Question: Question 2b, please. Either by hand or using excel, but preferably by hand. 2. (10 pt each) Consider a 4-security portfolio with the following information.

Question 2b, please. Either by hand or using excel, but preferably by hand.

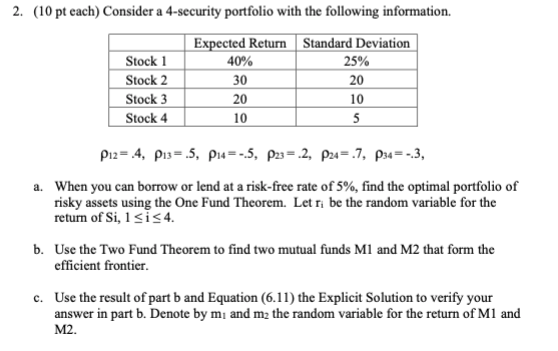

2. (10 pt each) Consider a 4-security portfolio with the following information. Expected Return Standard Deviation Stock 1 40% 25% Stock 2 20 Stock 3 20 10 Stock 4 10 5 30 Pz= 4, P13=.5, P1=-5, P23= -2, P24=.7, P34= -3, a. When you can borrow or lend at a risk-free rate of 5%, find the optimal portfolio of risky assets using the One Fund Theorem. Let r; be the random variable for the return of Si, 1 sis4. b. Use the Two Fund Theorem to find two mutual funds M1 and M2 that form the efficient frontier c. Use the result of part b and Equation (6.11) the Explicit Solution to verify your answer in part b. Denote by me and my the random variable for the return of M1 and M2. 2. (10 pt each) Consider a 4-security portfolio with the following information. Expected Return Standard Deviation Stock 1 40% 25% Stock 2 20 Stock 3 20 10 Stock 4 10 5 30 Pz= 4, P13=.5, P1=-5, P23= -2, P24=.7, P34= -3, a. When you can borrow or lend at a risk-free rate of 5%, find the optimal portfolio of risky assets using the One Fund Theorem. Let r; be the random variable for the return of Si, 1 sis4. b. Use the Two Fund Theorem to find two mutual funds M1 and M2 that form the efficient frontier c. Use the result of part b and Equation (6.11) the Explicit Solution to verify your answer in part b. Denote by me and my the random variable for the return of M1 and M2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts