Question: c) 6. Financial Statement Analysis - Part 2 (12 Marks) Information from the financial records of Companies Z and A are presented below for

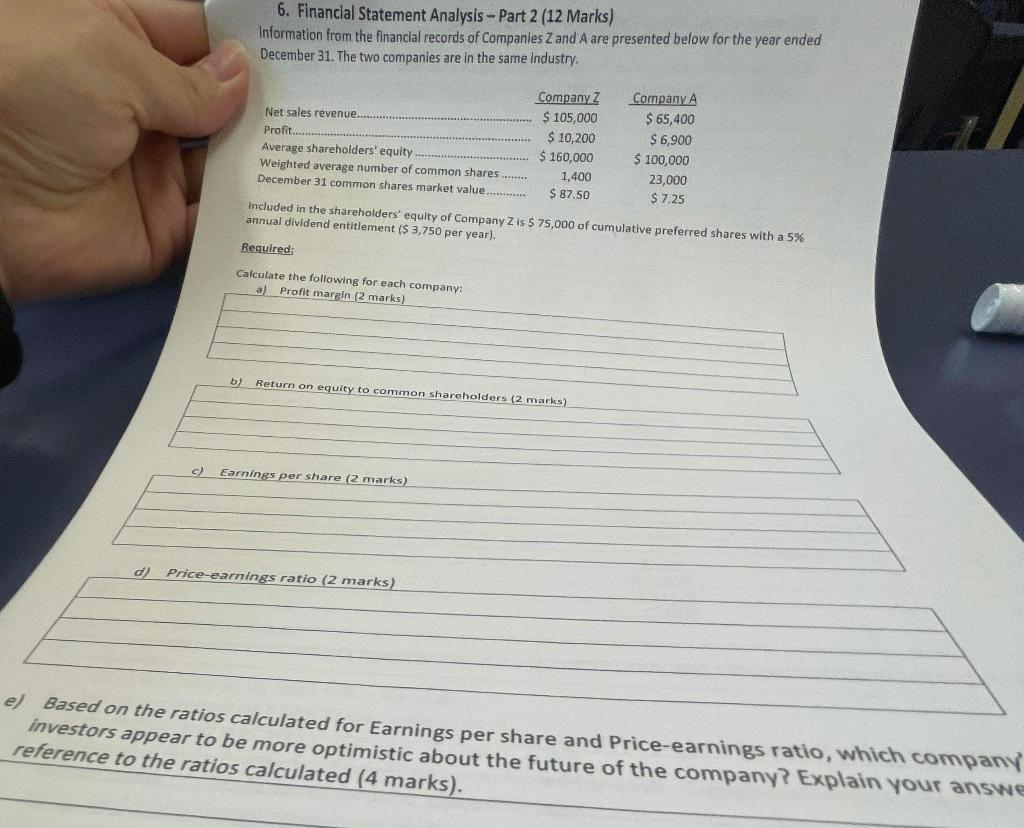

c) 6. Financial Statement Analysis - Part 2 (12 Marks) Information from the financial records of Companies Z and A are presented below for the year ended December 31. The two companies are in the same industry. b) Net sales revenue. Profit. Average shareholders' equity Weighted average number of common shares........ December 31 common shares market value............. Required: Calculate the following for each company: a) Profit margin (2 marks) Company Z $ 105,000 $ 10,200 $160,000 Earnings per share (2 marks) 1,400 $87.50 Included in the shareholders' equity of Company Z is $ 75,000 of cumulative preferred shares with a 5% annual dividend entitlement ($ 3,750 per year). Return on equity to common shareholders (2 marks) d) Price-earnings ratio (2 marks) Company A $ 65,400 $ 6,900 $ 100,000 23,000 $7.25 e) Based on the ratios calculated for Earnings per share and Price-earnings ratio, which company investors appear to be more optimistic about the future of the company? Explain your answe reference to the ratios calculated (4 marks).

Step by Step Solution

There are 3 Steps involved in it

a Profit Marg in Company Z Profit Net Sales Revenue 160 000 105 000 1 52 Company A Profit Net Sales ... View full answer

Get step-by-step solutions from verified subject matter experts