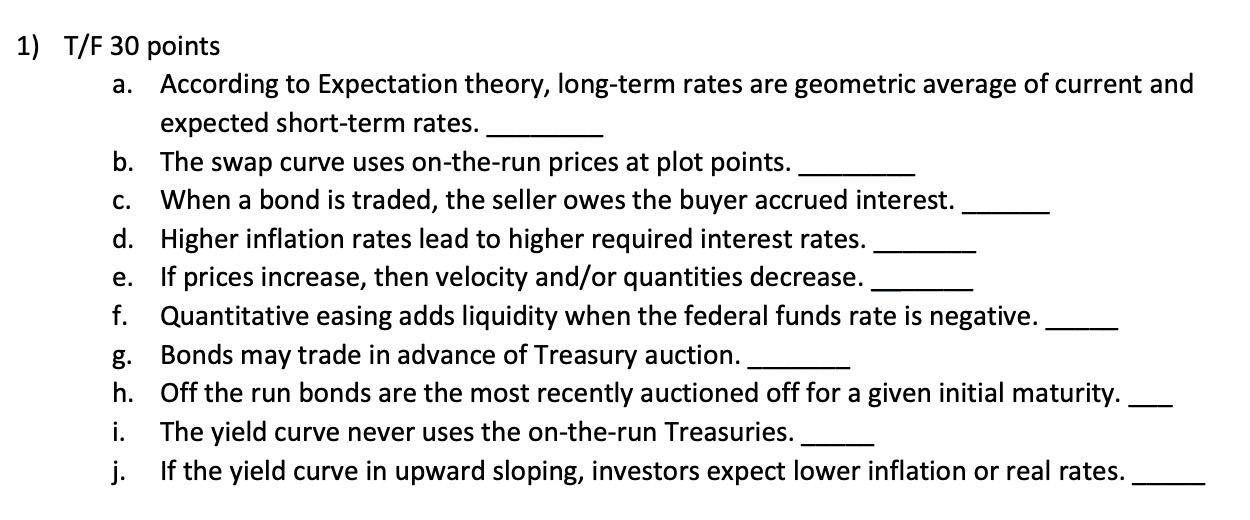

Question: C. 1) T/F 30 points a. According to Expectation theory, long-term rates are geometric average of current and expected short-term rates. b. The swap curve

C. 1) T/F 30 points a. According to Expectation theory, long-term rates are geometric average of current and expected short-term rates. b. The swap curve uses on-the-run prices at plot points. When a bond is traded, the seller owes the buyer accrued interest. d. Higher inflation rates lead to higher required interest rates. e. If prices increase, then velocity and/or quantities decrease. f. Quantitative easing adds liquidity when the federal funds rate is negative. Bonds may trade in advance of Treasury auction. h. Off the run bonds are the most recently auctioned off for a given initial maturity. i. The yield curve never uses the on-the-run Treasuries. j. If the yield curve in upward sloping, investors expect lower inflation or real rates

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts