Question: Business and Society Read the case study below and answer the questions that follow: [20 marks] 1MDB scandal: Malaysia files charges against Goldman Sachs

![that follow: [20 marks] 1MDB scandal: Malaysia files charges against Goldman Sachs](https://dsd5zvtm8ll6.cloudfront.net/questions/2024/03/65e94b362d717_1709787947663.jpg)

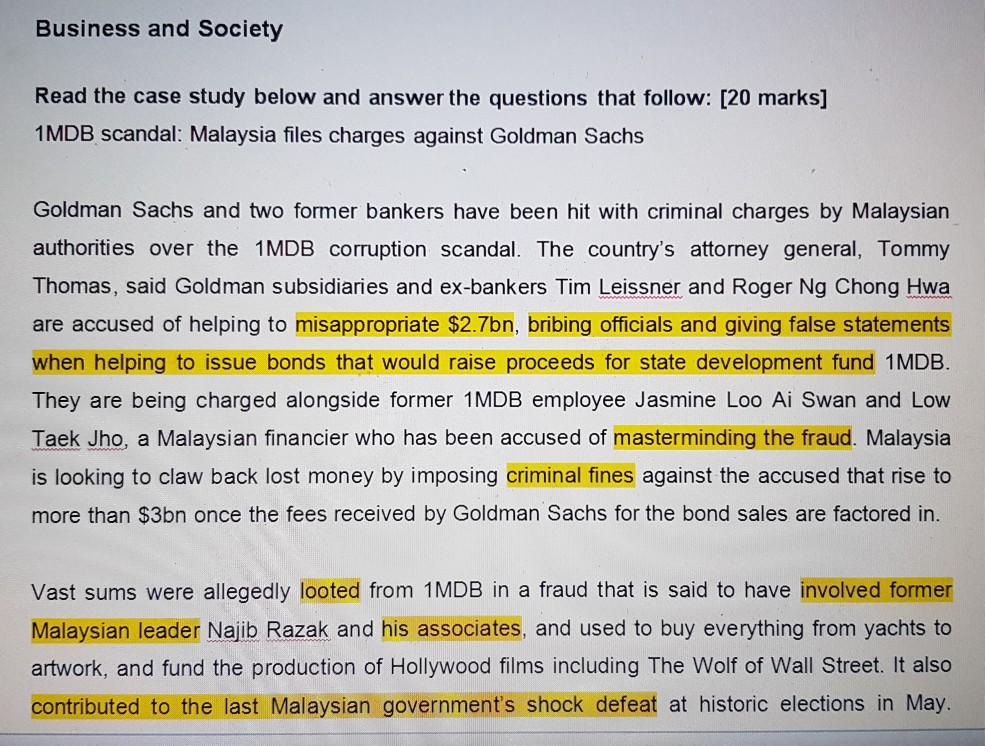

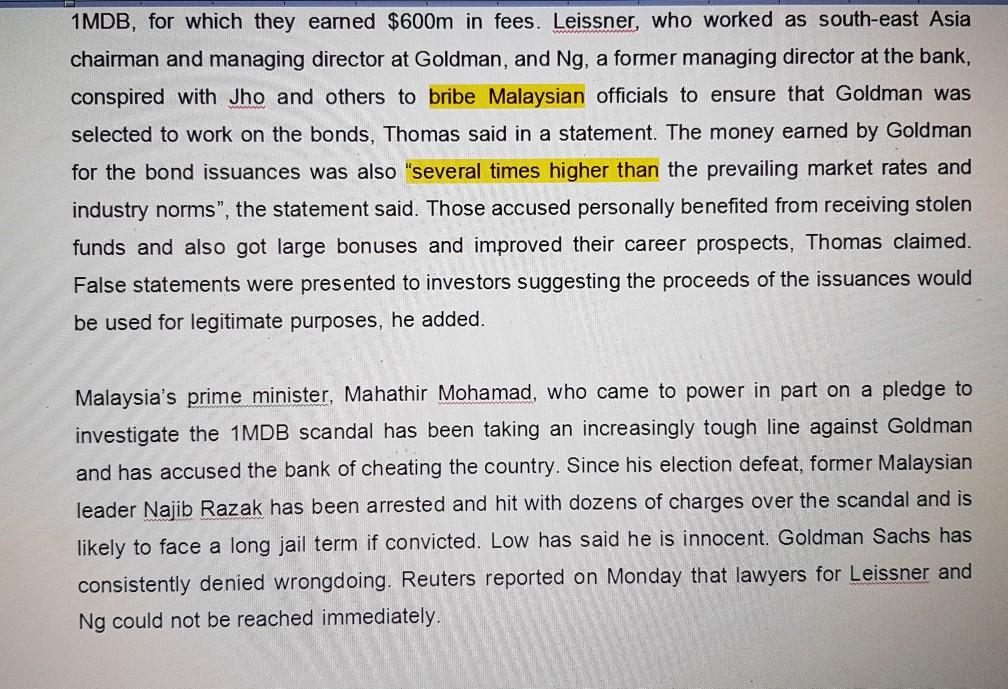

Business and Society Read the case study below and answer the questions that follow: [20 marks] 1MDB scandal: Malaysia files charges against Goldman Sachs Goldman Sachs and two former bankers have been hit with criminal charges by Malaysian authorities over the 1MDB corruption scandal. The country's attorney general, Tommy Thomas, said Goldman subsidiaries and ex-bankers Tim Leissner and Roger Ng Chong Hwa are accused of helping to misappropriate $2.7bn, bribing officials and giving false statements when helping to issue bonds that would raise proceeds for state development fund 1MDB. They are being charged alongside former 1MDB employee Jasmine Loo Ai Swan and Low Taek Jho, a Malaysian financier who has been accused of masterminding the fraud. Malaysia is looking to claw back lost money by imposing criminal fines against the accused that rise to more than $3bn once the fees received by Goldman Sachs for the bond sales are factored in. Vast sums were allegedly looted from 1MDB in a fraud that is said to have involved former Malaysian leader Najib Razak and his associates, and used to buy everything from yachts to artwork, and fund the production of Hollywood films including The Wolf of Wall Street. It also contributed to the last Malaysian government's shock defeat at historic elections in May. "Malaysia considers the allegations in the charges against all the accused to be grave violations of our securities laws," Thomas said in a statement. "And to reflect their severity, prosecutors will seek criminal fines against the accused well in excess of the $2.7bn misappropriated from the bonds proceeds and $600m in fees received by Goldman Sachs." If the accused are convicted, prosecutors have said they will push for sentences of up to 10 years in prison for Leissner and Ng. "Their fraud goes to the heart of our capital markets, and if no criminal proceedings are instituted against the accused, their undermining of our financial system and market integrity will go unpunished," Thomas added. News of the prosecution is a fresh blow for Goldman, with the Wall Street giant's corporate culture having come under increased scrutiny as details of the scandal continue to emerge. The US Department of Justice has already charged Leissner and Ng for conspiring to launder billions of dollars embezzled from 1MDB. Leissner last month pleaded guilty to conspiracy to launder money and conspiracy to violate the Foreign Corrupt Practices Act. Ng was arrested last month in Malaysia. Low Taek Jho, was also hit with charges but is still at large. Responding to the new charges from Malaysia, Goldman Sachs said: "We believe these charges are misdirected, will vigorously defend them and look forward to the opportunity to present our case. The firm continues to cooperate with all authorities investigating these matters." Goldman has come under fire for its role in underwriting bonds totalling $6.5bn on three occasions for 1MDB, for which they earned $600m in fees. Leissner, who worked as south-east Asia chairman and managing director at Goldman, and Ng, a former managing director at the bank, conspired with Jho and others to bribe Malaysian officials to ensure that Goldman was selected to work on the bonds, Thomas said in a statement. The money earned by Goldman for the bond issuances was also "several times higher than the prevailing market rates and industry norms", the statement said. Those accused personally benefited from receiving stolen funds and also got large bonuses and improved their career prospects, Thomas claimed. False statements were presented to investors suggesting the proceeds of the issuances would be used for legitimate purposes, he added. Malaysia's prime minister, Mahathir Mohamad, who came to power in part on a pledge to investigate the 1MDB scandal has been taking an increasingly tough line against Goldman and has accused the bank of cheating the country. Since his election defeat, former Malaysian leader Najib Razak has been arrested and hit with dozens of charges over the scandal and is likely to face a long jail term if convicted. Low has said he is innocent. Goldman Sachs has consistently denied wrongdoing. Reuters reported on Monday that lawyers for Leissner and Ng could not be reached immediately. Question One 1. Do you think the ethical fabric in Goldman Sachs has been worn out? Give your own views citing the most relevant ethical theories you can connect with. (5 marks) 1.1 Discuss the types of Ethical programs that exist in these context. (10 marks) Question Two 2. Discuss in the context of the above case, the role of Corporate Governance in companies. (5 marks)

Step by Step Solution

There are 3 Steps involved in it

1 The ethical fabric of Goldman Sachs appears to have been compromised based on the information provided in the case study Several ethical theories can be connected to this situation a Utilitarianism ... View full answer

Get step-by-step solutions from verified subject matter experts