Question: c. An analyst has produced predicated financial data for Micro plc, as shown in the table below. Value the shares of Micro using a

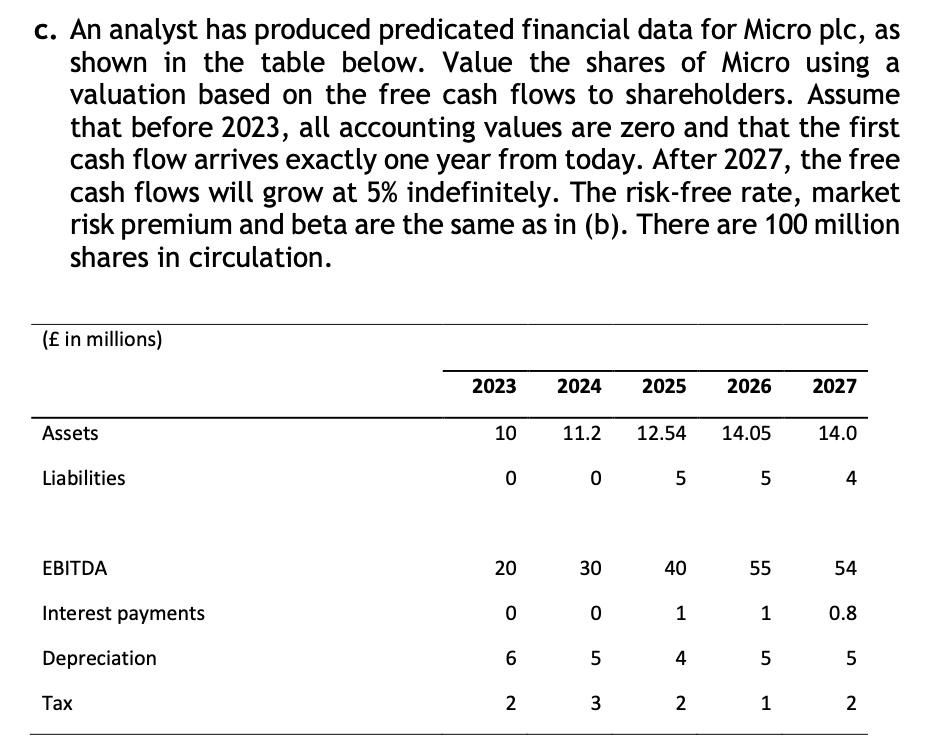

c. An analyst has produced predicated financial data for Micro plc, as shown in the table below. Value the shares of Micro using a valuation based on the free cash flows to shareholders. Assume that before 2023, all accounting values are zero and that the first cash flow arrives exactly one year from today. After 2027, the free cash flows will grow at 5% indefinitely. The risk-free rate, market risk premium and beta are the same as in (b). There are 100 million shares in circulation. ( in millions) Assets Liabilities EBITDA Interest payments Depreciation Tax 2023 10 0 20 0 6 2 2024 2025 2026 2027 11.2 12.54 14.05 0 30 0 LO 5 3 5 40 1 4. 2 5 55 1 5 1 14.0 4 54 0.8 5 2

Step by Step Solution

3.41 Rating (145 Votes )

There are 3 Steps involved in it

Here are the steps to value the shares of Micro plc based on the free cash flows to sh... View full answer

Get step-by-step solutions from verified subject matter experts