Question: By hand please. 2. (10 pt each) Consider a 4-security portfolio with the following information. Expected Return Standard Deviation Stock 1 40% 25% Stock 2

By hand please.

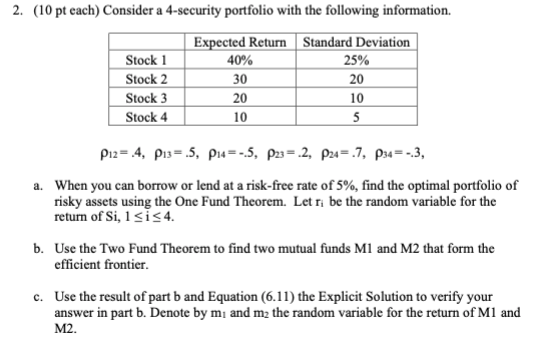

2. (10 pt each) Consider a 4-security portfolio with the following information. Expected Return Standard Deviation Stock 1 40% 25% Stock 2 30 20 Stock 3 20 10 Stock 4 10 5 P12= 4, P13= 5, P14 =-5, P23= 2, P24=.7, P34= -3, a. When you can borrow or lend at a risk-free rate of 5%, find the optimal portfolio of risky assets using the One Fund Theorem. Let t; be the random variable for the return of Si, 1 sis 4. b. Use the Two Fund Theorem to find two mutual funds M1 and M2 that form the efficient frontier c. Use the result of part b and Equation (6.11) the Explicit Solution to verify your answer in part b. Denote by m; and m2 the random variable for the return of M1 and M2. 2. (10 pt each) Consider a 4-security portfolio with the following information. Expected Return Standard Deviation Stock 1 40% 25% Stock 2 30 20 Stock 3 20 10 Stock 4 10 5 P12= 4, P13= 5, P14 =-5, P23= 2, P24=.7, P34= -3, a. When you can borrow or lend at a risk-free rate of 5%, find the optimal portfolio of risky assets using the One Fund Theorem. Let t; be the random variable for the return of Si, 1 sis 4. b. Use the Two Fund Theorem to find two mutual funds M1 and M2 that form the efficient frontier c. Use the result of part b and Equation (6.11) the Explicit Solution to verify your answer in part b. Denote by m; and m2 the random variable for the return of M1 and M2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts