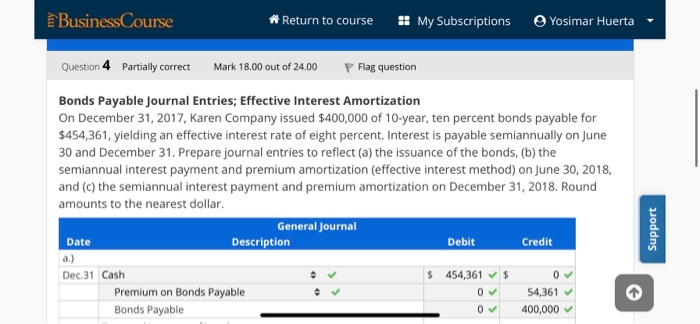

Question: Business Course * Return to course ! My Subscriptions Yosimar Huerta Question 4 Partially correct Mark 18.00 out of 24.00 P Flag question Bonds Payable

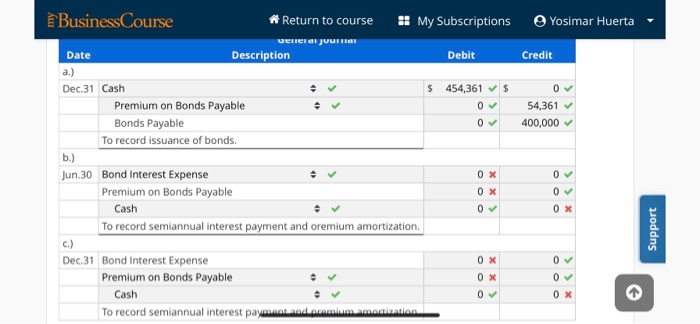

Business Course * Return to course ! My Subscriptions Yosimar Huerta Question 4 Partially correct Mark 18.00 out of 24.00 P Flag question Bonds Payable Journal Entries; Effective Interest Amortization On December 31, 2017, Karen Company issued $400,000 of 10-year, ten percent bonds payable for $454,361, yielding an effective interest rate of eight percent. Interest is payable semiannually on June 30 and December 31. Prepare journal entries to reflect (a) the issuance of the bonds, (b) the semiannual interest payment and premium amortization (effective interest method) on lune 30, 2018. and (c) the semiannual interest payment and premium amortization on December 31, 2018. Round amounts to the nearest dollar. General Journal Description Support Date Debit Credit a) $ 454,361 $ Dec.31 Cash Premium on Bonds Payable Bonds Payable 54,361 400,000 0 Business Course Return to course !! My Subscriptions Yosimar Huerta Date Description Debit Credit $ 454,361 $ 0 54,361 400,000 0 Dec.31 Cash Premium on Bonds Payable Bonds Payable To record issuance of bonds. b.) Jun.30 Bond Interest Expense Premium on Bonds Payable Cash To record semiannual interest payment and oremium amortization. Support Dec. 31 Bond Interest Expense Premium on Bonds Payable Cash To record semiannual interest payment 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts