Question: Bussiness Calc MATH 1020 Calculus Concepts 1.10 DMS Section: Group Number: Names of Group Members PRESENT: Learning Activity 16B Score: /10 Credits by give to

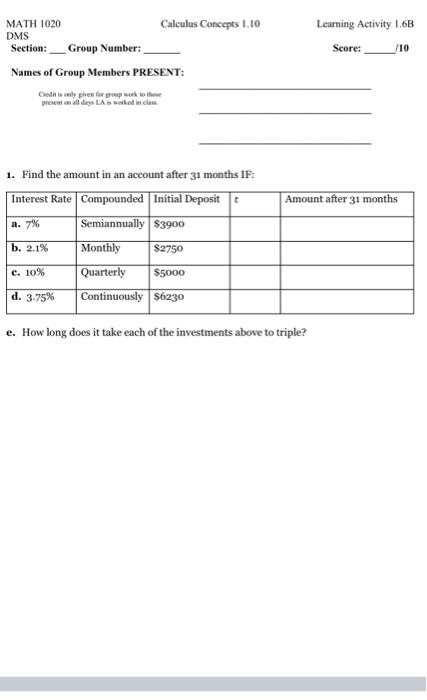

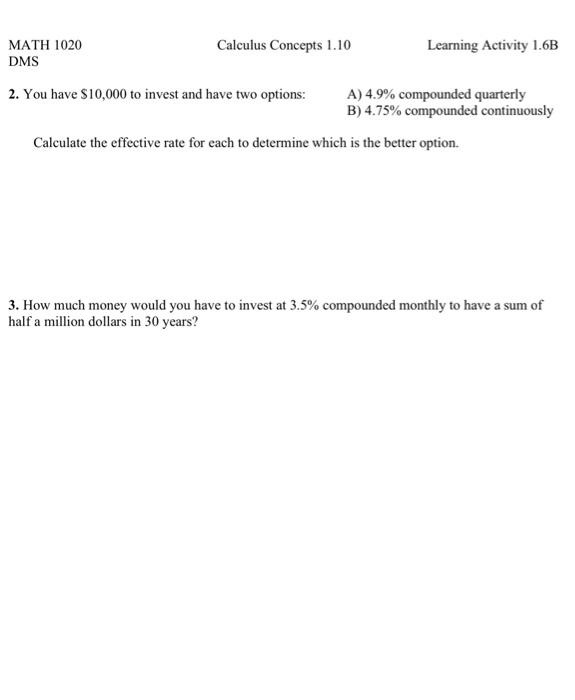

MATH 1020 Calculus Concepts 1.10 DMS Section: Group Number: Names of Group Members PRESENT: Learning Activity 16B Score: /10 Credits by give to the presents all days Lake in ce Amount after 31 months 1. Find the amount in an account after 31 months IF: Interest Rate Compounded Initial Deposit a. 7% Semiannually $3900 b. 2.1% Monthly $2750 e. 10% Quarterly $5000 d. 3.75% Continuously $6230 c. How long does it take each of the investments above to triple? MATH 1020 Calculus Concepts 1.10 Learning Activity 1.6B DMS 2. You have $10,000 to invest and have two options: A) 4.9% compounded quarterly B) 4.75% compounded continuously Calculate the effective rate for each to determine which is the better option. 3. How much money would you have to invest at 3.5% compounded monthly to have a sum of half a million dollars in 30 years? MATH 1020 Calculus Concepts 1.10 DMS Section: Group Number: Names of Group Members PRESENT: Learning Activity 16B Score: /10 Credits by give to the presents all days Lake in ce Amount after 31 months 1. Find the amount in an account after 31 months IF: Interest Rate Compounded Initial Deposit a. 7% Semiannually $3900 b. 2.1% Monthly $2750 e. 10% Quarterly $5000 d. 3.75% Continuously $6230 c. How long does it take each of the investments above to triple? MATH 1020 Calculus Concepts 1.10 Learning Activity 1.6B DMS 2. You have $10,000 to invest and have two options: A) 4.9% compounded quarterly B) 4.75% compounded continuously Calculate the effective rate for each to determine which is the better option. 3. How much money would you have to invest at 3.5% compounded monthly to have a sum of half a million dollars in 30 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts