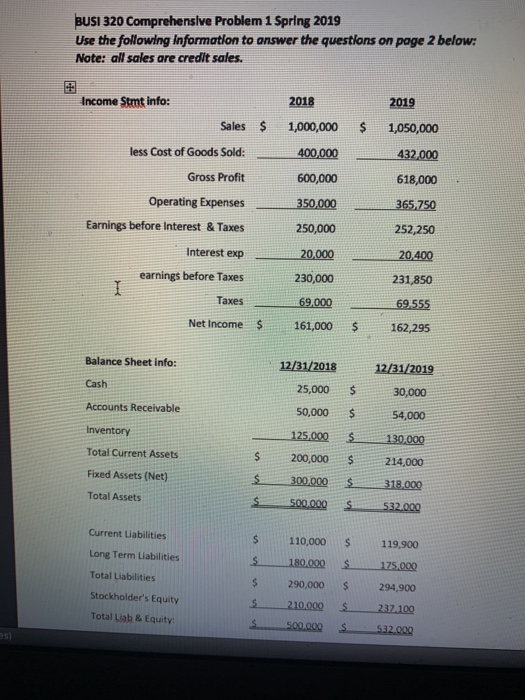

Question: BUSI 320 Comprehensive Problem 1 Spring 2019 Use the following information to answer the questions on page 2 below: Note: all sales are credit sales.

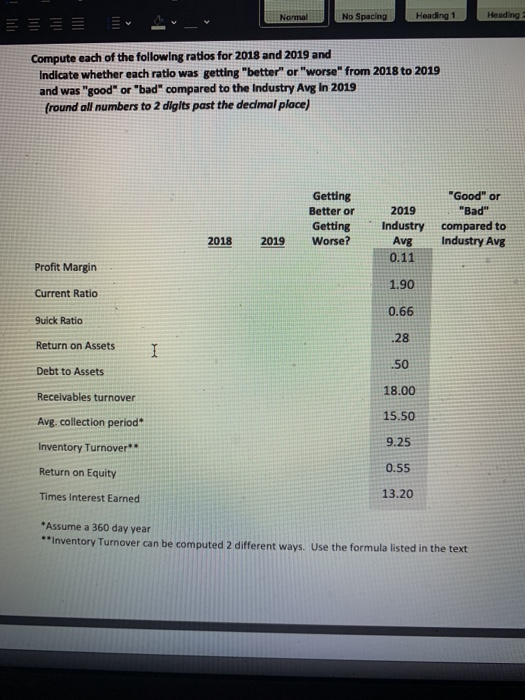

BUSI 320 Comprehensive Problem 1 Spring 2019 Use the following information to answer the questions on page 2 below: Note: all sales are credit sales. Income Stmt info: Sales $ $ 2018 1,000,000 400,000 600,000 less Cost of Goods Sold: Gross Profit 2019 1,050,000 432,000 618,000 365,750 252,250 350,000 Operating Expenses Earnings before Interest & Taxes 250,000 Interest exp 20,400 earnings before Taxes 231,850 20,000 230,000 69,000 161,000 Taxes 69.555 Net Income $ 162,295 Balance Sheet info: Cash 12/31/2018 25,000 50,000 $ Accounts Receivable $ Inventory 125.000 12/31/2019 30,000 54,000 130,000 214,000 318.000 532.000 Total Current Assets $ Fixed Assets (Net) 200,000 300,000 500.000 Total Assets S un Current Liabilities Long Term Liabilities Total Liabilities 110,000 180,000 290,000 210.000 500.000 $ $ $ $ $ 119,900 175.000 294,900 237.100 532.000 Stockholder's Equity Total Liab & Equity Normal No Spacing Heading 1 Heading Compute each of the following ratios for 2018 and 2019 and Indicate whether each ratio was getting "better" or "worse" from 2018 to 2019 and was "good" or "bad" compared to the Industry Avg In 2019 fround all numbers to 2 digits past the dedmal place) Getting Better or Getting Worse? "Good" or "Bad" compared to Industry Avg 2018 2019 Industry Avg 0.11 2019 Profit Margin 1.90 Current Ratio 0.66 9uick Ratio Return on Assets Debt to Assets Receivables turnover Avg. collection period Inventory Turnover Return on Equity 0.55 Times Interest Earned 13.20 *Assume a 360 day year **Inventory Turnover can be computed 2 different ways. Use the formula listed in the text

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts