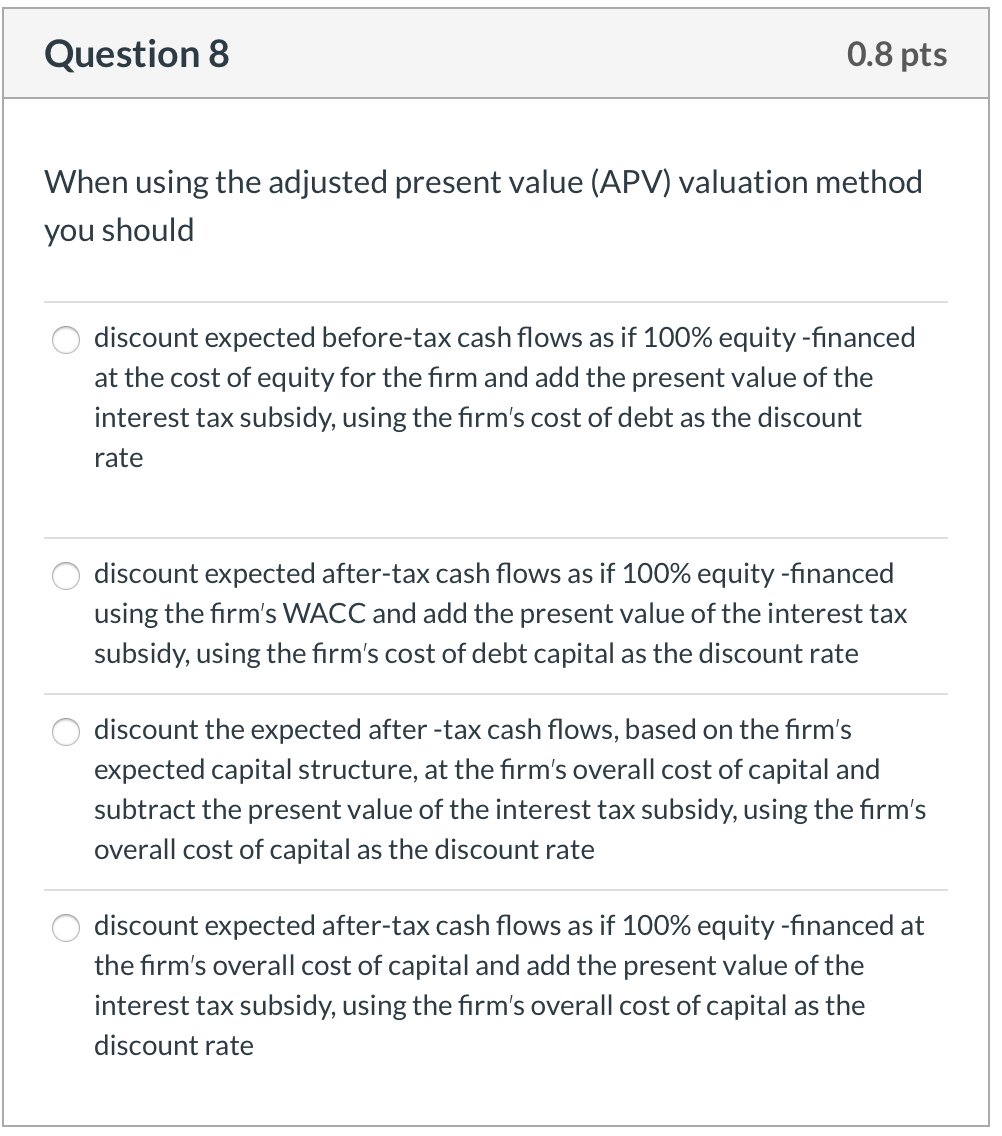

Question: Question 8 0.8 pts When using the adjusted present value (APV) valuation method you should O discount expected before-tax cash flows as if 100% equity-financed

Question 8 0.8 pts When using the adjusted present value (APV) valuation method you should O discount expected before-tax cash flows as if 100% equity-financed at the cost of equity for the firm and add the present value of the interest tax subsidy, using the firm's cost of debt as the discount rate O discount expected after-tax cash flows as if 100% equity-financed using the firm's WACC and add the present value of the interest tax subsidy, using the firm's cost of debt capital as the discount rate O discount the expected after-tax cash flows, based on the firm's expected capital structure, at the firm's overall cost of capital and subtract the present value of the interest tax subsidy, using the firm's overall cost of capital as the discount rate O discount expected after-tax cash flows as if 100% equity-financed at the firm's overall cost of capital and add the present value of the interest tax subsidy, using the firm's overall cost of capital as the discount rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts