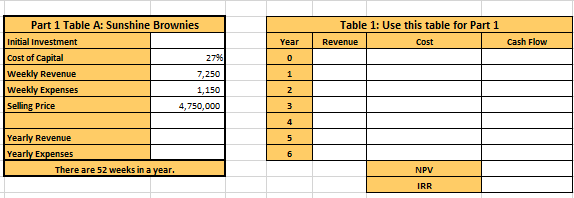

Question: Business Excel Question - Finance Table 1: Use this table for Part 1 Revenue Cost Year Cash Flow 0 Part 1 Table A: Sunshine Brownies

Business Excel Question - Finance

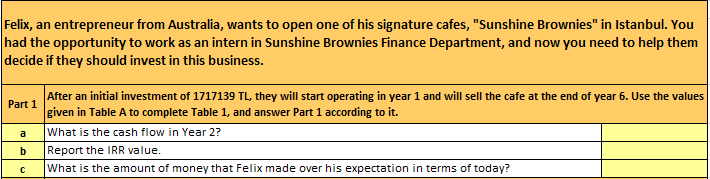

Table 1: Use this table for Part 1 Revenue Cost Year Cash Flow 0 Part 1 Table A: Sunshine Brownies Initial Investment Cost of Capital 2796 Weekly Revenue 7,250 Weekly Expenses 1,150 Selling Price 4,750,000 1 2 3 4 5 Yearly Revenue Yearly Expenses There are 52 weeks in a year. 6 NPV IRR Felix, an entrepreneur from Australia, wants to open one of his signature cafes, "Sunshine Brownies" in Istanbul. You had the opportunity to work as an intern in Sunshine Brownies Finance Department, and now you need to help them decide if they should invest in this business. Part 1 After an initial investment of 1717139 TL, they will start operating in year 1 and will sell the cafe at the end of year 6. Use the values given in Table A to complete Table 1, and answer Part 1 according to it. What is the cash flow in Year 2? Report the IRR value. What is the amount of money that Felix made over his expectation in terms of today? b Table 1: Use this table for Part 1 Revenue Cost Year Cash Flow 0 Part 1 Table A: Sunshine Brownies Initial Investment Cost of Capital 2796 Weekly Revenue 7,250 Weekly Expenses 1,150 Selling Price 4,750,000 1 2 3 4 5 Yearly Revenue Yearly Expenses There are 52 weeks in a year. 6 NPV IRR Felix, an entrepreneur from Australia, wants to open one of his signature cafes, "Sunshine Brownies" in Istanbul. You had the opportunity to work as an intern in Sunshine Brownies Finance Department, and now you need to help them decide if they should invest in this business. Part 1 After an initial investment of 1717139 TL, they will start operating in year 1 and will sell the cafe at the end of year 6. Use the values given in Table A to complete Table 1, and answer Part 1 according to it. What is the cash flow in Year 2? Report the IRR value. What is the amount of money that Felix made over his expectation in terms of today? b

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts