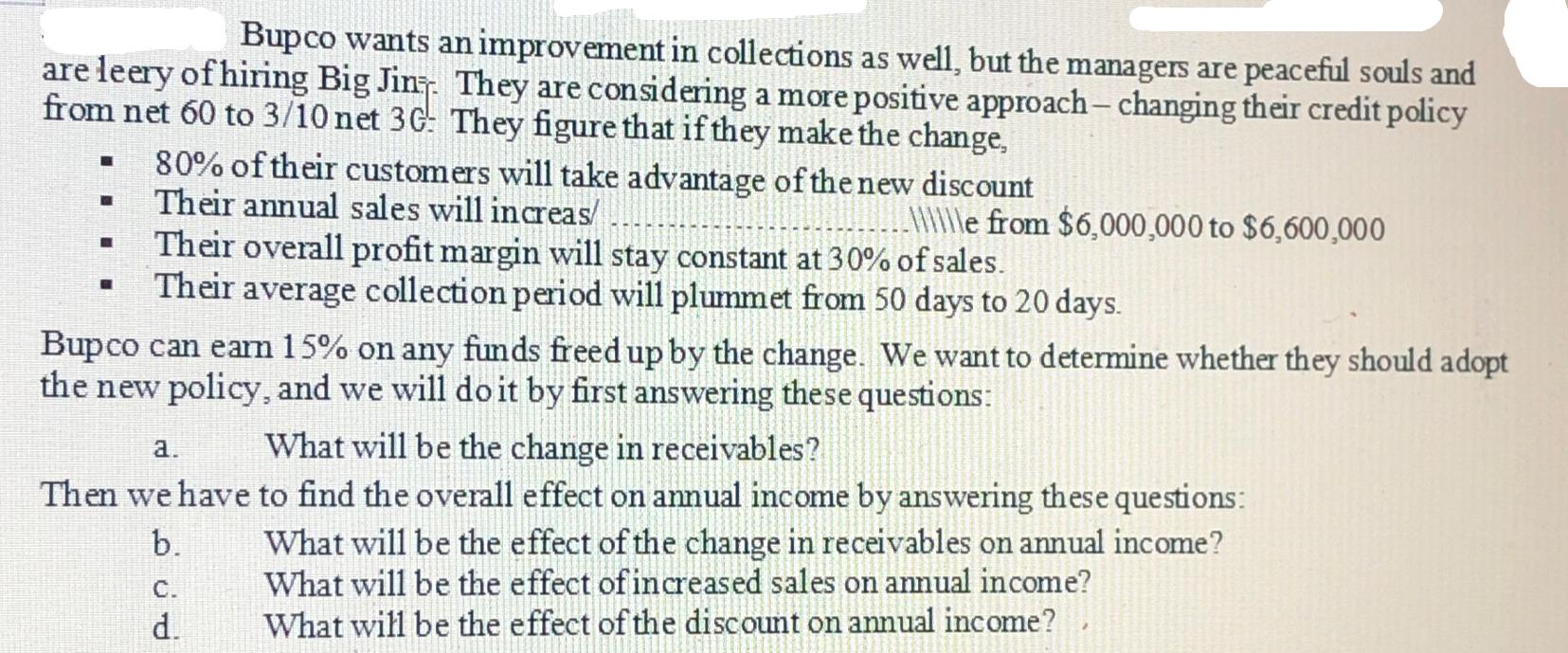

Bupco wants an improvement in collections as well, but the managers are peaceful souls and are leery of hiring Big Jin. They are considering a more positive approach-changing their credit policy from net 60 to 3/10 net 3G: They figure that if they make the change, 80% of their customers will take advantage of the new discount Their annual sales will increas/ le from $6,000,000 to $6,600,000 Their overall profit margin will stay constant at 30% of sales. Their average collection period will plummet from 50 days to 20 days. Bupco can earn 15% on any funds freed up by the change. We want to determine whether they should adopt the new policy, and we will do it by first answering these questions: a. What will be the change in receivables? Then we have to find the overall effect on annual income by answering these questions: What will be the effect of the change in receivables on annual income? b. C. What will be the effect of increased sales on annual income? d. What will be the effect of the discount on annual income?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Change in Receivables Current Receivables Average Collection Period 50 days Annual Sales 6000000 R...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663e6a52228a3_956721.pdf

180 KBs PDF File

663e6a52228a3_956721.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started