Question: Can I get some help on the ones I got incorrect please? eBook Print Question 3 Partially correct Mark 0.67 out of 0.93 P Flag

Can I get some help on the ones I got incorrect please?

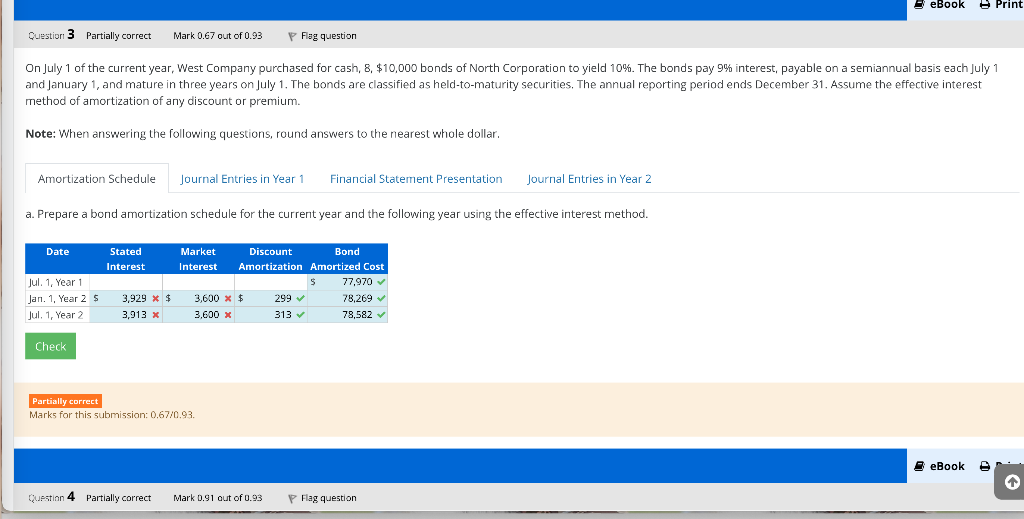

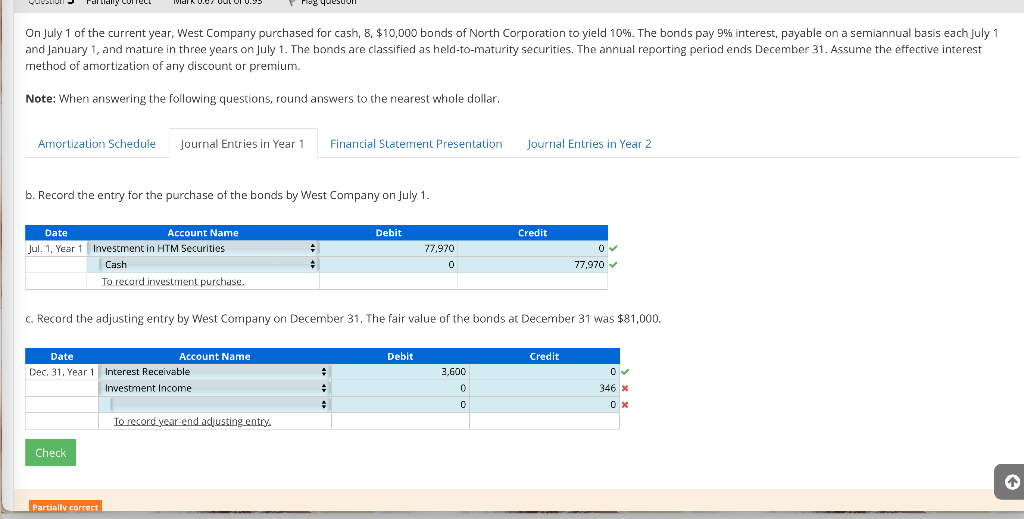

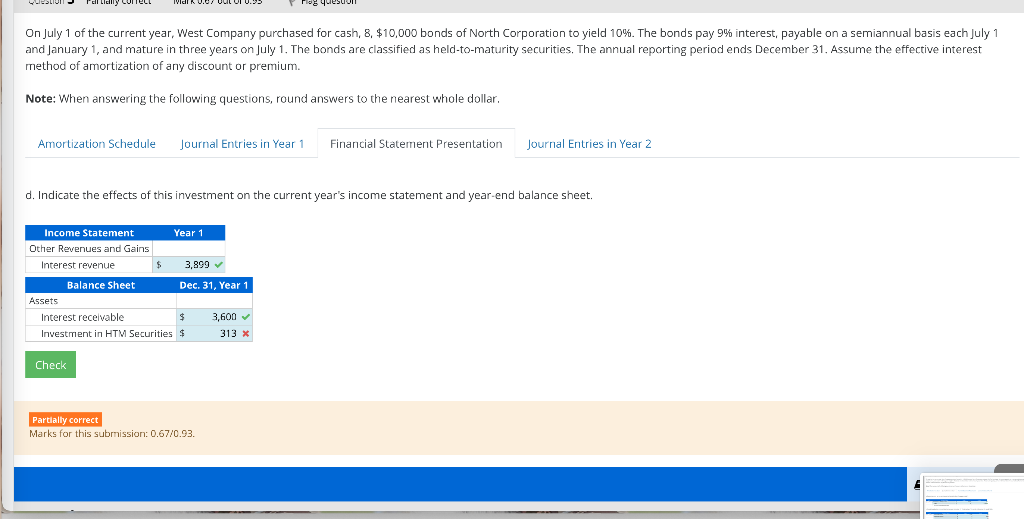

eBook Print Question 3 Partially correct Mark 0.67 out of 0.93 P Flag question On July 1 of the current year, West Company purchased for cash, 8. $10,000 bonds of North Corporation to yield 10%. The bonds pay 9% interest, payable on a semiannual basis each July 1 and January 1, and mature in three years on July 1. The bonds are classified as held-to-maturity securities. The annual reporting period ends December 31. Assume the effective interest method of amortization of any discount or premium. Note: When answering the following questions, round answers to the nearest whole dollar. Amortization Schedule Journal Entries in Year 1 Financial Statement Presentation Journal Entries in Year 2 a. Prepare a bond amortization schedule for the current year and the following year using the effective interest method. Date Stated Interest Jul. 1, Year 1 Jan. 1. Year 2 $ 1$ Jul. 1, Year 2 , 2 Market Discount Bond Interest Amortization Amortized Cost S 77,970 3,600 x $ 299 78,269 3,600 x 313 78,582 3,929 X $ 3,913 x Check Partially correct Marks for this submission: 0.67/0.93. eBook Question 4 Partially correct Mark 0.91 out of 0.93 P Flag question Full Walk 0.07 out or 0.23 no yesuo On July 1 of the current year, West Company purchased for cash, 8, $10,000 bonds of North Corporation to yield 10%. The bonds pay 9% interest, payable on a semiannual basis each July 1 and January 1, and mature in three years on July 1. The bonds are classified as held-to-maturity securities. The annual reporting period ends December 31. Assume the effective interest method of amortization of any discount or premium. Note: When answering the following questions, round answers to the nearest whole dollar. Amortization Schedule Journal Entries in Year 1 Financial Statement Presentation Journal Entries in Year 2 b. Record the entry for the purchase of the bonds by West Company on July 1. Debit Credit Date Account Name Jul. 1, Year 1 Investment in HTM Securities Cash To record investment purchase. 77.970 o 0 77.970 C. Record the adjusting entry by West Company on December 31. The fair value of the bonds at December 31 was $81,000. Debit Credit Date Account Name Dec 31, Year 1 Interest Receivable Investment Income + 3,600 + 0 0 346 x OX 0 To record year-end adjusting entry Check Partially correct Full Walk v.0 DuoT 0.23 no yesuo On July 1 of the current year, West Company purchased for cash, 8, $10,000 bonds of North Corporation to yield 10%. The bonds pay 9% interest, payable on a semiannual basis each July 1 and January 1, and mature in three years on July 1. The bonds are classified as held-to-maturity securities. The annual reporting period ends December 31. Assume the effective interest method of amortization of any discount or premium. Note: When answering the following questions, round answers to the nearest whole dollar. Amortization Schedule Journal Entries in Year 1 Financial Statement Presentation Journal Entries in Year 2 d. Indicate the effects of this investment on the current year's income statement and year-end balance sheet. Income Statement Year 1 Other Revenues and Gains Interest revenue $ 3,899 Balance Sheet Dec. 31, Year 1 Assets Interest receivable 3,600 Investment in HTM Securities $ 313 x Check Partially correct Marks for this submission: 0.67/0.93

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts