Question: BUS 201 Case Study Project #3 Spring, 2018 Name Directions: The answers for both parts must be written legibly. If I cannot read your answer,

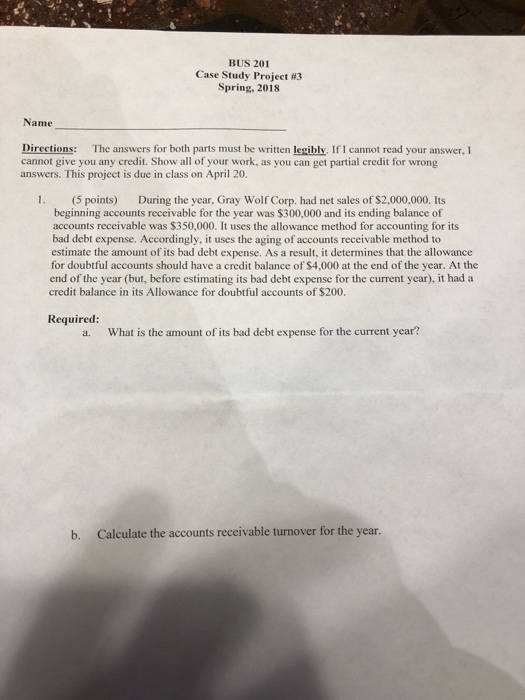

BUS 201 Case Study Project #3 Spring, 2018 Name Directions: The answers for both parts must be written legibly. If I cannot read your answer, I cannot give you any credit. Show all of your work, as you can get partial credit for wrong answers. This project is due in class on April 20. 1. During the year, Gray Wolf Corp. had net sales of $2,000,000. Its (5 points) beginning accounts receivable for the year was $300,000 and its ending balance of accounts receivable was $350,000. It uses the allowance method for accounting for its bad debt expense. Accordingly, it uses the aging of accounts receivable method to estimate the amount of its bad debt expense. As a result, it determines that the allowance for doubtful accounts should have a credit balance of $4,000 at the end of the year. At the end of the year (but, before estimating its bad debt expense for the current year), it had a credit balance in its Allowance for doubtful accounts of $200. Required: a. What is the amount of its bad debt expense for the current year b. Calculate the accounts receivable turnover for the year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts