Question: https://finance.yahoo.com/quote/TGT https://csimarket.com/Industry/industry_Efficiency.php?ind=1303 BUS 3110 Accounting for Managers Comprehensive Case Problems Ratios simarket.com/Indust Target Corporation FY 2015 FY 2014 LIQUIDITY 39. Working capital 1,508$ 1,888 Current

https://finance.yahoo.com/quote/TGT

https://csimarket.com/Industry/industry_Efficiency.php?ind=1303

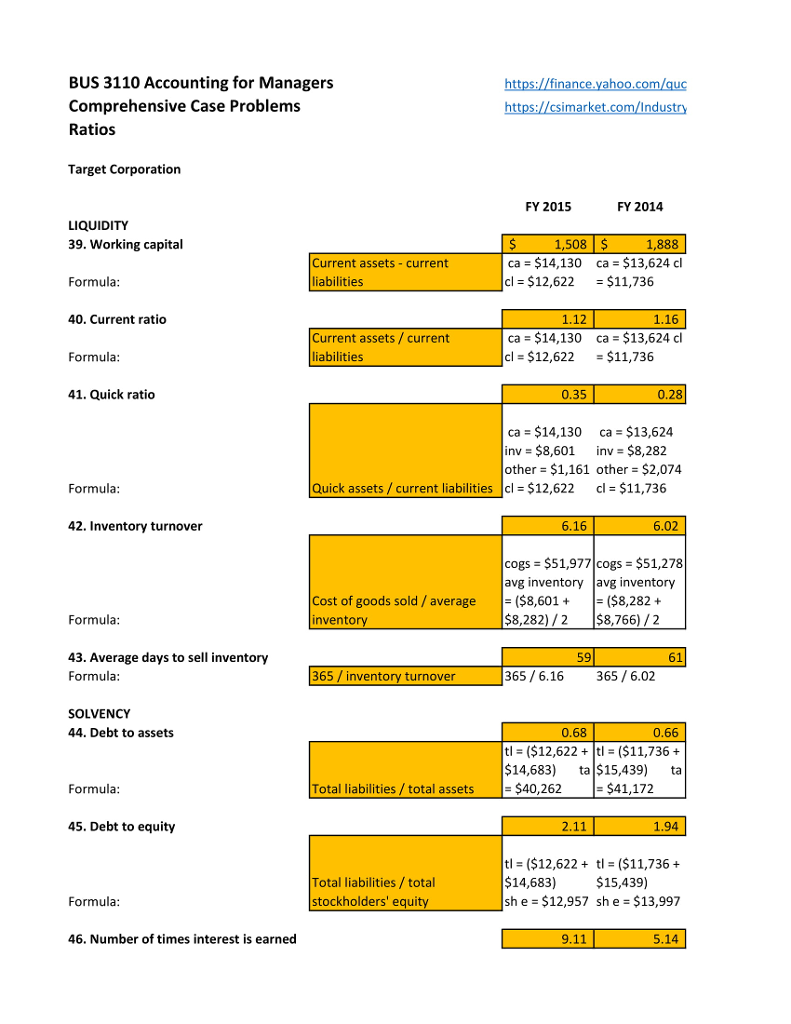

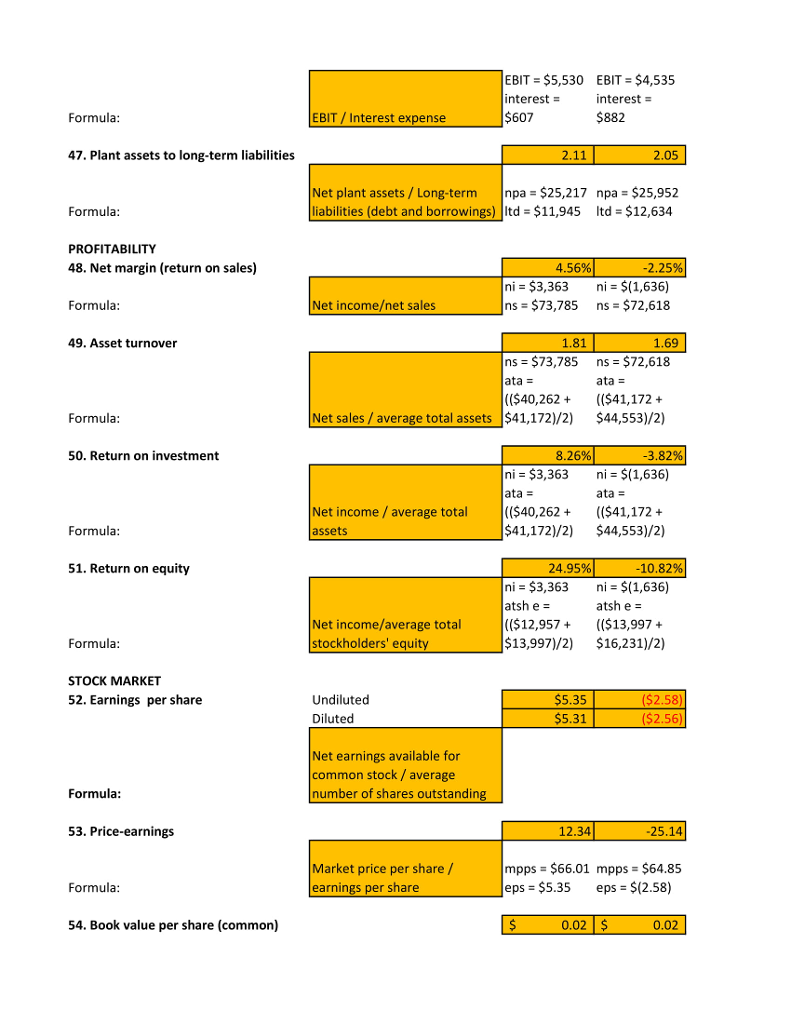

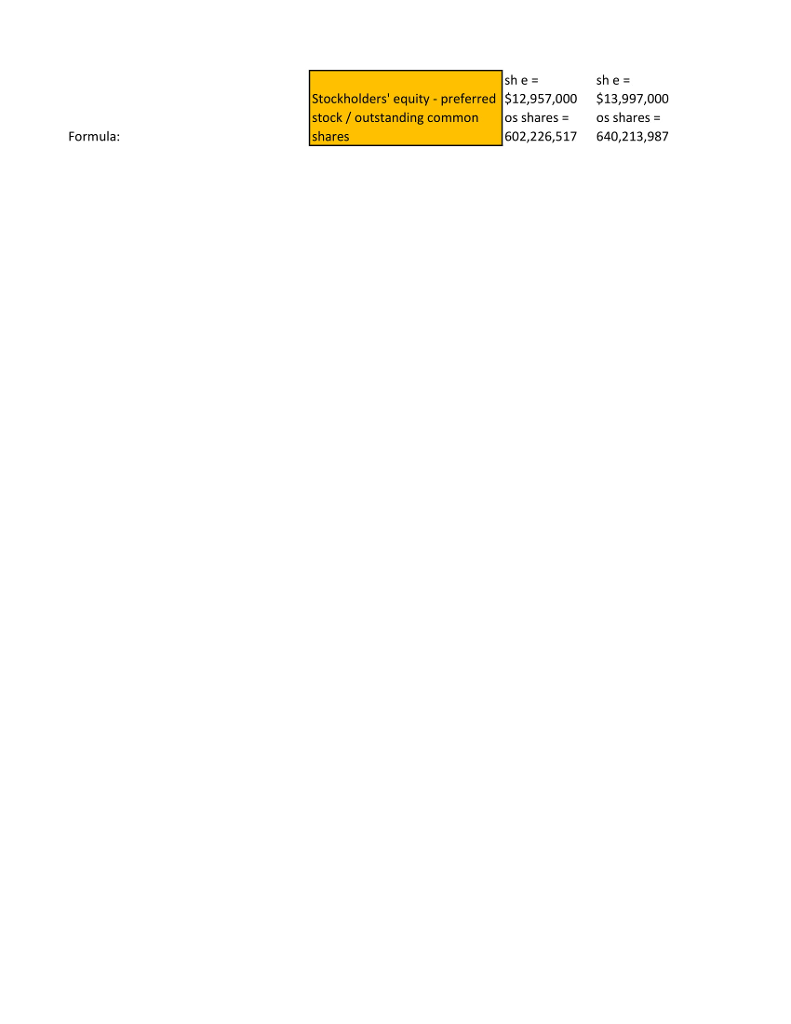

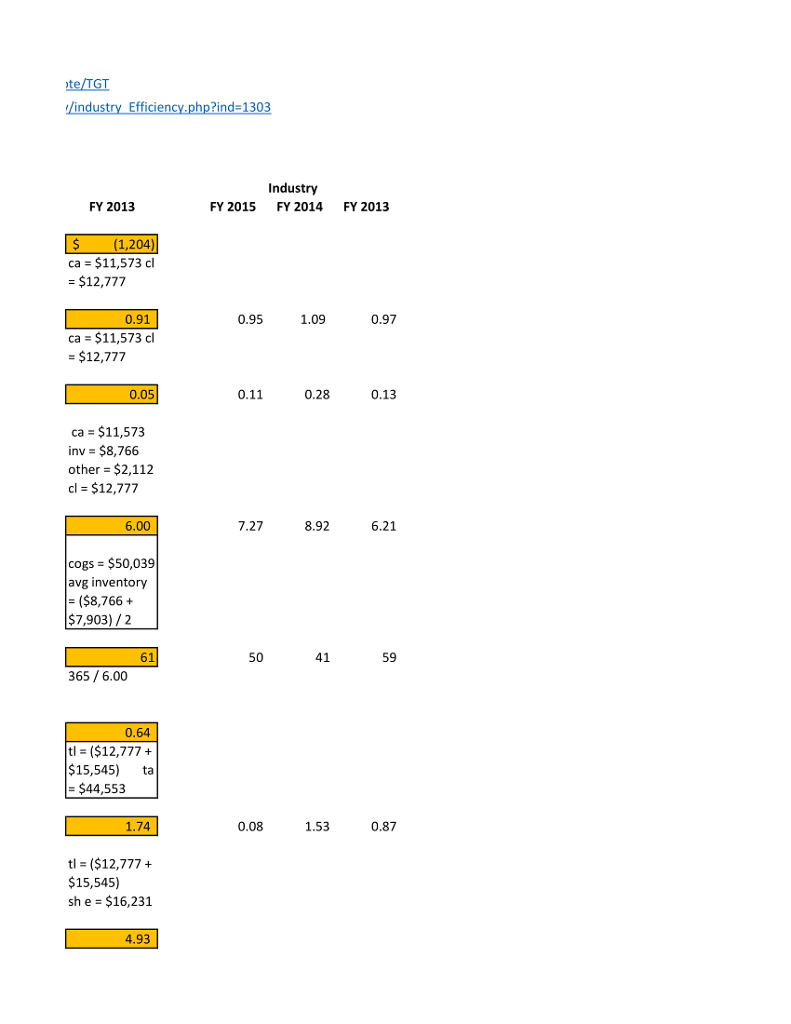

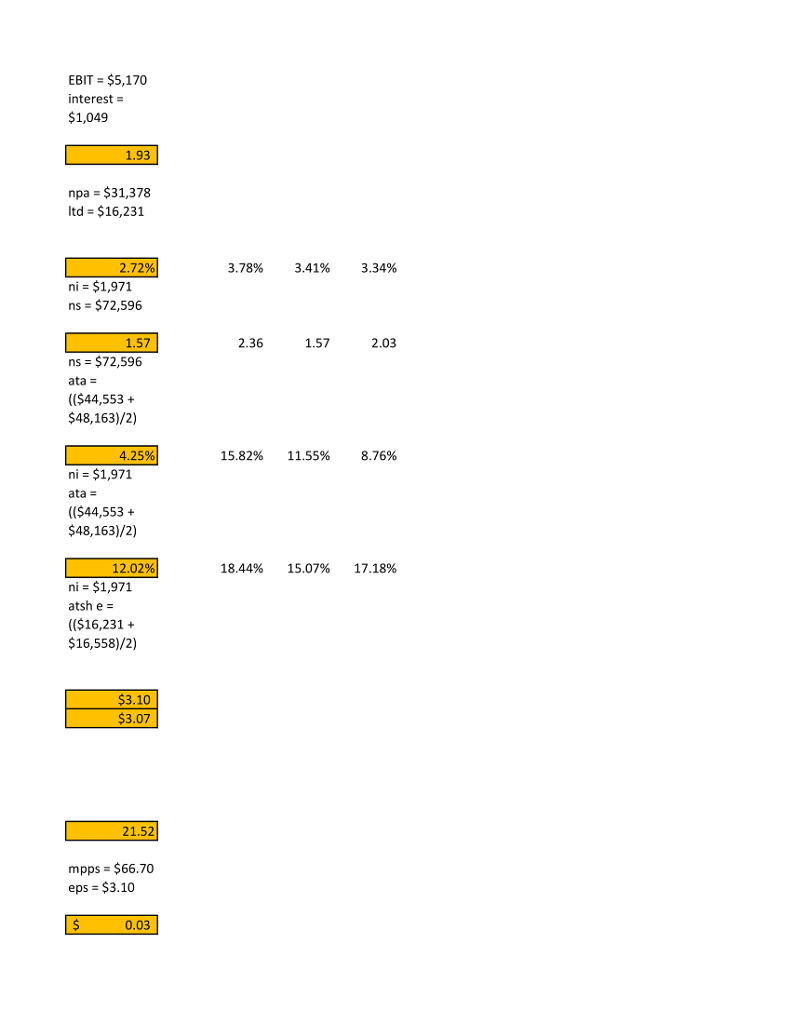

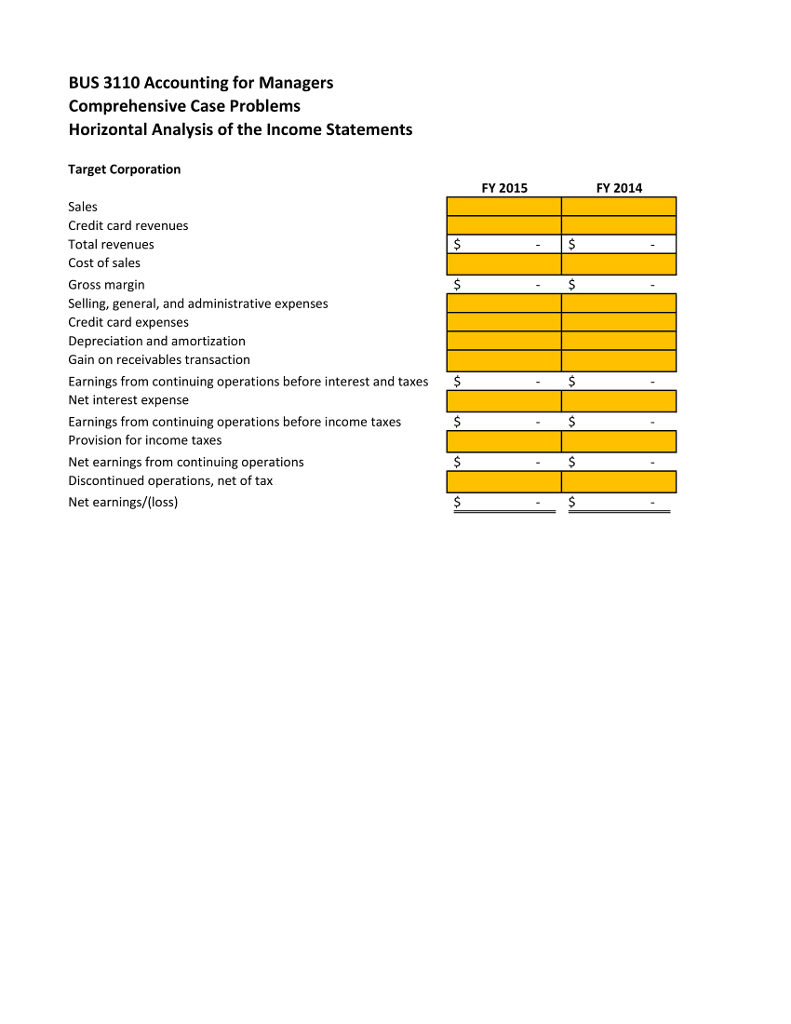

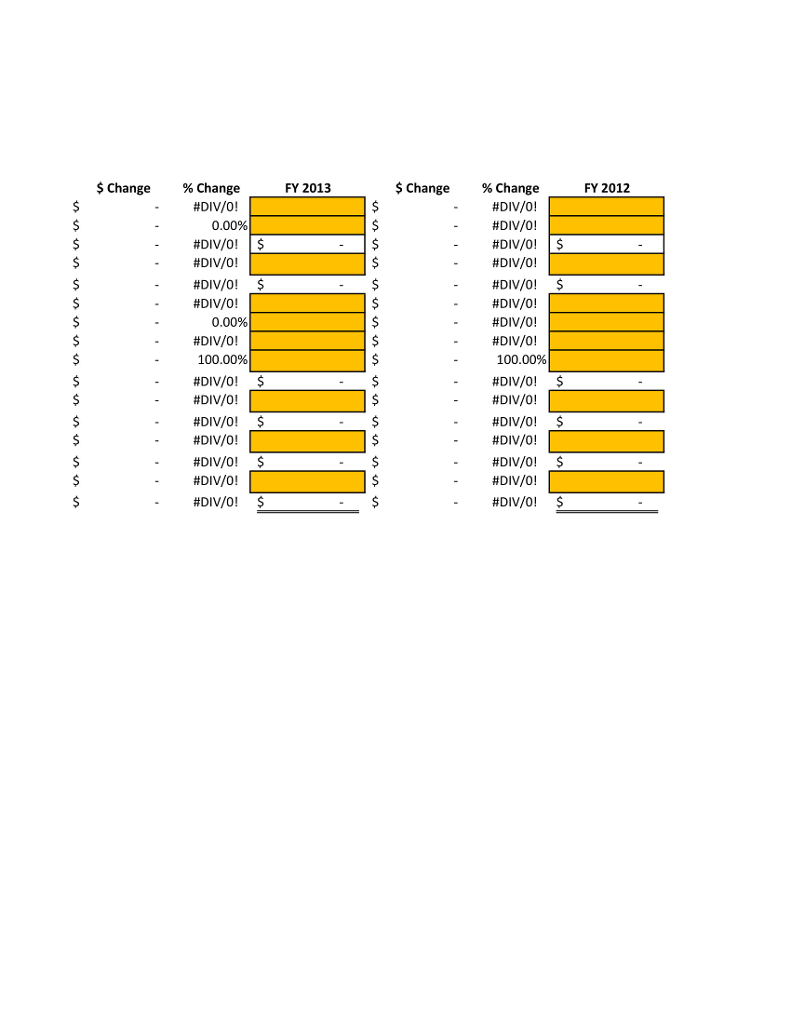

BUS 3110 Accounting for Managers Comprehensive Case Problems Ratios simarket.com/Indust Target Corporation FY 2015 FY 2014 LIQUIDITY 39. Working capital 1,508$ 1,888 Current assets -current liabilities ca $14,130 ca- $13,624 cl cl $12,622 $11,736 Formula 40. Current ratio 1.12 1.16 Current assets/current liabilities ca $14,130 ca $13,624 cl cl = $12,622 Formula: = $11,736 41. Quick ratio 0.35 0.28 ca $14,130 ca $13,624 inv $8,601 inv $8,282 other $1,161 other $2,074 Formula: Quick assets/current liabilities cl $12,622 cl $11,736 42. Inventory turnover 6.16 6.02 cogs = $51,977| cogs = $51,278 avg inventory avg inventory Cost of goods sold/ average invento ($8,601$8,282+ Formula $8,2822 $8,766) /2 43. Average days to sell inventory Formula 59 61 365/inventory turnover 65/6.16 365/6.02 SOLVENCY 44. Debt to assets 0.66 tl- ($12,622 ($11,736+ 14,683 ta $15,439) ta 0.68 Formula Total liabilities / total assets $40,262$41,172 45. Debt to equity 2.11 1.94 Total liabilities/total stockholders' equit tl ($12,622tl ($11,736+ $14,683) sh e $12,957 sh e $13,997 $15,439) Formula 46. Number of times interest is earned 9.11 5.14 BUS 3110 Accounting for Managers Comprehensive Case Problems Ratios simarket.com/Indust Target Corporation FY 2015 FY 2014 LIQUIDITY 39. Working capital 1,508$ 1,888 Current assets -current liabilities ca $14,130 ca- $13,624 cl cl $12,622 $11,736 Formula 40. Current ratio 1.12 1.16 Current assets/current liabilities ca $14,130 ca $13,624 cl cl = $12,622 Formula: = $11,736 41. Quick ratio 0.35 0.28 ca $14,130 ca $13,624 inv $8,601 inv $8,282 other $1,161 other $2,074 Formula: Quick assets/current liabilities cl $12,622 cl $11,736 42. Inventory turnover 6.16 6.02 cogs = $51,977| cogs = $51,278 avg inventory avg inventory Cost of goods sold/ average invento ($8,601$8,282+ Formula $8,2822 $8,766) /2 43. Average days to sell inventory Formula 59 61 365/inventory turnover 65/6.16 365/6.02 SOLVENCY 44. Debt to assets 0.66 tl- ($12,622 ($11,736+ 14,683 ta $15,439) ta 0.68 Formula Total liabilities / total assets $40,262$41,172 45. Debt to equity 2.11 1.94 Total liabilities/total stockholders' equit tl ($12,622tl ($11,736+ $14,683) sh e $12,957 sh e $13,997 $15,439) Formula 46. Number of times interest is earned 9.11 5.14

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts