Question: BUS 241 Berk 4/e Spring 2021 - David Debora Dani Roz! | 03/03/21 3:17 PM Homework: Chapter 18 Homework Save Score: 0 of 1 pt

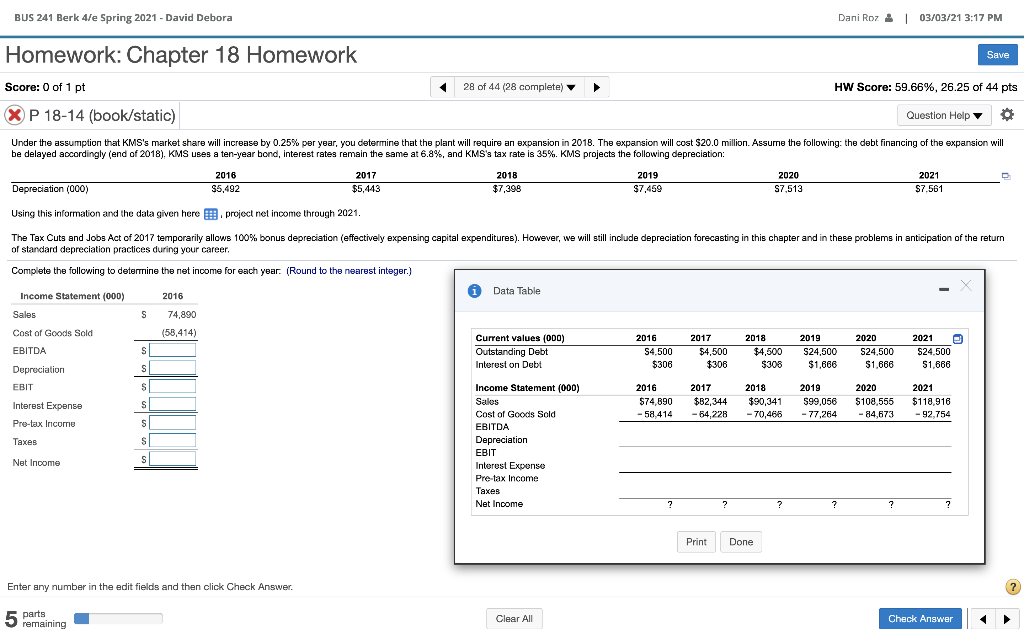

BUS 241 Berk 4/e Spring 2021 - David Debora Dani Roz! | 03/03/21 3:17 PM Homework: Chapter 18 Homework Save Score: 0 of 1 pt 28 of 44 (28 complete) HW Score: 59.66%, 26.25 of 44 pts XP 18-14 (book/static) Question Help 0 Under the assumption that KMS's market share will increase by 0.25% per year, you determine that the plant will require an expansion in 2018. The expansion will cost $20.0 million. Assume the following: the debt financing of the expansion will be delayed accordingly (end of 2018), KMS uses a ten-year bond, interest rates remain the same at 6.8%, and KMS's tax rate is 35%. KMS projects the following depreciation: 2016 2017 2018 2019 2020 2021 Depreciation (000) $5,492 $5,443 $7,398 $7,459 S7.513 $7.561 Using this information and the data given here project net income through 2021. The Tax Cuts and Jobs Act of 2017 temporarily allows 100% bonus depreciation (effectively expensing capital expenditures). However, we will still include depreciation forecasting in this chapter and in these problems in anticipation of the return of standard depreciation practices during your career. Complete the following to determine the net income for each year. (Round to the nearest integer.) x Income Statement (000) A Data Table 2016 Sales S s 74,890 (58,414) Cost of Goods Sold EBITDA S si Current values (000) Outstanding Debt Interest on Debt 2016 S4,500 $306 2017 $4,500 $308 2018 $4,500 $308 2019 S24,500 $1,666 2020 S24,500 $1,666 2021 PA $24.500 $1,666 Depreciation EBIT Interest Expense Income Statement (000) 2019 S S Sales 2016 $74,890 -58.414 2017 $82,344 -64,228 2018 $90,341 - 70,466 $99,056 2020 $108,555 -84,673 2021 $118,916 -92,754 - 77.264 Pre-tax Income sl S Taxes S Net Income S Cost of Goods Sold EBITDA Depreciation EBIT Interest Expense Pre-tax Income Taxes Net Income ? ? ? ? 7 ? 7 Print Done Enter any number in the edit fields and then click Check Answer. ? 5 parts remaining Clear All Check Answer BUS 241 Berk 4/e Spring 2021 - David Debora Dani Roz! | 03/03/21 3:17 PM Homework: Chapter 18 Homework Save Score: 0 of 1 pt 28 of 44 (28 complete) HW Score: 59.66%, 26.25 of 44 pts XP 18-14 (book/static) Question Help 0 Under the assumption that KMS's market share will increase by 0.25% per year, you determine that the plant will require an expansion in 2018. The expansion will cost $20.0 million. Assume the following: the debt financing of the expansion will be delayed accordingly (end of 2018), KMS uses a ten-year bond, interest rates remain the same at 6.8%, and KMS's tax rate is 35%. KMS projects the following depreciation: 2016 2017 2018 2019 2020 2021 Depreciation (000) $5,492 $5,443 $7,398 $7,459 S7.513 $7.561 Using this information and the data given here project net income through 2021. The Tax Cuts and Jobs Act of 2017 temporarily allows 100% bonus depreciation (effectively expensing capital expenditures). However, we will still include depreciation forecasting in this chapter and in these problems in anticipation of the return of standard depreciation practices during your career. Complete the following to determine the net income for each year. (Round to the nearest integer.) x Income Statement (000) A Data Table 2016 Sales S s 74,890 (58,414) Cost of Goods Sold EBITDA S si Current values (000) Outstanding Debt Interest on Debt 2016 S4,500 $306 2017 $4,500 $308 2018 $4,500 $308 2019 S24,500 $1,666 2020 S24,500 $1,666 2021 PA $24.500 $1,666 Depreciation EBIT Interest Expense Income Statement (000) 2019 S S Sales 2016 $74,890 -58.414 2017 $82,344 -64,228 2018 $90,341 - 70,466 $99,056 2020 $108,555 -84,673 2021 $118,916 -92,754 - 77.264 Pre-tax Income sl S Taxes S Net Income S Cost of Goods Sold EBITDA Depreciation EBIT Interest Expense Pre-tax Income Taxes Net Income ? ? ? ? 7 ? 7 Print Done Enter any number in the edit fields and then click Check Answer. ? 5 parts remaining Clear All Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts