Question: BUS 590 Business Strategy: Case Study 1. Do a financial analysis of the assigned case study (which will be a company of your choice). 2.

BUS 590 Business Strategy: Case Study

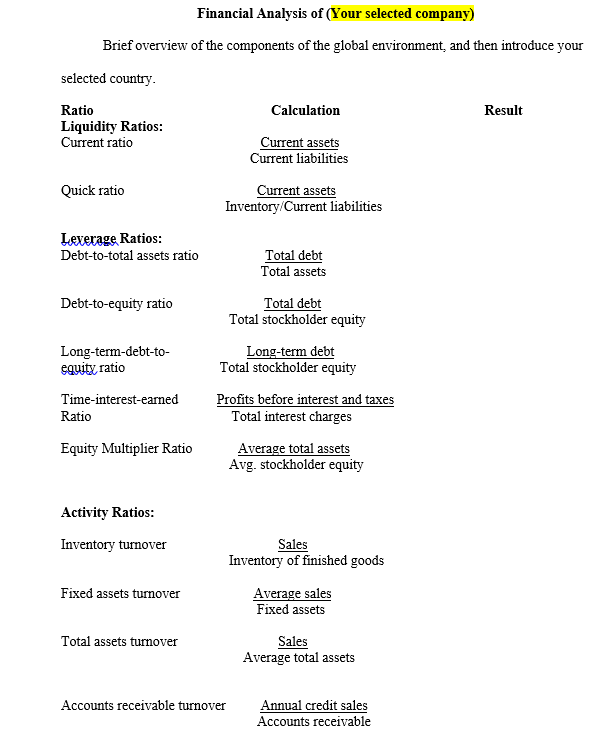

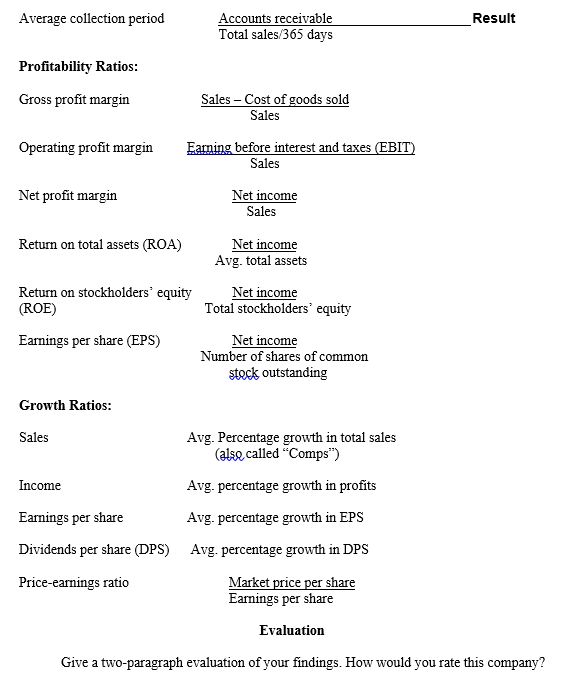

1. Do a financial analysis of the assigned case study (which will be a company of your choice). 2. Read pages 186-194 - Chapter 6 Appendix B 3. On pages 193-194, Exhibit 6.B6 - A Summary of Key Financial Ratios, there are 23 calculations. Choose a company and report two years' worthof financial statistics (from the Exhibit). 4. Show the calculation result sheet in the templates' picture attached herewith, and then write a two-paragraph evaluation of the firm's financial status. 5. CITE YOUR SOURCES. Also, it must provide a reference for all sources used to support the case study. (Note: As a minimum, the textbook and one additionalpeer-reviewed source shall be used and referenced.)

Financial Analysis of {Your selected company) Brief overview of the components of the global environment, and then introduce your selected country. Ratio Liquidity Ratios: Current ratio Quick ratio whims: Debttototal assets ratio Debttoequity ratio Lougtermdebttd MIME Tirueiuterestearued Ratio Calculation Current assets Current liabilities Current assets Inventory-"Current liabilities Total debt Total assets Total debt Total stockholder equity ngterm debt Total stockholder equity Prots before interest and taxes Total interest charges Equity Multiplier Ratio Average total assets Avg. stockholder equity Activity Ratios: Inventory turnover Sales Inventory of nished goods Fixed assets turnover Average sales Fixed assets Total assets turnover Sales Average total assets Accounts receivable turnover Annual credit sales Accounts receivable Result Average collection period Accounts receivable Result Total sales/365 days Profitability Ratios: Gross profit margin Sales - Cost of goods sold Sales Operating profit margin Earning before interest and taxes (EBIT) Sales Net profit margin Net income Sales Return on total assets (ROA) Net income Avg. total assets Return on stockholders equity Net income (ROE) Total stockholders' equity Earnings per share (EPS) Net income Number of shares of common stock outstanding Growth Ratios: Sales Avg. Percentage growth in total sales (also called "Comps") Income Avg. percentage growth in profits Earnings per share Avg. percentage growth in EPS Dividends per share (DPS) Avg. percentage growth in DPS Price-earnings ratio Market price per share Earnings per share Evaluation Give a two-paragraph evaluation of your findings. How would you rate this company

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts