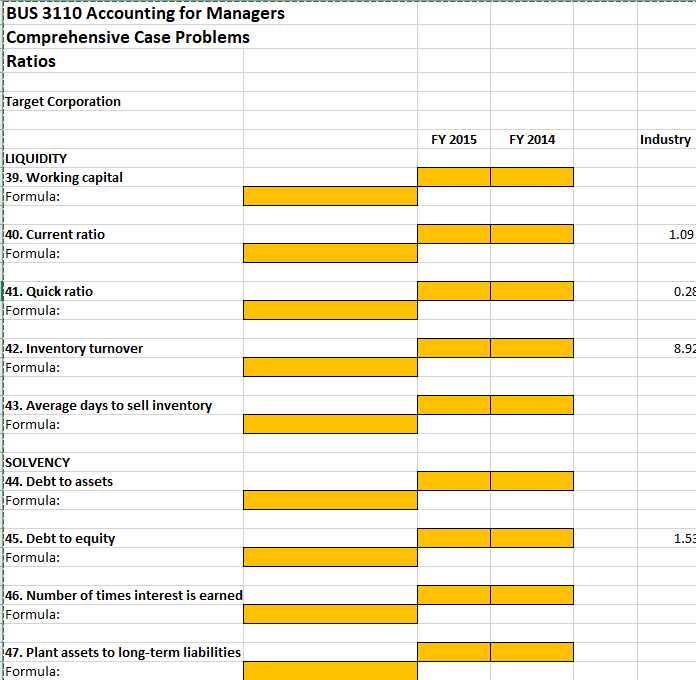

Question: BUS 3110 Accounting for Managers Comprehensive Case Problems Ratios Target Corporation FY 2015 FY 2014 Industry LIQUIDITY 39. Working capital Formula: 40. Current ratio Formula:

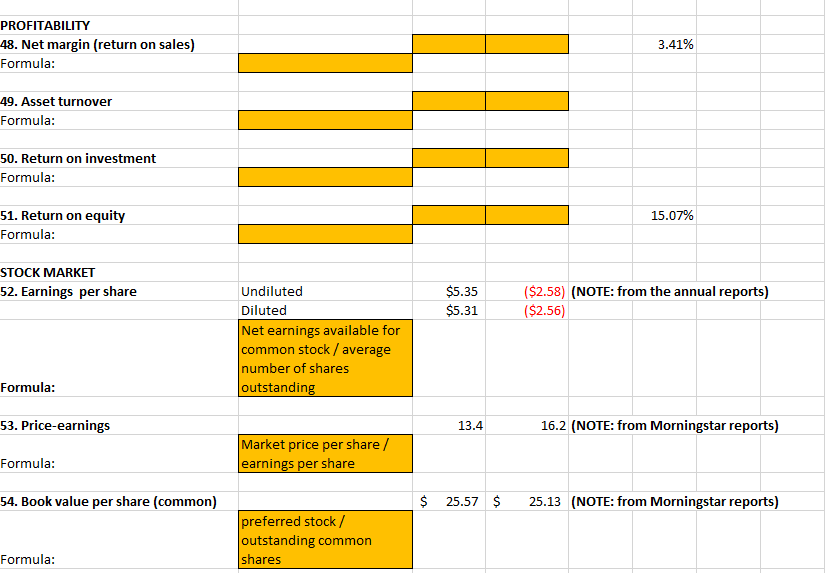

BUS 3110 Accounting for Managers Comprehensive Case Problems Ratios Target Corporation FY 2015 FY 2014 Industry LIQUIDITY 39. Working capital Formula: 40. Current ratio Formula: 1.09 41. Quick ratio Formula: 0.2 8.9 42. Inventory turnover Formula: 43. Average days to sell inventory Formula: SOLVENCY 44. Debt to assets Formula: 45. Debt to equity Formula: 46. Number of times interest is earned Formula: 47. Plant assets to long-term liabilities Formula: PROFITABILITY 48. Net margin (return on sales) Formula: 3.41% 49. Asset turnover Formula: 50. Return on investment Formula: 51. Return on equity Formula: 15.07% STOCK MARKET $5.35 $5.31 52. Earnings per share Undiluted Diluted Net earnings available for common stock/average number of shares outstandin ($2.58) (NOTE: from the annual reports) ($2.56 Formula 53. Price-earnings 13.4 16.2 (NOTE: from Morningstar reports) Market price per share/ Formula: earnings per share 54. Book value per share (common) $ 25.57$ 25.13 (NOTE: from Morningstar reports) preferred stock outstanding common shares Formula: BUS 3110 Accounting for Managers Comprehensive Case Problems Ratios Target Corporation FY 2015 FY 2014 Industry LIQUIDITY 39. Working capital Formula: 40. Current ratio Formula: 1.09 41. Quick ratio Formula: 0.2 8.9 42. Inventory turnover Formula: 43. Average days to sell inventory Formula: SOLVENCY 44. Debt to assets Formula: 45. Debt to equity Formula: 46. Number of times interest is earned Formula: 47. Plant assets to long-term liabilities Formula: PROFITABILITY 48. Net margin (return on sales) Formula: 3.41% 49. Asset turnover Formula: 50. Return on investment Formula: 51. Return on equity Formula: 15.07% STOCK MARKET $5.35 $5.31 52. Earnings per share Undiluted Diluted Net earnings available for common stock/average number of shares outstandin ($2.58) (NOTE: from the annual reports) ($2.56 Formula 53. Price-earnings 13.4 16.2 (NOTE: from Morningstar reports) Market price per share/ Formula: earnings per share 54. Book value per share (common) $ 25.57$ 25.13 (NOTE: from Morningstar reports) preferred stock outstanding common shares Formula

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts